Quotes

All Instrument Types

- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

🔥 This hedge fund gained 26.16% in the last month. Get their top stocks with our free stock ideas tool. See stock ideas

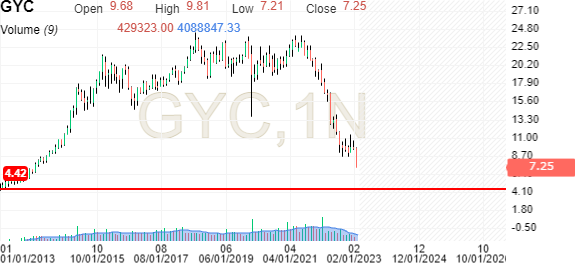

Grand City Properties SA (GYC)

Xetra

| Symbol | Exchange | Currency | ||

|---|---|---|---|---|

| GYC | Xetra | EUR | Delayed | |

| GYCd | BATS Europe | EUR | Delayed | |

| GYC | TradeGate | EUR | Delayed | |

| GYC | Frankfurt | EUR | Delayed | |

| GYC | Vienna | EUR | Real-time |

Add to/Remove from Watchlist

Add to Watchlist

10.92

+0.14

+1.30%

- Volume: 11,670

- Bid/Ask: 10.89 / 10.92

- Day's Range: 10.68 - 10.92

Grand City

10.92

+0.14

+1.30%

- General

- Chart

- News & Analysis

- Financials

- Technical

- Forum

- Technical Analysis

- Candlestick Patterns

- Analyst Price Target

GYC Candlestick Patterns

Dozens of bullish and bearish live candlestick chart patterns for the Grand City Properties SA stock and use them to predict future market behavior. The Grand City stock patterns are available in a variety of time frames for both long and short term investments. Gain a trading edge with the auto pattern recognition feature and gain an insight into what the patterns mean.

