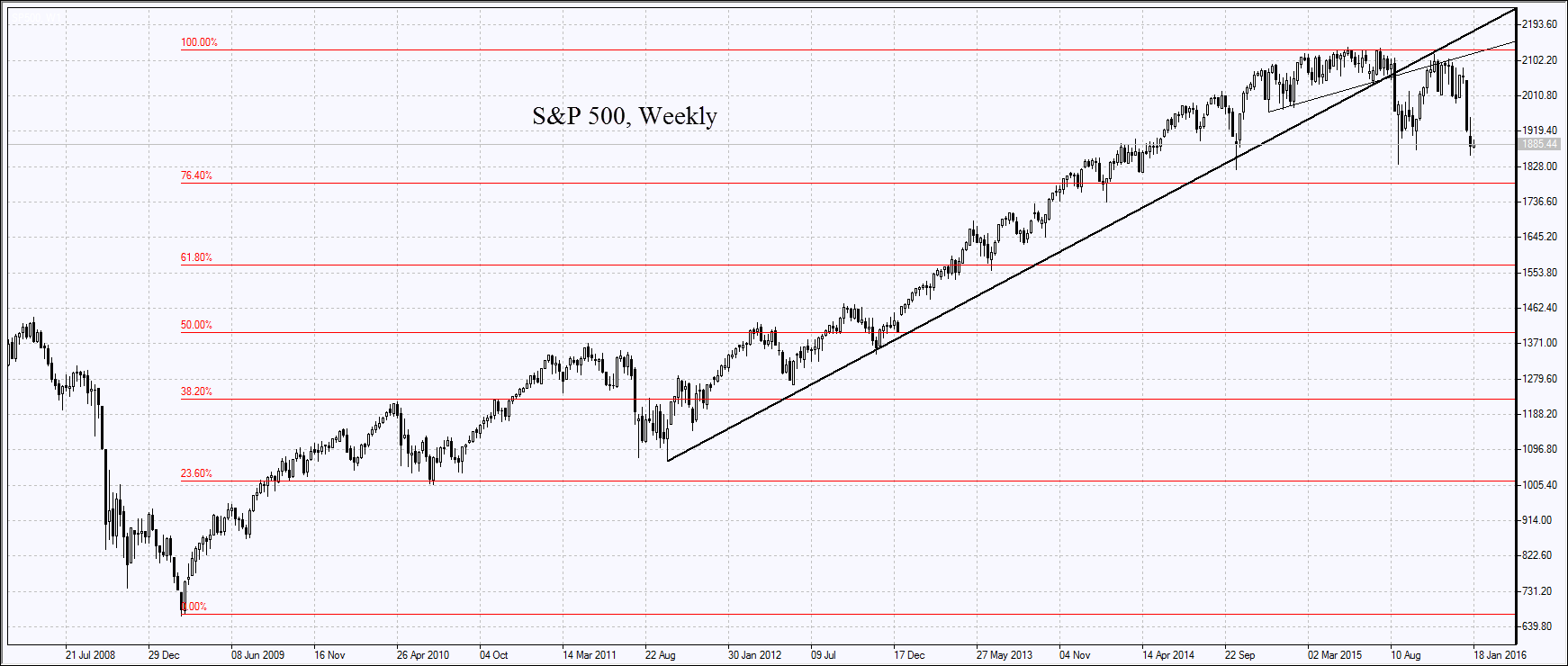

US stock market edged lower on Friday amid negative economic data on fallen December retail sales in the US. Market participants believe that consumers now acquire less winter clothes due to the warm weather. The cheap gasoline is another factor. Moreover, the industrial production fell for the third straight month in December. About 100 S&P 500 components hit the fresh 12-month lows. Last week the Dow Jones 30 and S&P 500 indices lost 2.2% each while NASDAQ Composite lost 3.3%. The US dollar indexended the week marginally higher within its neutral range. On Friday Intel (O:INTC) stocks suffered a record in 7 years daily fall of 9.1% on weak quarterly reports. For the same reason the Citigroup (N:C) bank lost 6.4% while Wells Fargo (N:WFC) lost 3.6%. The trading volume was 42% above the average for the last 20 days amounting to 10.8 bn. stocks. Today US stock exchanges are closed today due to the Martin Luther King holiday.

European stock indices are slightly correcting upwards after their fall on Friday. Airbus Group (PA:AIR) stocks advanced 1.5% on the news Iran is going to acquire 114 aircraft from the company. The pan-European Stoxx Europe 600 index has been falling for the 3rd straight week having lost already 9.8%. Today in the EU no important macroeconomic statistics is expected.

