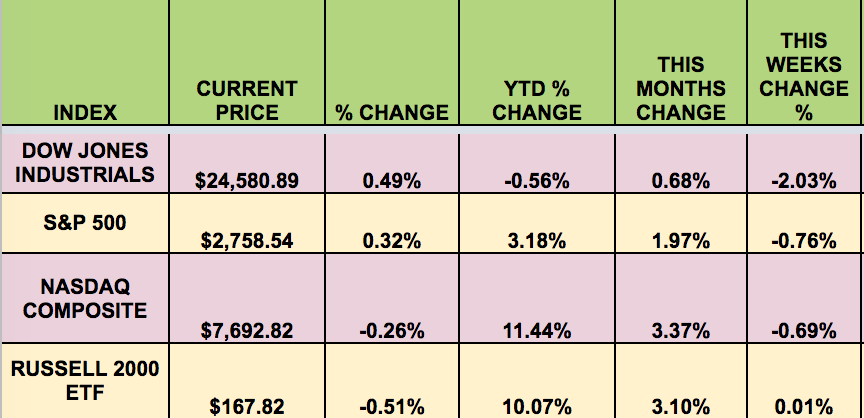

Markets: It was a mixed week for the market, with only the Russell 2000 breaking even, as escalating trade war tensions weighed on most sectors. The S&P 500 and the Dow both rose on Friday, with the Dow ending an 8-day skid, via some help from energy stocks, but Tech losses pressured the NASDAQ.

“Trade war fears drove the Dow down 400 points, or 1.6%, in early trading on Tuesday. That put it in negative territory for the year and on track for its sixth straight decline. The US administration threatened to impose tariffs on an additional $200 billion worth of Chinese goods if Beijing follows throw with its promise to retaliate against a previous round of US tariffs. There is no end in sight to the trade skirmish, as both sides continue to up the ante. The Chinese Commerce Ministry responded that it would “strike back hard” with “measures that match the US move in quantity and quality.”

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: IVR, ACRE, AFC, AGNC, AHT, ARI, ATAX, CCT, BGS, CLDT, CIM, CLNS, CMO, CVA, EARN, KREF, MFA, PEGI, SLD, SCM, SRC, STWD, UNIT.

