by Eli Wright

Oil fell yesterday on fears of oversupply ahead of US Crude Oil Inventories and natural gas prices sank to a one-month low on warm winter weather forecasts. The US dollar dipped, and many equity markets, including the Dow and S&P 500 followed suit, on weaker energy and financial stocks. The big exception was the NASDAQ, which hit another new record high. A variety of NASDAQ listed healthcare stocks saw strong gains yesterday as well. Currently, global markets are mixed.

In Asia overnight, the Hang Seng rose 0.73% to close at 22,738. However, the rising yen put pressure on the Nikkei Index, which dropped 0.79% to 19,301.44. The Shanghai Composite also fell, down 0.32% to 3,161.24.

In Europe this morning, the DAX edged 0.05% lower, to 11,558.50 while the Stoxx 50 declined 0.24% to 3,301.50. However the FTSE 100 has been riding the pound’s decline to new record highs. The FTSE is currently up 0.18% to 7,250.50.

On Wall Street, the Dow lost 0.38% to close at 19,887.38 while the S&P 500 fell 0.34% to 2,268.90. The NASDAQ, on the other hand, rose 0.19% to a record high of 5,531.82.

In pre-market trading, the Dow is down 0.03%; the S&P is down 0.04%; and the NASDAQ is flat.

The US 2-year Treasury yield has slipped bit to 1.194%. However 10- and 30-year yields are both up, to 2.381% and 2.971%, respectively.

Forex

The dollar traded weaker yesterday; the Dollar Index is currently down to 101.69. The JOLTS Job Openings report later this morning could spur the greenback higher, the expected 5.555M reading would be a bit higher than last month's numbers. The President-elect's speech tomorrow, during which he will likely provide details on his plans for fiscal and trade policy, could have additional impact on the USD.

The Chinese yuan moved up 0.2% overnight, to 6.9236, after Chinese PPI came in at 5.5%, better than the 4.5% expected. The Japanese yen is currently trading at 115.78 versus the dollar. And the euro firmed, back over $1.06.

In Britain on Sunday, Prime Minister Theresa May described her position on where things would stand once Article 50 was triggered, including that her government would prioritize populist politics and anti-immigration reforms over access to Europe’s single-market. Traders took it to mean she favored a hard Brexit and they've been expressing their displeasure ever since by offloading the pound. It has plummeted to an 11-week low of $1.2121.

In the coming days, sterling will likely be influenced by UK Manufacturing data and Trade Balance figures, both due out tomorrow.

Commodities

The weaker dollar, combined with declining US equities, sent some investors back to gold. Yesterday the yellow metal advanced nearly one percent. It’s currently trading at $1,184.65.

It may almost be time to shift from the bearish view of the precious metal. Even though since Election Day, US stocks have rallied 6.5% while gold has dropped as much as 7.6%, yesterday’s Wall Street price action showed that some investors think the stock market may be over-inflated; as discussed here yesterday. Should that be the case, perhaps it could be time to view gold as undervalued.

Additionally, if inflation outpaces the Fed’s rate hikes, than real rates—what you get when you subtract inflation from the Federal funds rate—could turn negative, which would be good news for gold bulls.

Oil fell more than two percent yesterday as last week’s Baker Hughes report showing US oil rig counts at a one-year high, the tenth straight weekly increase for this metric, finally began to outweigh the optimism traders had been feeling about OPEC production cuts.

It appears oil prices could—at least for the foreseeable future—remain in a tug-a-war, with news of OPEC production cuts counterbalanced by news of US production increases and/or OPEC deal compliance failures. Some analysts think that oil bears are ready to challenge $50 support. However, as of this writing, oil prices are up approximately 0.30%: crude is $52.32, while Brent is $55.33.

Natural gas prices fell 5% yesterday, as updated short-term weather models expect above-average temperatures in large swathes of the country for the next two weeks. It’s currently trading at $3.157.

