Nearly a month ago, in our March 18 blog post (part 1), we said, “The impressive, long-term uptrend in gold (from 2005 to 2011) appears to be reaching an end. Since forming an all-time high in September 2011, SPDR Gold Trust (GLD), a popular ETF proxy for the spot gold commodity, has merely been oscillating in a sideways range. However, it appears that a definitive move lower may be on the horizon in the coming weeks.”

That “definitive move lower” occurred last Friday, as GLD plunged 4.7% and sliced through a major level of horizontal price support.

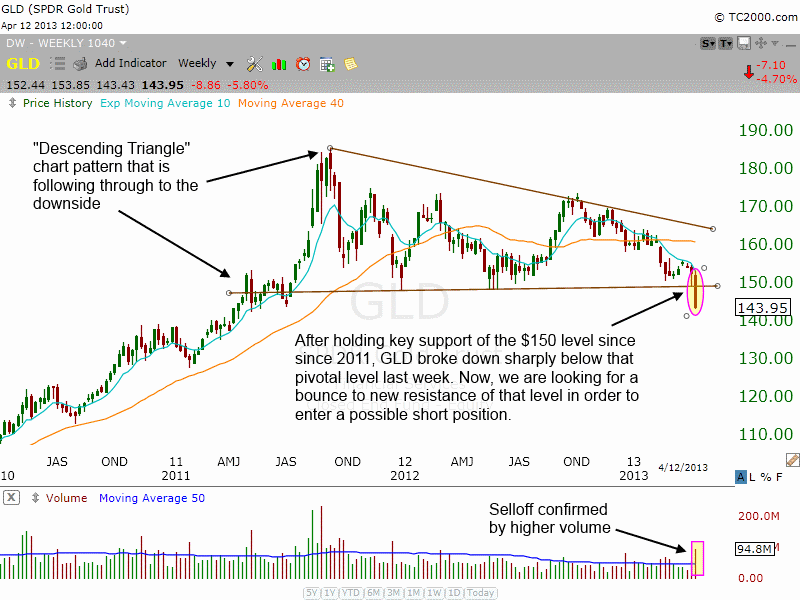

For the past year and a half, GLD had merely been oscillating in a range, near its all-time highs. However, the ETF formed several “lower highs” during this time, while firmly holding pivotal horizontal price support at the $150 level. This led to the creation of a descending triangle chart pattern during that time, which may be starting to follow-through to the downside.

On the annotated weekly chart of GLD below, notice the descending triangle pattern that preceded last Friday’s breakdown below key horizontal price support:

In our original March 18 analysis, we said we were stalking GLD to enter a new short position (or buy a “short ETF”). Ideally, we were prepared to enter a short position if GLD bounced into key resistance of its 50-day moving average, which would have provided us with a low-risk entry point with a very positive reward-risk ratio. But GLD remained so weak that it never happened.

Our second scenario was to sell short GLD if/when it simply broke down below the obvious and very important level of support at the $150 area. Now that this second scenario has occurred, GLD definitely has our attention as a possible short entry in the coming days. Since it is a commodity ETF with low correlation to the direction of the broad market, it is of minimal concern that our market timing model is presently in “buy” mode.

As for an entry point, it is CRUCIAL to understand that we rarely enter stocks or ETFs on the short side as they are breaking down below obvious levels of support. Instead, we prefer to wait for the first subsequent bounce into new resistance of the prior support level (prior support always becomes new resistance after the support is broken). Then, we wait for the first bearish bar that forms after the bounce (big gap down or significant intraday decline).

Based on the above explanation of our short selling methodology, our anticipated entry into GLD (or buy entry into a “short ETF”) is now a bounce to near the $150 level that is followed by the first subsequently bearish price action. As always, we will provide subscribers of The Wagner Daily with our exact entry, stop, and target price if/when this technical trade setup provides us with an ideal, low-risk entry point.

On a different note, all 7 open positions in our model portfolio of The Wagner Daily (3 ETFs and 4 stocks) are presently showing unrealized gains, and are technically well positioned to climb higher in the coming days. As we frequently remind newsletter subscribers, we are always much more focused on the performance of leading stocks and ETFs than the actual price action of the major indices.

In a healthy market, equities with relative strength will continue higher, even when the broad market takes a rest. Last Friday, for example, 5 of our 7 open positions (all long) moved higher, even though not a single one of the main stock market indexes closed in positive territory. Furthermore, we are finally starting to see some nice follow-through in our ETF and stock picks.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Profit From The Break Of The 6-Year Uptrend In Gold, Part 2

Published 04/15/2013, 02:07 AM

Updated 07/09/2023, 06:31 AM

Profit From The Break Of The 6-Year Uptrend In Gold, Part 2

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.