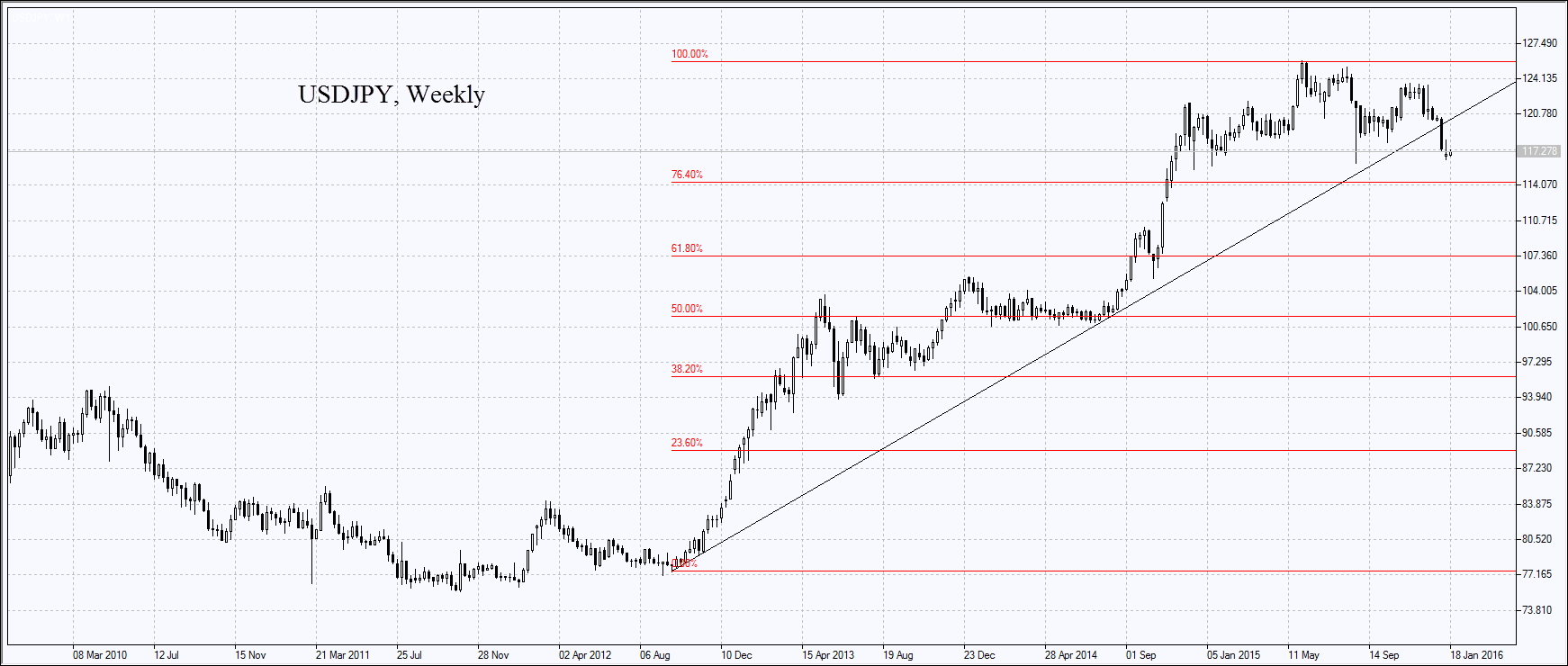

Nikkei edged marginally lower today on the negative corporate news. Nomura Securities investment company has revised down its forecast for SoftBank Group Corp (OTC:SFTBY) from 8.58 yens to 7.55 yens, which made its stocks fall in price by 7.9%. Mizuho Financial Group Inc (T:8411) stocks lost 2.5% after their outlook was revised down too. Today in the morning strong macroeconomic data were released in Japan on November industrial production and December department stores sales. Yen has slightly slid down today amid positive news from China. Previously investors considered it as a safe haven asset so the yen was strengthening. The Bank of China has undertaken measures against yuan speculations and set firmer midpoint rate in order to prevent its further fall. At the start of the year yuan has reached the 5-year low. Tomorrow at 7:00 CET the final machine tool orders for December will be released in Japan.

Tomorrow at 3:00 СЕТ the significant macroeconomic data will be released in China, that may influence the commodity futures: GDP for the 4th quarter, retail sales and the December industrial production. In our opinion, the tentative outlook is moderately negative. The year-on-year growth of Chinese GDP may be the lowest for the last 25 year amounting to 6.8%.

