Tuesday June 14: Five things the markets are talking about

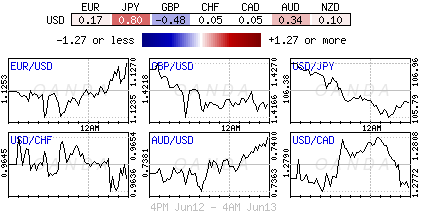

Investors continued search for safety is lifting the historical go to currency pairs and gold ($1,280) in overnight trading.

The JPY (¥105.73) and the CHF ($0.9640) continue to rise strongly as worries about the possibility of a vote to exit the EU in next week’s U.K. referendum, falling global equities and German bund yields moving into negative territory is encouraging this drive towards perceived safer assets.

Being a heavy-laden central bank week (FOMC, BoJ, BoE and SNB) its only natural for the market to trim a percentage of their positions ahead of monetary policy announcements.

1. Global bourses retreat

Global stocks are extending their losses today as uncertainty about upcoming central bank meetings, the global economy and next week’s U.K. referendum push investors toward safer assets.

The Stoxx Europe 600 is down -1.1% in early trade, following yesterday’s losses on Wall Street. The S&P 500 fell -0.8% to 2,079.06, its lowest level in almost three-weeks.

Brexit polls continue to narrow, triggering concerns about the future of the U.K’s economy and health of its financial markets.

Banks and energy shares are leading losses in Europe ahead of the open stateside, as Brent crude oil fell -1.2% to $49.77 a barrel. Investors are also looking ahead to central bank meetings this week for clarity on the future of monetary policy.

Indices: Nikkei 225 -1.4%, S&P/ASX -2.0%, KOSPI -0.4%, Shanghai Composite -0.3%, Hang Seng -0.3%, Sep S&P 500 flat at 2,070. Stoxx50 -1.5% at 2,820, FTSE -1.2% at 5,970, DAX -1.3% at 9,535, CAC 40 -1.3% at 4,170, IBEX 35 -1.1% at 8,215, FTSE MIB -1.0% at 16,460, SMI -1.4% at 7,671, S&P 500 Futures -0.4%

2. Bunds rally into negative territory

With investors favouring safer assets, global government bond yields continue to fall to new record lows. This morning, the 10-year German Bund yield fell below zero for the first time ever to -0.004%.

With the ECB competing with investors for product, buying by the central bank is also helping to push yields on EU government debt lower. The ECB does not buy government bonds if their yields are below the central bank’s deposit rate – currently at -0.4%. That means half of the outstanding stock of German bonds is now excluded from the ECB’s shopping list.

This demand for German product will only continue to tighten supply conditions. The yield on US 10’s dropped even further to +1.577%, compared with +1.616% at the close yesterday.

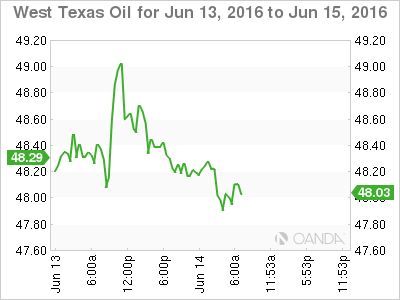

3. Oil and gold prices diverge

Oil prices have fallen to their lowest point in 12 days today, a third consecutive day of losses connected with another increase in U.S. drilling activity. Currently, higher crude prices are motivating some producers to restart closed wells and maybe increase supply.

Brent is trading below the psychological $50 handle a barrel ($49.77), while WTI futures are trading down -1% at $48.59 a barrel as we head stateside.

Crude prices have rallied by more than +80% from its mid-February lows, supported by production outages from Nigeria to Canada and falling output in the U.S.

Gold is trading atop of its four-week high ($1286.70) buoyed by a benign Fed policy as well as safe haven demand due to the U.K’s upcoming Brexit vote.

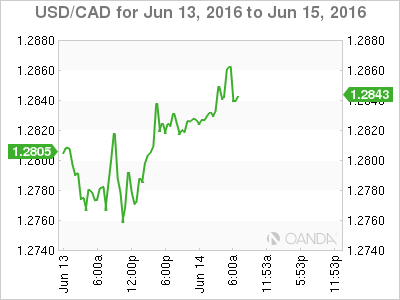

4. Loonie too expensive?

Despite the commodity sensitive currency trading hand in hand with commodity prices, the IMF believes that the CAD (C$1.2855) remains “moderately overhauled,” by up to +5%, relative to the country’s medium-term fundamentals.

In its latest report the IMF suggests that the loonies depreciation over the past two-years – closely linked to crude-oil price fall – has managed to improve the price competitiveness of Canadian exports and provided support for economy’s shift toward the non-resource sector.

IMF believes that a weaker CAD won’t undo the erosion of manufacturing sector in prior decade. As a result, agency said, Canada needs greater investment in capital equipment, employee training and innovation to drive growth in non-resource and services fields.

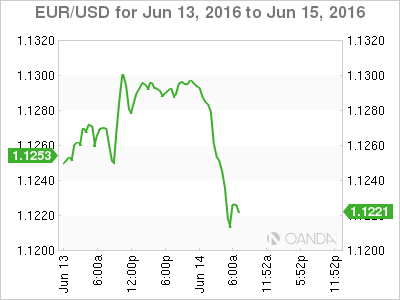

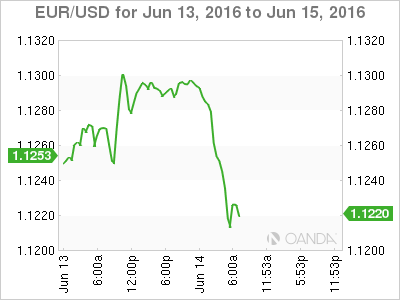

5. Sterling price moves

Trading sterling (£1.4127) ahead of next week’s EU referendum vote is not for the faint of heart. The erratic and sudden intraday price moves is reflecting the lack of liquidity in the market, which is causing volatility and sharp price swings.

The pound is currently swinging on every legitimate and unconfirmed poll. Do not expect market conditions to improve, if anything heightened volatility should continue until there is clarity.

The cost of options protection against sterling falling continues to rise as investors become ever more nervous after the latest opinion polls show an increasing risk of a U.K. vote to leave the EU in next week’s referendum.

One-month implied volatility has rallied to +28.75%, now firmly above the peak around +28% hit in 2008.