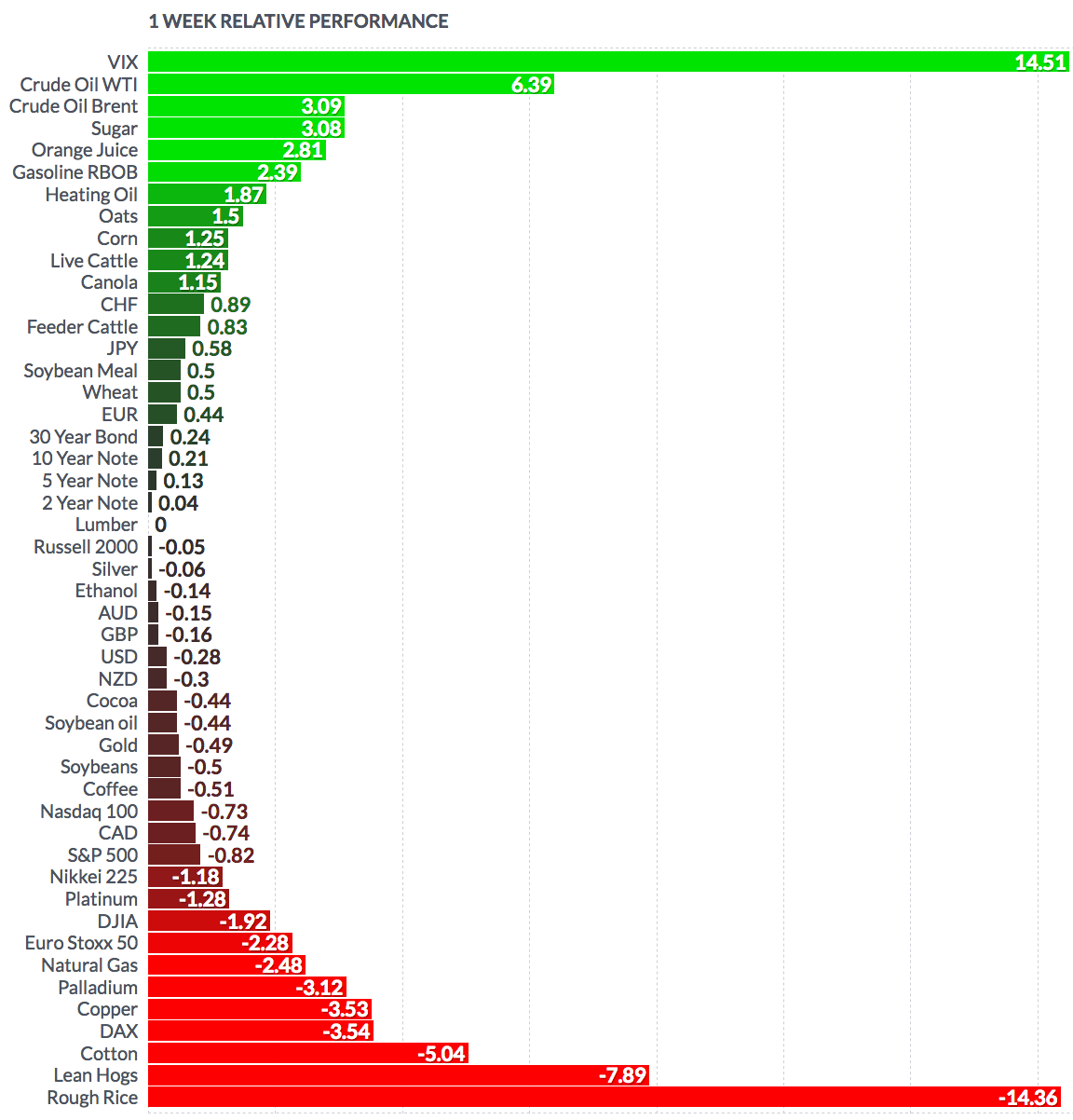

Volatility: The VIX rose 14.94% this week, ending the week at $13.77.

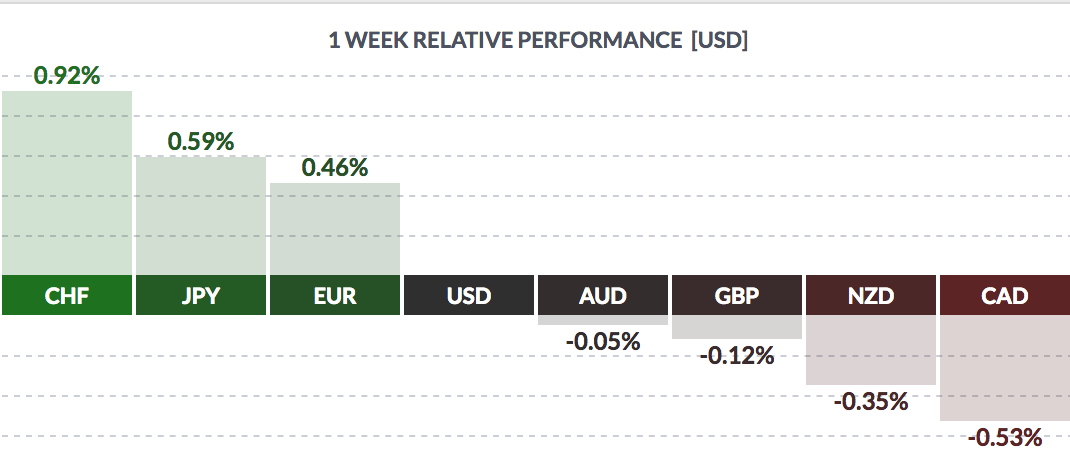

Currency: The dollar was mixed this week – it rose vs. the Aussie, NZD, and the Loonie, but fell vs. the Swiss franc, the yen, and the euro.

Market Breadth: 5 of the DOW 30 stocks rose this week, vs. 27 last week. 36% of the S&P 500 rose this week, vs. 50% last week.

Economic News:

“Sentiment among U.S. homebuilders fell in June to match the lowest level this year, reflecting sharply elevated lumber costs, according to a report Monday from the National Association of Home Builders/Wells Fargo. Tariffs on lumber and other imported materials are making construction more expensive, which in turn limits affordability for prospective buyers, according to the NAHB.

Higher lumber prices have added nearly $9,000 to the price of a new single-family home since January 2017, the Washington-based group said. Lumber prices rose to a record in May. Higher mortgage rates, a shortage of affordably-priced listings, and soaring property values have also made purchases less attractive, especially for people entering the market for the first time.”

