- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Opening Bell: U.S. Futures Rebound Despite Grim Data; Gold Jumps; Oil Steady

- Asia slumps but U.S. contracts, European equities bounce

- Oil at 18-year low after record drop on inventories overstock

- Financials continue releasing Q1 earnings today: BlackRock (NYSE:BLK), Morgan Stanley(NYSE:MS) (NYSE:MS) and Bank of New York Mellon (NYSE:BK) (NYSE:BK) all report on Thursday.

- China releases GDP, Industrial Production, Retail Sales and jobless figures on Friday.

- Futures on the S&P 500 Index rose 0.8%.

- The Stoxx Europe 600 Index gained 1.1%.

- The MSCI Asia Pacific Index decreased 0.9%.

- The Dollar Index increased 0.3%.

- The euro decreased 0.2% to $1.0885.

- The British pound fell 0.1% to $1.25.

- The Japanese yen weakened 0.3% to 107.79 per dollar.

- The yield on 10-year Treasuries climbed two basis points to 0.65%.

- Germany’s 10-year yield gained two basis points to -0.45%.

- Britain’s 10-year yield rose one basis point to 0.312%.

- West Texas Intermediate crude climbed 0.2% to $19.91 a barrel.

- Gold strengthened 0.3% to $1,722.52 an ounce.

Key Events

Though Asian equities were mixed on Thursday, in the wake of economic data more dire than expected and disappointing earning results, U.S. futures for the Dow Jones, S&P 500, Russell 2000 and NASDAQ trimmed Wednesday’s losses and are currently in the green. European shares also opened higher.

The U.S. dollar ticked higher and gold jumped.

Global Financial Affairs

The rebound in U.S. contracts and higher open for European equities underscores the need for investors to now expect the unexpected from markets. Though Asian indices took a cue from yesterday’s Wall Street selloffs, spurred by a historically low Retail Sales figure in March, as well as surprisingly poor Empire State Manufacturing and Manufacturing Output releases, the fact that U.S. futures and European stocks are on the rise has caught investors on the back foot after they'd expected the selloff to resume.

The irony could just be a sign of the times as COVID-19 continues to dominate the market's wall of worries. Currently the number of outbreaks worldwide has topped two million as the virus continues to spread. The number of fatalities globally is at 137,193 and rising, with more than 28,000 of those deaths in the U.S. alone. We can therefore expect continuing fluctuations in both sentiment and prices, with every piece of news whipsawing traders in one direction or the other.

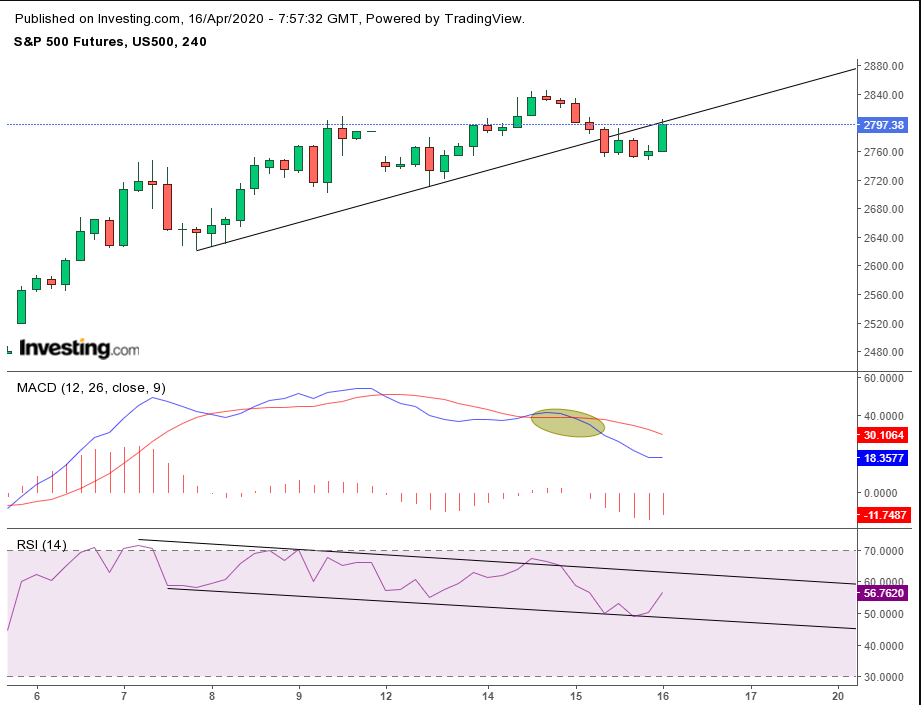

Today, contracts on the S&P 500 fell below an uptrend line—which it was testing from below—after both the MACD and RSI triggered sell signals amid negative divergences.

Major national indices pulled up all sectors of the Stoxx Europe 600 Index, as virus-related deaths in Spain and Italy flattened and British budget carrier easyJet (LON:EZJ) and its bigger rival Ryanair (LON:RYA) each pitched a recovery scenario for their beleaguered businesses.

Earlier, Asian exchanges reacted to the dual devastation wrought by the pandemic and government data. Japan’s Nikkei fell the hardest, (-1.33%), while China’s Shanghai Composite led with gains (+0.31%).

Yesterday, with Q1 earnings from Goldman Sachs (NYSE:GS), Bank of America (NYSE:BAC) and Citigroup (NYSE:C) all showing losses, stocks gave up monthly highs.

The U.S. dollar edged higher after its jump yesterday, along with Treasurys. Still, bond demand, including for the 10-year note, diminished today.

Technically, the global reserve currency bounced off the 50 DMA, rebounding above the March 30 trough; a fall below would have established a downtrend.

Gold is rising today, together with equities, after falling yesterday, again, in tandem with stocks.

To many investors, this may seem counter intuitive. Once again, we find the commodity is more closely correlated to dollar strength than to stocks. The trick is to attempt to determine whether, in fact, gold is now operating not as a safe haven asset, or if it is, perhaps only for bears.

Interestingly, for the past two days Bitcoin has traced out the same pattern. Technically, gold may be following a H&S bottom breakout with a pullback. That argument is buttressed by an Evening Star, completed yesterday.

Oil fluctuated, settling on today’s opening price just above $20, after tumbling Wednesday to the $19 region, amid a record collapse in fuel demand and the biggest ever weekly increase in U.S. domestic crude supplies.

Considering oil is hovering near 18-year lows and is at the bottom of its range since March 18, traders may find it's currently providing an ideal long position, at least from a risk-reward perspective.

Up Ahead

Market Moves

Stocks

Currencies

Bonds

Commodities

Related Articles

Just one week after posting its worst weekly loss over a year, and after a week of unfavorable economic data for both the US economic outlook and Federal Reserve (Fed)...

This will be one of the busier weeks of the year with earnings, the Fed, lots of data, and a Treasury Quarterly Refunding announcement. There are many differing views on the QRA,...

Gold Stays Below 2,340 Ahead of Wednesday's Fed Interest Rate Decision The gold (XAU) price rose in the first half of Friday's trading session. XAU/USD then reversed near 2,352 due...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.