By Marc Jones

LONDON (Reuters) - Europe led world stock markets back to higher ground on Thursday as tentative moves to reopen parts of the some of its larger coronavirus-hit economies offset some truly stinking global economic numbers.

Asian equities and U.S. futures had wilted earlier in the day after warnings of a Great Depression-style slump in the world economy, a record plunge in U.S. retail sales, oil near an 18-year low [O/R] and the prospect of a sky high jump in U.S. jobless claims later in the session.

But the pan-European STOXX 600 index (STOXX) rose over 1% in early trade, spurred by a drop in the virus death tolls in both Spain and Italy and reassuring statements from two of the continent's big budget airlines about their survival prospects. (EU)

Wall Street futures (ESc1) recovered, too, and in the currency and bond markets both the dollar

"We have had this big wave of big announcements by governments and central banks and now we need to get into the nitty gritty of how it all works," said AXA Investment Managers chief economist Gilles Moec.

"We need to see if it is working, how it is working and if we need to do more."

Markets may be seizing on the fact that policymakers, however reluctantly, are starting to allow stringent lockdowns to ease.

Germany is proposing to reopen schools and some retailers starting May 4, while around 20 U.S. states spared the worst of the coronavirus pandemic may start reopening their economies by President Donald Trump's May 1 target date.

Firms are looking to restart as well. Volkswagen (DE:VOWG_p) has said its factories in Germany and Slovakia will resume some production from April 20 with others following a week later.

But the economic figures are dire. After the IMF’s forecasts for this year, markets are expecting China to report on Friday that Q1 GDP contracted for the first time on record, and hopes for a quick rebound are fading fast.

A Reuters survey showed that most Japanese firms feel stimulus announced so far are insufficient and Wednesday's U.S. data also showed manufacturing output there dropping the most in over 74 years.

OIL IN A RUT

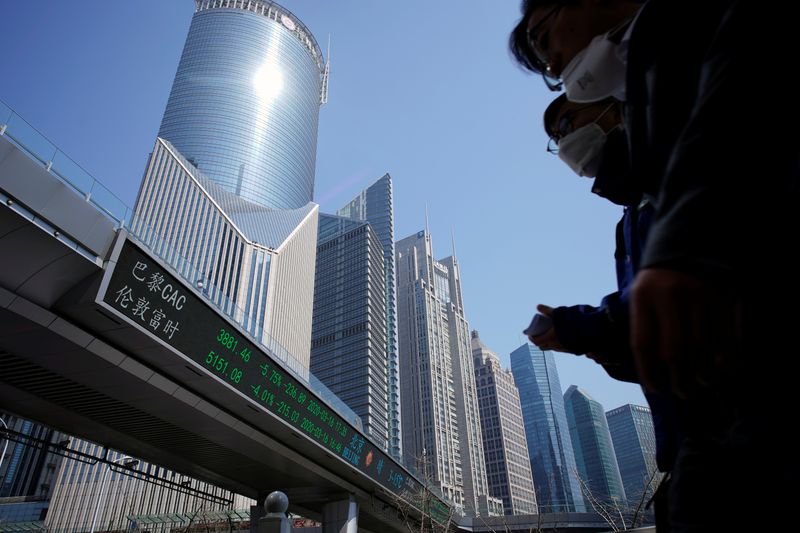

Asia had had a difficult day as a result. Tokyo's Nikkei dropped 1.3% and MSCI's broadest index of Asia-Pacific shares outside Japan (MIAPJ0000PUS) lost almost 1%, wiping out early week gains that had taken it to a one-month high.

The risk-sensitive Australian dollar

U.S. crude (CLc1) sat at $20.22 per barrel, just over $1 above an 18-year low hit on Wednesday, and Brent crude (LCOc1) rose 37 cents or 1.3% in European trade to $28.02 per barrel.

The International Monetary Fund is predicting zero growth in Asia this year for the first time in 60 years, as exporters are pounded by slumping demand and anti-virus measures force consumers to stay home and shops to shut down.

Benchmark indexes in Australia (AXJO), Hong Kong (HSI) and Shanghai (SSEC) also posted falls between 0.4% and 1.3% and some emerging markets fell harder.

"A recovery timeline...remains impossible to predict," said Ronald Lam, chief customer officer at airline Cathay Pacific (HK:0293), which has slashed nearly all its passenger capacity and lost a fifth of its value this year.