By Marcela Ayres

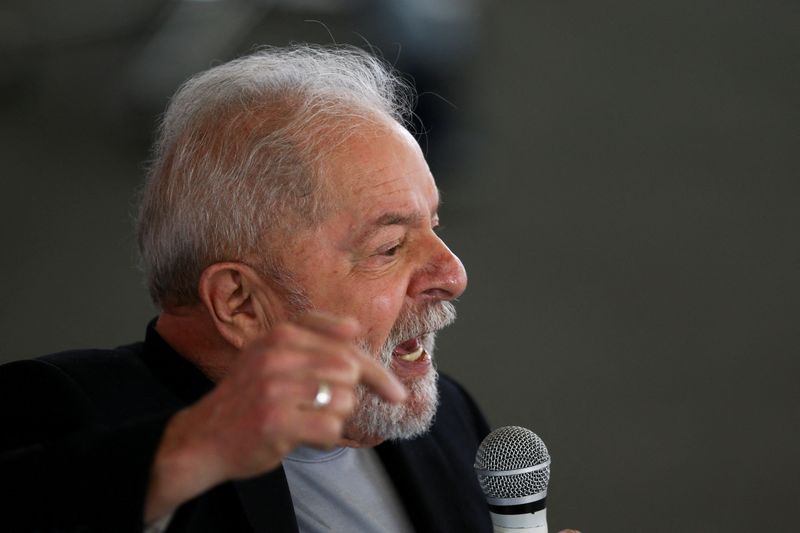

BRASILIA (Reuters) - A Canadian research note calling ex-president Luiz Inacio Lula da Silva a possible "savior" of Brazil's sluggish economy has stoked debate in financial markets over increasingly bullish foreign investors eyeing a return of the left-wing leader.

BCA Research analysts raised their recommendation on Brazilian equities and sovereign debt to "overweight" in a note published this week, based on "rising odds" of Lula winning the presidential election in October.

"Lula's current policy proposals and his agenda following the election will be moderate, providing a positive impetus to financial markets," wrote the BCA analysts, led by Chief Emerging Markets Strategist Arthur Budaghyan, in a note titled "Is Lula Brazil's Savior?"

The outlook comes as foreign flows into Brazilian financial markets have surged to $9.5 billion so far this year, boosting the local currency 7% against the dollar as the benchmark Bovespa stock index has risen 8%.

Much of that has come from a belief among global investors that Lula, who enjoys a double-digit lead over right-wing President Jair Bolsonaro in recent opinion polls, will take a pragmatic approach to policy, as prominent Brazilian hedge fund managers flagged during an event last week.

While many domestic investors rue the demise of a reform agenda that Bolsonaro promised on taking office, foreign investors take comfort in memories of the orthodox economic policies Lula adopted early in his 2003-2010 presidency.

"The leading candidate in the polls has a positive international image. He is not unknown, he is a candidate who has been tried," said Gabriel Galipolo, former CEO of Banco Fator and managing partner of Galipolo Consultancy.

He highlighted that Brazil is one of several emerging markets lifted in recent weeks by investors shifting out of the U.S. tech sector and toward other high-yielding assets. Brazilian interest rates have also climbed into double digits as the central bank battles inflation aggressively, which has also lured financial flows.

Another chief economist at a Brazilian bank told Reuters Lula's proposals to re-ignite growth with public investments and more generous social programs may even be good for the economy.

Policymaking under Bolsonaro has been torn lately between an economy minister intent on fiscal discipline and allies in Congress eager to spend on pork barrel projects. In contrast, Lula has proven to be a nimble negotiator in Congress.

"A Lula government would also have more ability to move between congressmen," said the economist, requesting anonymity to avoid political blowback.

However, even the most optimistic investors recognize the challenge in coming years of stabilizing public debt levels, which now stand at 80.3% of gross domestic product.

"In the long run, odds are that Lula's government will attempt to 'inflate its way out of debt,'" the BCA analysts told clients. "Hence, our long-term strategy on Brazil remains intact: long stocks but hedge currency risk."