- German industrial output is expected to rebound in January

- The red ink for German factory orders was probably just an anomaly

- Industrial production in Brazil is on track to rise after sliding for over two years

- ADP should report softer but still healthy growth in US private payrolls in February

Today’s update on industrial production in Germany will be widely read after yesterday’s surprisingly weak numbers on factory orders for Europe’s largest economy. We’ll also see new data on Brazil’s industrial output and ADP’s estimate of US private payrolls in February.

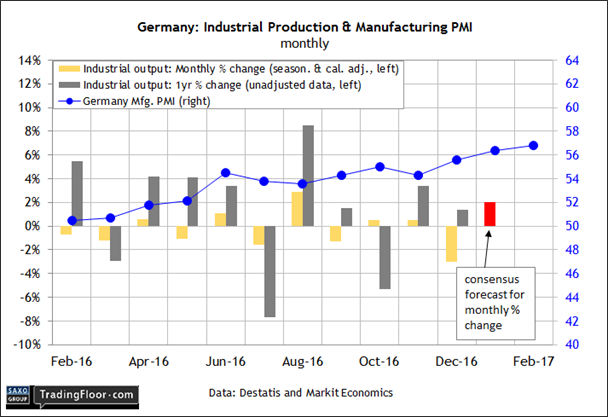

Germany: Industrial Production (0800 GMT): The surprisingly weak report on factory orders for January -- the 7.4% slide was the biggest decline in eight years -- has raised new concerns about the outlook for Europe’s biggest economy in 2017. Will today’s release on industrial production repair the damage to sentiment?

Yes, according to Econoday.com’s consensus forecast. Economists are looking for a rebound in output in January. Production is on track to rise 2.0% following a 3.0% slide in December. If the data falls in line with the upbeat outlook, the annual pace of output will stay positive, dispensing the third month of positive year-over-year comparisons.

Sentiment data for manufacturing still looks solid, suggesting that the red ink for factory orders was a fluke. IHS Markit reported last week that the Germany Manufacturing PMI jumped to its highest reading in six years in February.

Meanwhile, Germany’s economy ministry advised yesterday that the slump in factory orders in January was probably a temporary setback. “The business climate in the manufacturing sector is significantly brighter than the long-time annual average so a revival of the economy in the industrial sector can still be expected,” the government said.

The question is whether the “revival” will be visible in today’s hard data on industrial activity.

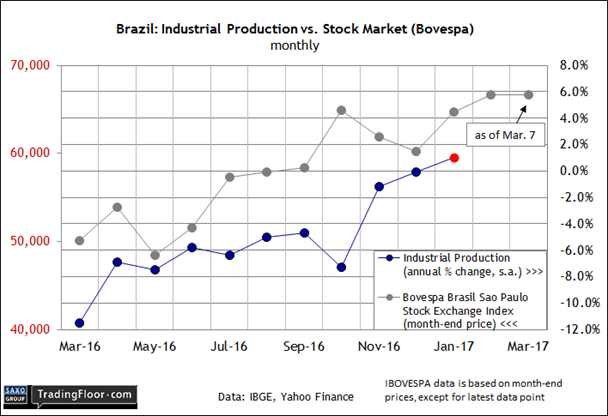

Brazil: Industrial Production (1100 GMT): Latin America’s largest economy continues to struggle. Yesterday’s GDP report shows that output fell more than expected in the fourth quarter.

GDP slumped 0.9% in Q4 after falling 0.7% in Q3. The latest decrease marks the biggest setback for the broad trend in a year. “There’s no new evidence of where the economic activity is going to come from,” said the chief economist at Gradual Cctvm, an investment firm in Brazil.

Today’s update on industrial activity is headed for weaker results too, according to TradingEconomics.com’s consensus forecast. The monthly change in output is expected to fall 0.5% in January after rising a solid 2.3% in the previous month.

The year-over-year trend for industrial production, however, may provide a brighter profile. Economists project that the annual pace will rise 1.0% in January compared to the year-earlier period. If the estimate holds, the news will be a milestone for this indicator, which has been in the red in the annual column for two-and-half years. In turn, a positive reading today would provide more support for arguing that Brazil’s economy could still find its footing in 2017 and emerge from recession.

Roubini Global Economics is projecting that GDP will advance 0.7% this year after falling 3.6% in 2016. Meantime, Brazil’s stock market has been anticipating recovery for months. The Bovespa Index has surged more than 30% over the past 12 months, largely on expectations that the recession had run its course.

A positive report in today’s industrial data for the year-over-year change will keep hope alive that 2017 could still turn out to be a turning point for the beleaguered Latin American economy.

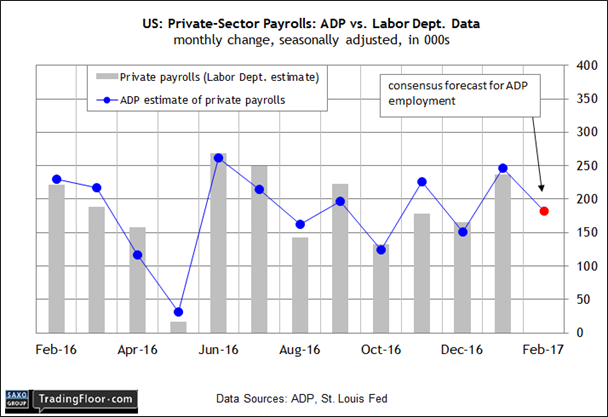

US: ADP Employment Report (1315 GMT): If there’s any number that can dent the rosy glow about US economic expectations, payrolls is at the top of the list. But the outlook at the moment remains bright, as today’s update from ADP is expected to show.

Economists project that US companies added 183,000 workers in February, according to Econoday.com’s consensus forecast for ADP’s estimate. Although that’s down from January’s 246,000 pop, the forecast for today’s release is still strong enough to dispel worries that US economic growth is faltering.

Nonetheless, there may be gremlin in the machine. Yesterday’s revised nowcast for GDP growth in this year’s first quarter fell to a weak 1.3%, according to the Atlanta Fed’s GDPNow model. If accurate, the economy is set to decelerate further after posting a sluggish 1.9% rise in last year’s Q4.

By the Organization for Economic Cooperation and Development’s reckoning, however, the full-year outlook for the US remains upbeat. “Domestic demand is set to strengthen, helped by gains in household wealth and a gradual upturn in oil production,” the OECD said in yesterday’s revised forecast. “GDP growth is expected to pick up to 2.4% this year and 2.8% in 2018, supported by an anticipated fiscal expansion, despite higher long-term interest rates and a stronger dollar.”

In the wake of the weak GDPNow estimate for Q1 GDP, it's reasonable to ask: Is the OECD’s outlook headed for a downgrade? A preliminary answer, for good or ill, may arrive in today’s ADP report.

Disclosure: Originally published at Saxo Bank TradingFloor.com