Profit from clinical innovation

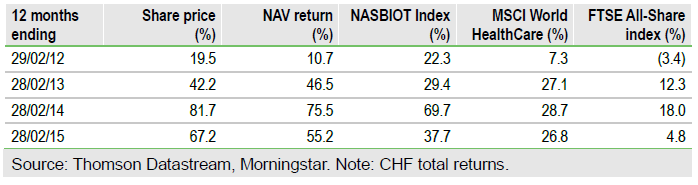

BB Biotech AG (SIX:BION) is a Swiss specialist biotech investment company, with a bias towards mid-sized and larger companies generating revenues. The company targets double-digit annual returns and outperformed its NASDAQ Biotechnology benchmark in 2014 in what was a very strong year for the sector, posting a total return (in Swiss francs) of 75.1% versus 50.3% for the index.

Inclusion in the Stoxx 600 index from December 2014 reflects strong capital performance and increased liquidity. This will increase the fund’s visibility to investors, while buying from passive funds may have helped the discount to narrow to its current level of c 14%.

Investment strategy: Where science and finance meet

BION aims to achieve total returns of c 15% a year over a medium- to long-term horizon by investing in high-growth biotechnology firms that are developing and marketing new products to address areas of unmet medical need. Its investment team brings together scientific and investment professionals to enable evaluation both of complex clinical issues and company financials, filtering down a universe of c 800 stocks to a portfolio of 20-35 holdings. The managers, based mainly in Zurich and New York, are supported by an executive board of directors with significant industry experience, who have the final say on portfolio construction.

Outlook: Bulls still running despite price criticism

The biotech sector has continued to perform strongly over the past year, shrugging off market reversals in March and October 2014 and January 2015. Increasing criticism of drug pricing has been a factor in all three corrections, but the resumption of the bull market on each occasion suggests there are at least as many investors who see the sector as offering high growth at relatively attractive valuations, as those who fear that price pressure could spell an end to the bull run. Investors should be mindful of macroeconomic and geopolitical worries, however, as in the past, rises in risk aversion have tended to hit high-growth sectors such as technology and biotech more than markets as a whole.

Valuation: Discount narrower since index inclusion

BION’s discount to net asset value has narrowed since its inclusion in the Stoxx Europe 600 index in December 2014, and stood at 13.6% at 10 March, compared with an average of 21-22% over the past one, three and five years. The discount remains wider than UK-listed peers, but could narrow further through a combination of buying from index-tracking funds and discount-targeting measures such as a 5% annual buyback policy and a relatively high yield (3.7% at 10 March), funded by capital distributions.

To Read the Entire Report Please Click on the pdf File Below