On April 14, we wrote a blog post titled How To Profit From The Break Of 6-Year Uptrend in Gold. At that time, we said of SPDR Gold Trust (GLD) that a bounce into new resistance of its prior support level (around the $150 area) would provide an ideal, low-risk short selling entry point.

But since the gold ETF plunged nearly 20% over just a two-day period (April 12 and 15), the odds of a quick bounce all the way back to the breakdown level became minimal. Nevertheless, two weeks after the meltdown, GLD is now technically setting up for a secondary short selling entry point, based on momentum, that is also ideal.

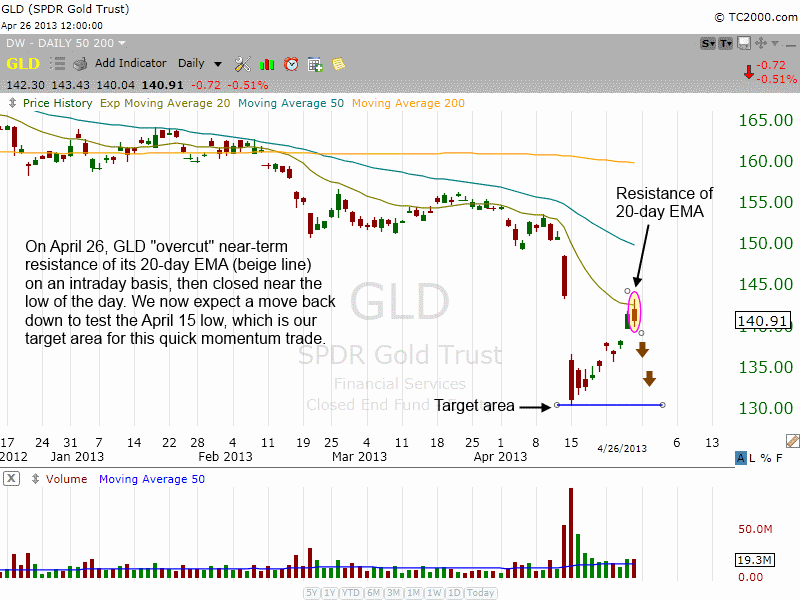

Since its April 15 low, GLD has been bouncing from near-term, oversold conditions. Last Friday, the gold ETF bumped into and “overcut” resistance of its 20-day exponential moving average on an intraday basis. However, by the closing bell, GLD had fallen back down below its 20-day EMA and closed near its low of the day. This is shown on the daily chart below:

When looking to profit from a stock or ETF that breaks down below support, then subsequently bounces into resistance, we prefer to avoid entering a new short position while the equity is still moving higher. Rather, after the breakdown, we wait for the first day that the equity closes substantially lower following a rally into resistance.

In the case of GLD, last Friday’s probe above the 20-day EMA and formation of a bearish reversal candlestick is especially attractive because it followed a strong move higher that occurred on April 25 (bulls are forced to sell). As such, GLD now presents us with a low-risk entry point on the short side only if the price falls below the April 26 low (all bets are off for short selling entry until that happens).

With this swing trade setup, we want to clarify that we are NOT necessarily expecting GLD to make another leg lower within its current downtrend. Rather, we are merely anticipating at least a retest of the April 15 low (such as an “undercut”) before GLD stabilizes and tries to make any type of significant move higher. As such, note that our projected holding period of this momentum trade setup is expected to be shorter-term than our typical ETF swing trade.

Also, note that our actual trade setup on today’s official “watchlist” is actually to buy the inversely correlated DB Gold Double Short ETN (DZZ), rather than selling short GLD. We do this because many Wagner Daily subscribers have non-marginable cash accounts, such as an IRA accounts, that prohibit short selling of any kind. But through buying a “short ETF” instead, these traders can still benefit from the downside movement of certain market sectors. Still, we are basing our entry and exit points on the actual chart of GLD, rather than DZZ, to ensure the most accurate tracking to the price of spot gold.

On a separate note, here is a brief update on the open stock and ETF positions presently in our model swing trading portfolio: We sold a partial position of Celldex Therapeutics (CLDX) for an 18% gain on April 25, but remain long about half the original shares. LinkedIn (LNKD) is currently 7.8% above our April 9 entry point and we continue to ride the profit. The other three individual stocks in our model portfolio are each slightly higher than their recent entry points, and we remain long.

On the ETF side, our existing long position in Semiconductor HOLDR (SMH) has been following through to the upside nicely. It held last week’s breakout to a new 52-week high and its currently up about 3% from our average entry price. US Natural Gas Fund (UNG), also showing an unrealized gain going into today, formed a bullish “hammer” candlestick after finding support at its 20-day EMA last Friday. It looks well positioned for further gains in the coming week.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Short Selling Gold: Now A Low-Risk Momentum Trade

Published 04/29/2013, 07:13 AM

Updated 07/09/2023, 06:31 AM

Short Selling Gold: Now A Low-Risk Momentum Trade

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.