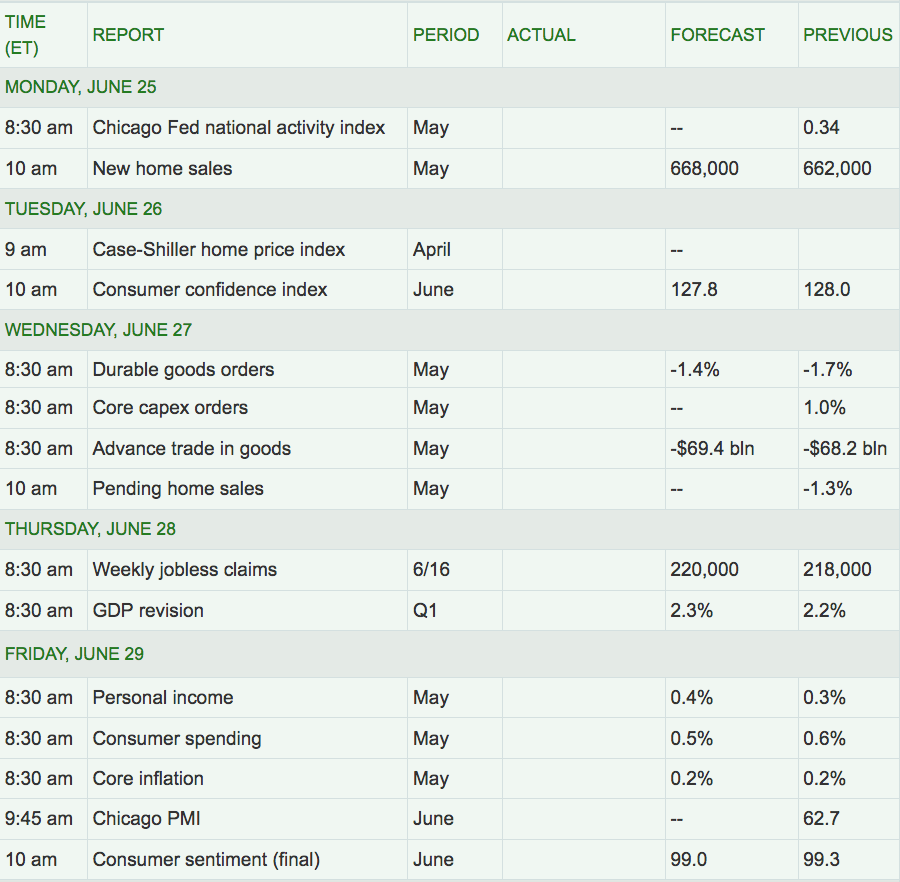

Week Ahead Highlights: Housing and Consumer data will be in focus next week, with several reports due out.

“An overhauled telecommunications sector featuring most of the so-called FANG stocks could debut as Wall Street’s hottest bet when it kicks off in September, boosted by a rising wave of media and television acquisitions. The S&P 500 Telecom Services Sector will be renamed Communications Services and supercharged with the addition of Facebook (NASDAQ:FB), Netflix (NASDAQ:NFLX). and Google-owner Alphabet – three of the four FANGs, along with Amazon (NASDAQ:AMZN) – as well as other companies that have driven the stock market to record highs in recent years.

The changes are part of the largest-ever shakeup of the stock market’s broad business categories.

In total, 14 S&P 500 companies, including Netflix, will shift from the consumer discretionary sector into communications, joining AT&T (NYSE:T), Verizon (NYSE:VZ) and CenturyLink (NYSE:CTL) in the biggest shakeup of the Global Industry Classification Standard, or GICS, since it was created in 1999. Five S&P 500 companies will switch from technology to communications.

The new sector will also include Walt Disney), Comcast (NASDAQ:CMCSA), and other entertainment and media companies scrambling to consolidate and fend off competition from newcomers Netflix and Alphabet (NASDAQ:GOOGL), which produce content and sell it directly to consumers.” (Reuters)

Next Week’s US Economic Reports:

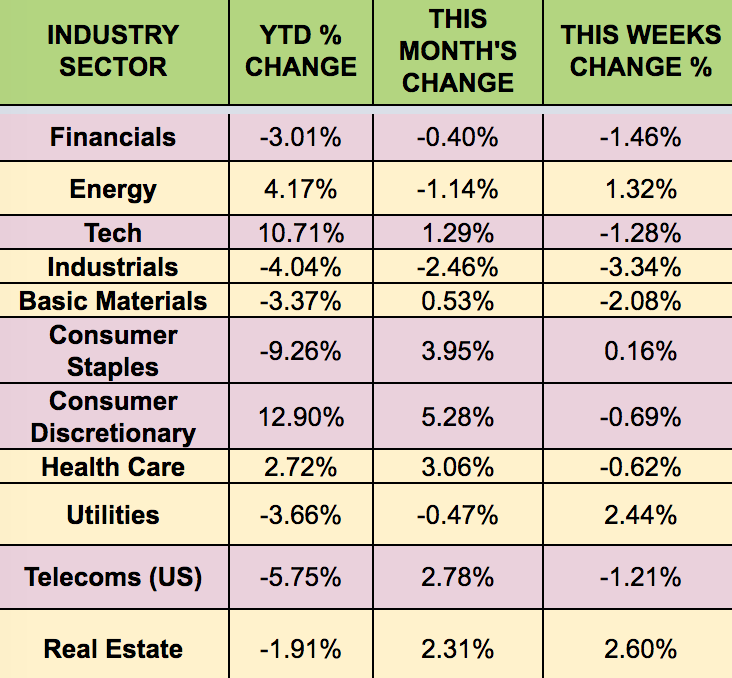

Sectors: The Utilities, Real Estate) and Energy sectors led this week, while Industrials trailed, pushed lower by trade war fallout.

Futures:

WTI Crude finished the week up 6.39%, at $69.35/barrel, its highest price in nearly a month, while Natural Gas fell 2.48%.

“OPEC agreed on Friday on a modest increase in oil production from next month after its leader Saudi Arabia persuaded arch-rival Iran to cooperate, following calls from major consumers to curb rising fuel costs. But the agreement failed to announce a clear target for the output increase, leaving traders guessing how much more OPEC will actually pump. OPEC said in a statement that it would raise supply by returning to 100 percent compliance with previously agreed output cuts, but gave no concrete figures.”