We are looking at another stronger open for the Australian equity market this morning, with SPI futures sitting up 19 points (+0.3%) and we should see the bulls building on the recent momentum, with the ASX 200 eyeing an open at 5745 and a re-test of yesterday’s high of 5751.

We will see some much-needed participation come back into play today, after pathetic value of $3.41 billion was traded through the ASX 200 yesterday, and that obviously won’t surprise given the Labour Day holiday. We should gravitate back towards the year-to-date (value) daily average of $6.11 billion and in terms of event risks, I wouldn’t expect today’s statement from the Reserve Bank (14:30 aest) to worry us too greatly. Market pricing on potential RBA moves looks fair and if anything looks quite rich, with a 52% chance of a hike priced into the swaps market for the June meeting. One should expect the message to be unchanged from recent commentary and that being that Aussie economics is in a reasonable place, the labour market is tightening and this should contribute towards higher wages in 2018 and thus the RBA should be on track to meet its inflation goals under the current accommodative monetary policy regime.

That said, while the central bank should acknowledge the stronger global economic backdrop, they should continue to reinforce the notion that while other central banks may look to normalise policy in the period ahead, it doesn’t mean they will.

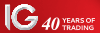

AUD/USD looks interesting here and while we saw a move into $0.7796 at 18:45 aest, the bulls have stepped in and once again defended the 15 August of $0.7807 low with real vigour for the third day in a row. A close through $0.7807 seems important if we are assessing how much influence the bears have here and the probability the huge AUD long position held by the speculative players in the market will start to revert back to a mean. In fact, after the short squeeze from the 78c figure we have seen the AUD as one of the better performers relative to the USD on the session, where the USD has been fairly well bid relative to other G10 currencies, with GBP/USD actually the big (downside) mover on the day.

The USD move continues to be of great interest, notably because technically the USD basket has firmly broken out of the downtrend drawn from the April highs and this signals a change in behaviour from the market. While the USD currently resides at 93.40, a close through 94.00 would be a significant development and could hold strong ramifications for so many other markets. Notably, if the move in the USD is backed by even higher US bond yields (especially on a ‘real’ or inflation-adjusted basis), then emerging market (EM) assets will face increased headwinds, and this should manifest on the AUD, which at times wears the G10 proxy of all things EM.

In terms of overnight drivers to consider, on one hand, we saw the US September ISM manufacturing print coming in at 60.8, where you have to go back to May 2004 to find a similar pace of expansion in US manufacturing. However, while we have seen some good numbers in the more forward-looking indicators, such as the new orders and new exports orders sub-component, the market seems to be giving the ISM manufacturing print some element of caution given the huge 7.3 point increase in the supplier deliveries index, which of course reflects the disruptions caused by the hurricanes.

Another aspect holding US bond yields from rising further in the recent sell-off (US treasuries are largely unchanged across the curve) has been comments from Dallas Fed president, Robert Kaplan, who is a voter and considered quite neutral on monetary policy. Mr Kaplan’s view that “we’re going to have to look hard at whether we should take further action in December” and that the Fed “can afford in my judgment to be patient in removing accommodation” has been noted. While much focus on the fixed income market has been placed on the 5- and 7-year part of the curve, the comments from Kaplan have seen a very modest drop in the implied probability of December hike, although the markets still see a 70% chance of a hike.

US equities have again been at the backbone of the move higher in Aussie SPI futures, although European equities, with the exception of Spain, have been an even stronger performer both overnight and over the past five trading sessions. The Spanish IBEX 35 fell 1.2%, on volume 168% above the 30-day average, which shouldn’t surprise too much given the news flow seen there, while we have also seen the premium demanded to hold Spanish bonds widened 10 basis points relative to German bunds. The S&P 500 is our guide though, which continues to grind higher, amid further falls in implied volatility (the VIX sits at 9.51%) and I sit in the camp that higher levels are likely to be seen here. Notably, ahead of Q3 US earnings season, which kicks off with Blackrock (NYSE:BLK) reporting numbers on the 10th October amid fairly achievable expectations of 4.5% EPS growth for the aggregated S&P 500 earnings.

On the session and by way of a guide, healthcare (+0.7%), financials (+0.7%) and materials (+0.8%) have put in the points.

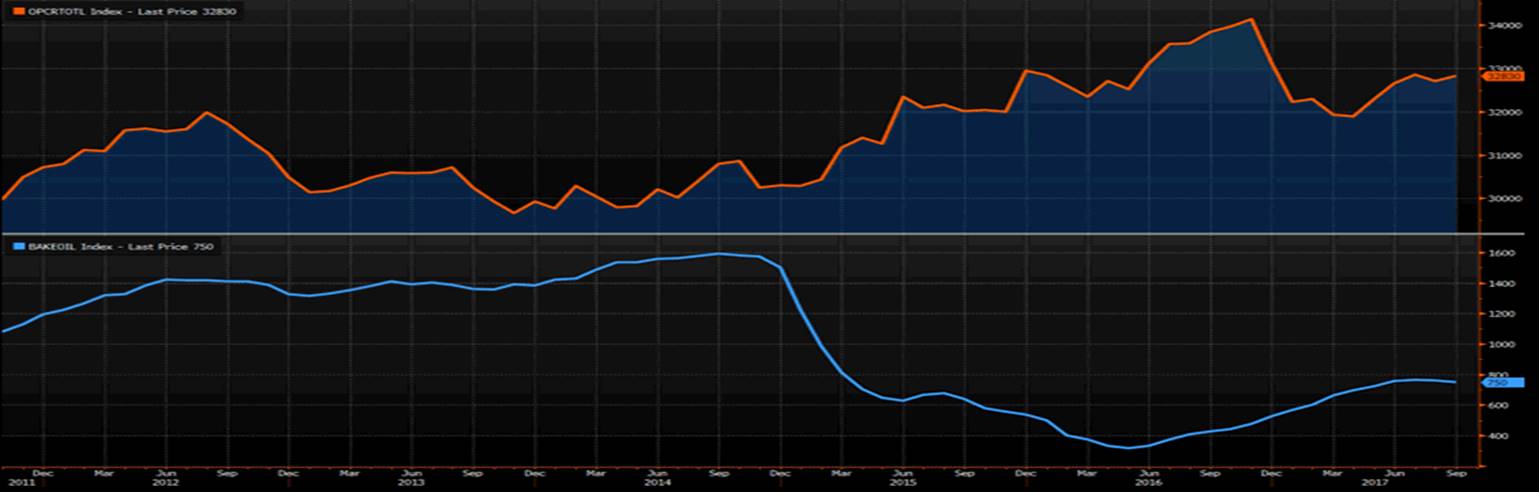

Interestingly, we have only seen the S&P energy sector lower by 0.2%, despite US crude falling 2.1% into $50.59 and good weakness too in Brent crude and this suggests a similar feat for the Aussie energy space. The six-rig increase in the weekly Baker-Hughes oil rig count has been noted, as has the 0.4% monthly increase in the estimated OPEC production run-rate to 32.83 million barrels. Elsewhere in commodity land and copper has modestly lower, while China is closed for Golden Week and therefore the Dalian commodity exchange is offline and we see BHP’s ADR down seven cents, while Vale’s US-Listing closed up 0.1%.