Stocks

Though the S&P and Dow dropped, some NASDAQ-listed stocks, in particular a variety of healthcare stocks were the big winners yesterday.

Diffusion Pharma (NASDAQ:DFFN) skyrocketed an incredible 176.7%; EnteroMedics Inc (NASDAQ:ETRM) soared 92.6%; and ARIAD Pharmaceuticals (NASDAQ:ARIA) jumped 72.85%. GenVec Inc (NASDAQ:GNVC), Viking Therapeutics (NASDAQ:VKTX), CTi Biopharma (NASDAQ:CTIC), EXACT Sciences (NASDAQ:EXAS), and NewLink Genetics (NASDAQ:NLNK) all saw big gains as well. Even pet healthcare saw a bounce: animal hospital operator VCA Antech Inc (NASDAQ:WOOF) agreed to be acquired by privately held food giant Mars, Inc and saw shares rise 28.29%.

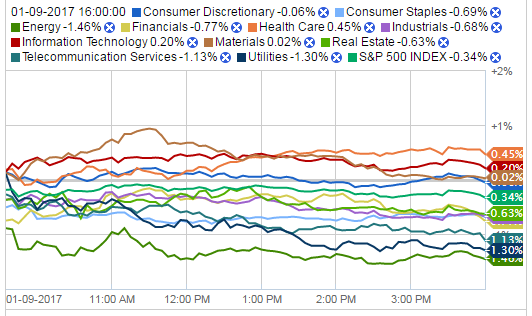

The S&P drop of 0.34% yesterday was largely a product of sinking oil and gas prices. Virtually all 35 components of the Energy Index got hit and the sector led all S&P decliners, falling 1.46%.

Source: Fidelity.com

Southwestern Energy (NYSE:SWN) finished the day down 4.88%; Devon (NYSE:DVN) and Range Resources (NYSE:RRC) both fell 4.29%; Cabot Oil & Gas (NYSE:COG) lost 3.50%; and EQT (NYSE:EQT) dropped 3.31%.

Marathon (NYSE:MRO), Murphy Oil (NYSE:MUR), Anadarko (NYSE:APC), ConocoPhillips (NYSE:COP), Chesapeake (NYSE:CHK), and Hess (NYSE:HES) all fell more than two percent.

Noble (NYSE:NBL), Exxon Mobil (NYSE:XOM), Newfield Exploration (NYSE:NFX), Apache (NYSE:APA), Baker Hughes (NYSE:BHI), and Halliburton (NYSE:HAL) all declined more than one percent on the day.

The Information Technology Index, up 0.20% yesterday, was one of the only sectors to post gains. The biggest gainer was Global Payments (NYSE:GPN), which jumped 7.17% on better than expected Q2 2017 earnings; EPS was $0.89, higher than the expected $0.87, and revenue was $817.2M, significantly better than the $524M that was expected.

NVIDIA (NASDAQ:NVDA) rose 4.05%; it’s now up 261% TTM. Applied Materials (NASDAQ:AMAT) and Western Digital (NASDAQ:WDC) both gained approximately 2%.

In other news, it would be naïve to assume that every company that embraces Trump’s campaign promise to bring jobs to America will see immediate gains. However, two companies—Alibaba (NYSE:BABA) and Fiat Chrysler (NYSE:FCAU)—saw their stock shares rise yesterday when they indicated they were in sync with Trump's job-growth wishes.

Alibaba founder and executive chairman Jack Ma met with the President-elect yesterday to discuss how Alibaba could create one million American jobs by connecting US businesses with Chinese consumers. It is estimated that 80% of Chinese online purchases are made via the Alibaba platform. Alibaba shares rose 0.88% yesterday, and are up an additional 0.08% in after-hours trading.

As well yesterday, Fiat Chrysler pre-empted a Trump Twitter attack, confirming the company plans to add 2,000 US jobs and invest $1 billion to upgrade its US factories. Shares rose 1.44% on the day.