Customize

Candlestick Patterns

Time Frame

Pattern Indication

Type

Reliability

| Pattern | Timeframe | Reliability | Candles Ago | Candle Time | |

|---|---|---|---|---|---|

| Emerging Patterns | |||||

| Bullish Engulfing | 1D | Current | |||

| Bullish Engulfing | 5H | Current | |||

| Bullish Engulfing | 1H | Current | |||

| Completed Patterns | |||||

| Bullish Engulfing | 1W | 2 | Apr 28, 2024 | ||

| Belt Hold Bearish | 30 | 2 | May 15, 2024 03:30AM | ||

| Three Outside Down | 1M | 3 | Feb 24 | ||

| Harami Cross | 1W | 3 | Apr 21, 2024 | ||

| Bullish Engulfing | 30 | 3 | May 15, 2024 03:00AM | ||

| Engulfing Bearish | 1M | 4 | Jan 24 | ||

| Upside Gap Three Methods | 1M | 4 | Jan 24 | ||

| Engulfing Bearish | 1W | 4 | Apr 14, 2024 | ||

| Doji Star Bearish | 15 | 5 | May 15, 2024 03:15AM | ||

| Three Outside Up | 15 | 5 | May 15, 2024 03:15AM | ||

| Falling Three Methods | 1H | 6 | May 14, 2024 07:00AM | ||

| Belt Hold Bearish | 30 | 6 | May 14, 2024 10:30AM | ||

| Dark Cloud Cover | 30 | 6 | May 14, 2024 10:30AM | ||

| Bullish Engulfing | 15 | 6 | May 15, 2024 03:00AM | ||

| Belt Hold Bullish | 1H | 7 | May 14, 2024 06:00AM | ||

| Three Inside Up | 1H | 7 | May 14, 2024 06:00AM | ||

| Abandoned Baby Bullish | 15 | 9 | May 14, 2024 11:00AM | ||

| Bullish Engulfing | 30 | 10 | May 14, 2024 08:30AM | ||

| Three Outside Up | 1D | 11 | Apr 29, 2024 | ||

| Inverted Hammer | 1H | 11 | May 13, 2024 11:00AM | ||

| Belt Hold Bearish | 15 | 11 | May 14, 2024 10:30AM | ||

| Engulfing Bearish | 15 | 11 | May 14, 2024 10:30AM | ||

| Belt Hold Bullish | 1D | 12 | Apr 26, 2024 | ||

| Bullish Engulfing | 1D | 12 | Apr 26, 2024 | ||

| Harami Bullish | 1W | 13 | Feb 11, 2024 | ||

| Inverted Hammer | 1D | 13 | Apr 25, 2024 | ||

| Harami Bullish | 5H | 13 | May 07, 2024 11:00AM | ||

| Falling Three Methods | 1M | 14 | Mar 23 | ||

| Harami Bullish | 1H | 14 | May 13, 2024 08:00AM | ||

| Harami Cross | 1H | 14 | May 13, 2024 08:00AM | ||

| Three Outside Up | 30 | 14 | May 14, 2024 06:30AM | ||

| Bullish doji Star | 1W | 15 | Jan 28, 2024 | ||

| Belt Hold Bullish | 30 | 15 | May 14, 2024 06:00AM | ||

| Bullish Engulfing | 30 | 15 | May 14, 2024 06:00AM | ||

| Harami Bullish | 5H | 17 | May 06, 2024 05:00AM | ||

| Thrusting Bearish | 1W | 18 | Jan 07, 2024 | ||

| Doji Star Bearish | 15 | 18 | May 14, 2024 08:45AM | ||

| Three Inside Up | 30 | 19 | May 14, 2024 04:00AM | ||

| Bullish Engulfing | 15 | 19 | May 14, 2024 08:30AM | ||

| Harami Cross Bearish | 30 | 22 | May 13, 2024 11:30AM | ||

| Tri-Star Bearish | 15 | 22 | May 14, 2024 07:15AM | ||

| Abandoned Baby Bullish | 1H | 23 | May 10, 2024 08:00AM | ||

| Bullish Engulfing | 1H | 23 | May 10, 2024 08:00AM | ||

| Bullish doji Star | 1M | 24 | May 22 | ||

| Bullish doji Star | 1H | 24 | May 10, 2024 07:00AM | ||

| Belt Hold Bullish | 30 | 24 | May 13, 2024 10:30AM | ||

| Dragonfly Doji | 30 | 26 | May 13, 2024 09:30AM | ||

| Tri-Star Bullish | 15 | 26 | May 14, 2024 06:15AM | ||

| Bullish Hammer | 1M | 27 | Feb 22 | ||

| Dragonfly Doji | 1M | 27 | Feb 22 | ||

| Bullish doji Star | 1M | 29 | Dec 21 | ||

| Dragonfly Doji | 1M | 29 | Dec 21 | ||

| Harami Bullish | 30 | 29 | May 13, 2024 07:30AM | ||

| Harami Cross | 30 | 29 | May 13, 2024 07:30AM | ||

| Three Black Crows | 30 | 30 | May 13, 2024 07:00AM | ||

| Three Black Crows | 1W | 31 | Oct 08, 2023 | ||

| Belt Hold Bullish | 5H | 31 | Apr 26, 2024 12:00AM | ||

| Bullish Engulfing | 5H | 31 | Apr 26, 2024 12:00AM | ||

| Engulfing Bearish | 1M | 32 | Sep 21 | ||

| Belt Hold Bearish | 30 | 32 | May 13, 2024 05:30AM | ||

| Engulfing Bearish | 30 | 32 | May 13, 2024 05:30AM | ||

| Doji Star Bearish | 1D | 34 | Mar 25, 2024 | ||

| Belt Hold Bullish | 5H | 34 | Apr 24, 2024 11:00PM | ||

| Evening Star | 30 | 34 | May 13, 2024 04:00AM | ||