Brent oil prices have fallen today to the lowest since 2003 as the sanctions against Iran are lifted since January 16. Market participants expect Iran to increase its production by 500 thousand barrels a day in a couple of months. Currently Iran is producing 1mln barrels less a day than before sanctions imposed on it in 2011. In our opinion, real production volumes may increase only when Iran regains its $100 bn. held in the Western banks by reason of sanctions. In such a case, oil will correct upwards.

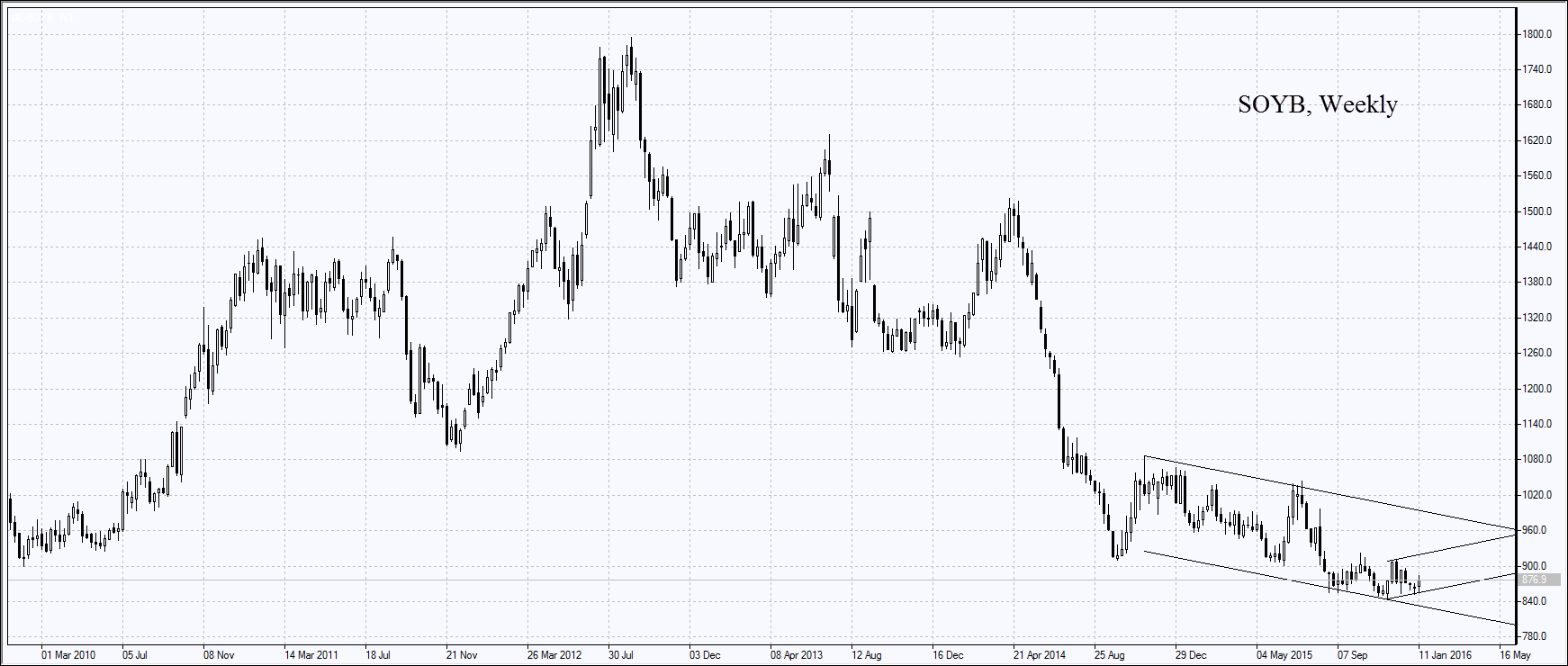

Wheat and corn edged up on Friday in the absence of important news. Market participants could have decided to close the shorts ahead of the long holidays, while soybeans went lower. Meanwhile, the Brazilian AgRural agency does not rule out the possibility that its production in Brazil may fall because of the drought in the central and western parts of the country. By mid-January 0.5% of soybeans were harvested in Brazil. Despite the slowdown of the economic growth, the soy oil consumption in China is expected to rise by 7.8% in 2015/16 season while the palm oil consumption will increase only 0.4%. In the previous season the demand increased 3.4% and 1% respectively. In 2015 the soy oil import to China has reached its historical high of 81.69 bn. tonnes. The China’s demand may support the soy prices.