Market Brief

We are waiting, the market is waiting, but the US recovery continues to lag as yesterday’s data surprised on the downside. May industrial production contracted -0.2%m/m versus 0.2% consensus, prior read revised lower to -0.5%. The popular Empire Manufacturing index highlights the struggles of the manufacturing sector, undermined by a strong dollar and lower oil prices. The index came in negative to -1.98 in June, while market expected an improvement with a positive figure of 2. Capacity utilisation also contracted to 78.1% versus 78.3% expected and prior read. It’s looking increasingly likely that Q2 2015 won’t be a re-play of last year when the US economy expanded at a rate of 4.6%q/q annualised in Q2 14. Yesterday, EUR/USD edged higher after the news, but is moving sideways since then as the market focuses on Grexit.

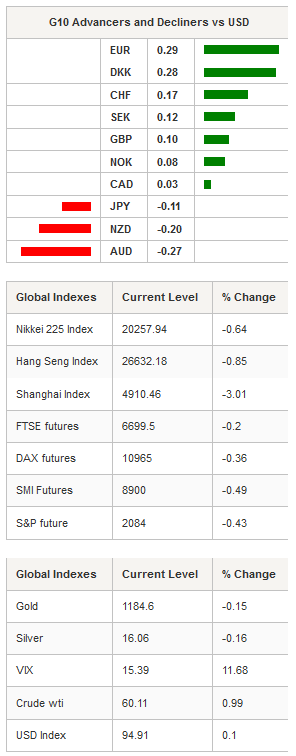

As expected, stocks markets were and are heavily sold-off as Greek worries spread across the world. Asian regional markets suffer massive losses with the Shanghai Composite down -3.01%, while the Shenzhen Composite retreated -3.05%. In Japan, the Nikkei is down -0.64%, Hong Kong’s Hang Seng loses -0.83%, while South Korean shares are down -0.67%. USD/JPY still sits on the 123.20 support (Fib 38.2% on mid-May – June rally). On the upside, a resistance remains at 125.86 (previous high), while a support can be found at 122.37 (Fib 50%).

In Australia, the Reserve Bank reiterated its call for further Aussie depreciation, the minutes showed. The cash rate is on hold so far as the RBA is assessing the information on economic and financial conditions as it became available. We may see the cash rate below 2%, but we think that we need to see further weakness of the Australian economy. AUD/USD trades range-bound between 0.7598 and 0.7814 (Fib 0% and 38.2% on mid-May – June debasement).

In UK, May CPI report is due this morning, and markets expect deflation to be short lived with CPI median forecast at 0.1%y/y in May and Core CPI at 1%y/y. However, we expect inflation pressures to remain subdued, as on a trade-weighted basis, the GBP has strengthened considerably and is now back around its pre-financial crisis levels. GBP/USD is gaining momentum as the cable validated a break to the upside of its 200dma. On the medium-term, the pound converted the 1.5569 resistance (Fib 38.2% on July 2014 – April 15 debasement). On the upside, the next resistance stands at 1.57 (previous high and psychological level) while on the downside, a support can be found at 1.55.

In the European stock market, the free fall continues as buyers are overwhelmed by sellers. Futures on the Footsie are down -0.20%, DAX -0.36, CAC -0.37, SMI -0.49% and Euro Stoxx -0.55%.

Today, traders will be watching UK CPI report; German ZEW; tax collection, formal job creation and April Retail sales from Brazil; May housing start and building permits from the US.

Today's Calendar Estimates Previous Country / GMT EC EU Top Court Rules on ECB's OMT Bond-Buying Plan - - EUR / 07:30 NO May Trade Balance NOK - 1.2B NOK / 08:00 UK May CPI MoM 0.20% 0.20% GBP / 08:30 UK May CPI YoY 0.10% -0.10% GBP / 08:30 UK May CPI Core YoY 1.00% 0.80% GBP / 08:30 UK May Retail Price Index 258.8 258 GBP / 08:30 UK May RPI MoM 0.30% 0.40% GBP / 08:30 UK May RPI YoY 1.10% 0.90% GBP / 08:30 UK May RPI Ex Mort Int.Payments (YoY) 1.10% 0.90% GBP / 08:30 UK May PPI Input NSA MoM 0.60% 0.40% GBP / 08:30 UK May PPI Input NSA YoY -11.30% -11.70% GBP / 08:30 UK May PPI Output NSA MoM 0.10% 0.10% GBP / 08:30 UK May PPI Output NSA YoY -1.60% -1.70% GBP / 08:30 UK May PPI Output Core NSA MoM 0.00% 0.00% GBP / 08:30 UK May PPI Output Core NSA YoY 0.10% 0.10% GBP / 08:30 UK Apr ONS House Price YoY - 9.60% GBP / 08:30 EC 1Q Employment QoQ - 0.10% EUR / 09:00 EC 1Q Employment YoY - 0.90% EUR / 09:00 GE Jun ZEW Survey Current Situation 63 65.7 EUR / 09:00 GE Jun ZEW Survey Expectations 37.3 41.9 EUR / 09:00 EC Jun ZEW Survey Expectations - 61.2 EUR / 09:00 BZ Jun FGV Inflation IGP-10 MoM 0.47% 0.52% BRL / 11:00 BZ Jun 15 FGV CPI IPC-S 0.83% 0.85% BRL / 11:00 BZ Apr Retail Sales MoM 0.70% -0.90% BRL / 12:00 BZ Apr Retail Sales YoY -1.80% 0.40% BRL / 12:00 BZ Apr Retail Sales Broad MoM -0.50% -1.60% BRL / 12:00 BZ Apr Retail Sales Broad YoY -8.00% -0.70% BRL / 12:00 US May Housing Starts 1090K 1135K USD / 12:30 US May Housing Starts MoM -4.00% 20.20% USD / 12:30 US May Building Permits 1100K 1143K USD / 12:30 US May Building Permits MoM -3.50% 10.10% USD / 12:30 CA Apr Int'l Securities Transactions 5.00B 22.50B CAD / 12:30 BZ May Formal Job Creation Total -51282 -97828 BRL / 22:00 BZ May Tax Collections 94000M 109241M BRL / 22:00 CH May Foreign Direct Investment YoY CNY 8.00% 10.50% CNY / 22:00

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1385

CURRENT: 1.1315

S 1: 1.0882

S 2: 1.0521

GBP/USD

R 2: 1.5879

R 1: 1.5800

CURRENT: 1.5618

S 1: 1.5191

S 2: 1.5090

USD/JPY

R 2: 135.15

R 1: 125.64

CURRENT: 123.55

S 1: 122.03

S 2: 118.18

USD/CHF

R 2: 0.9712

R 1: 0.9573

CURRENT: 0.9282

S 1: 0.9072

S 2: 0.8986