| Evening Doji Star | 30 | 34 | May 13, 2024 04:00AM | ||

| Abandoned Baby Bearish | 30 | 34 | May 13, 2024 04:00AM | ||

| Advance Block Bearish | 1W | 35 | Sep 10, 2023 | ||

| Doji Star Bearish | 30 | 35 | May 13, 2024 03:30AM | ||

| Gravestone Doji | 30 | 35 | May 13, 2024 03:30AM | ||

| Rising Three Methods | 30 | 36 | May 13, 2024 03:00AM | ||

| Belt Hold Bullish | 15 | 36 | May 14, 2024 03:00AM | ||

| Bullish Engulfing | 15 | 36 | May 14, 2024 03:00AM | ||

| Belt Hold Bearish | 1H | 37 | May 09, 2024 03:00AM | ||

| Harami Cross | 1W | 38 | Aug 20, 2023 | ||

| Upside Gap Three Methods | 1D | 40 | Mar 15, 2024 | ||

| Thrusting Bearish | 30 | 40 | May 10, 2024 10:00AM | ||

| Belt Hold Bullish | 15 | 40 | May 13, 2024 10:30AM | ||

| Three Inside Up | 5H | 41 | Apr 22, 2024 01:00AM | ||

| Harami Cross | 1M | 42 | Nov 20 | ||

| Thrusting Bearish | 1D | 42 | Mar 13, 2024 | ||

| Harami Bullish | 5H | 42 | Apr 19, 2024 08:00AM | ||

| Three Outside Up | 1W | 43 | Jul 16, 2023 | ||

| Bullish Engulfing | 30 | 43 | May 10, 2024 08:00AM | ||

| Falling Three Methods | 15 | 43 | May 13, 2024 09:30AM | ||

| Bullish Engulfing | 1W | 44 | Jul 09, 2023 | ||

| Bullish Engulfing | 5H | 44 | Apr 18, 2024 07:00AM | ||

| Doji Star Bearish | 1W | 45 | Jul 02, 2023 | ||

| Bullish doji Star | 30 | 45 | May 10, 2024 07:00AM | ||

| Homing Pigeon | 5H | 46 | Apr 17, 2024 11:00AM | ||

| Harami Bullish | 15 | 48 | May 13, 2024 07:45AM | ||

| Harami Cross | 15 | 48 | May 13, 2024 07:45AM | ||

| Bullish doji Star | 5H | 49 | Apr 16, 2024 10:00AM | ||

| Bullish Engulfing | 30 | 49 | May 10, 2024 05:00AM | ||

| Gravestone Doji | 1D | 50 | Mar 01, 2024 | ||

| Engulfing Bearish | 1M | 51 | Feb 20 | ||

| Upside Gap Three Methods | 5H | 52 | Apr 15, 2024 09:00AM | ||

| Engulfing Bearish | 1H | 52 | May 07, 2024 06:00AM | ||

| Belt Hold Bearish | 15 | 52 | May 13, 2024 05:30AM | ||

| Engulfing Bearish | 15 | 52 | May 13, 2024 05:30AM | ||

| Harami Cross Bearish | 1H | 53 | May 07, 2024 05:00AM | ||

| Shooting Star | 30 | 53 | May 10, 2024 03:00AM | ||

| Three Inside Up | 5H | 54 | Apr 14, 2024 11:00PM | ||

| Harami Cross Bearish | 30 | 54 | May 09, 2024 11:30AM | ||

| Belt Hold Bearish | 1H | 55 | May 07, 2024 03:00AM | ||

| Engulfing Bearish | 1H | 55 | May 07, 2024 03:00AM | ||

| Doji Star Bearish | 15 | 56 | May 13, 2024 03:30AM | ||

| Gravestone Doji | 15 | 56 | May 13, 2024 03:30AM | ||

| Harami Bullish | 1M | 58 | Jul 19 | ||

| Inverted Hammer | 1M | 58 | Jul 19 | ||

| Morning Doji Star | 1W | 58 | Apr 02, 2023 | ||

| Engulfing Bearish | 1M | 59 | Jun 19 | ||

| Bullish doji Star | 1W | 59 | Mar 26, 2023 | ||

| Separating Lines Bullish | 30 | 60 | May 09, 2024 08:30AM | ||

| Homing Pigeon | 1H | 61 | May 06, 2024 06:00AM | ||

| Belt Hold Bearish | 30 | 61 | May 09, 2024 07:00AM | ||

| Belt Hold Bullish | 1D | 62 | Feb 14, 2024 | ||

| Harami Bullish | 1W | 63 | Feb 26, 2023 | ||

| Harami Cross | 1W | 63 | Feb 26, 2023 | ||

| Morning Doji Star | 1D | 64 | Feb 12, 2024 | ||

| Morning Star | 1D | 64 | Feb 12, 2024 | ||

| Bullish doji Star | 1D | 65 | Feb 09, 2024 | ||

| Belt Hold Bearish | 5H | 65 | Apr 09, 2024 03:00AM | ||

| Dark Cloud Cover | 5H | 65 | Apr 09, 2024 03:00AM | ||

| Three Black Crows | 1D | 66 | Feb 08, 2024 | ||

| Belt Hold Bearish | 30 | 66 | May 09, 2024 03:00AM | ||

| Falling Three Methods | 1D | 67 | Feb 07, 2024 | ||

| Morning Doji Star | 1H | 67 | May 03, 2024 09:00AM | ||

| Harami Cross Bearish | 15 | 67 | May 10, 2024 08:30AM | ||

| Dark Cloud Cover | 1D | 68 | Feb 06, 2024 | ||

Add Chart to Comment

Confirm Block

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

Report this comment

I feel that this comment is:

Comment flagged

Thank You!

Your report has been sent to our moderators for review