Forex News and Events

Brazil: impeachment is done, what is next?

It is done, after months of waiting, Dilma Rousseff has been formally kicked-out yesterday after the Brazilian Senate voted 61-20 to remove her from office after she illegally used money from state banks to fill budget holes. Michel Temer, former vice-president, was sworn in as new president until 2018. Since the beginning of the impeachment process, traders has been constantly betting that the removal of Rousseff would give the government more flexibility to shore up fiscal deficit and put the country back on a sustainable growth path.

Market’ expectations are very high and place a heavy burden on the new government. The stock market is has been surging massively over the last few months as central banks across the globe kept pumping liquidity in the global economy and investors chased higher returns. The Bovespa index surged almost 60% from January’s lows, Brazilian rates has been falling sharply as investors forecast a brighter outlook and the Brazilian real surged 30% against the US dollar.

On the other hand, economic data kept worsening as the real GDP declined 3.8%y/y in the second quarter of 2016, after falling 5.4% in the March quarter. The labour market remains under significant pressure with the unemployment rate surging to 11.6% in July - compared to 8.6% a year ago - which will weigh heavily on Brazil’s consumption and will therefore slowdown the recovery process.

We expect the market to focus again on the fundamental now that Rousseff is definitely out. When we compare market’s expectations with the current state of the Brazilian economy, it is pretty straightforward to conclude that something is wrong. Therefore, we expect Brazilian assets to correct downward over the next few weeks as traders slowly realise they lived up to the hype.

Russia’s recovery is still fragile

The Russian economy continues to improve. While the financial markets had previously priced in a severe economic correction, it seems that a year later, momentum is positive and growing. Indeed, Russian PMI increased for August to 50.8, exceeding expectations. At the same time the Ruble is consolidating against the dollar. The currency only stopped appreciating due to renewed market hopes of a Fed rate hike before year-end.

At the September Russian Central Bank meeting, we will be expecting a rate cut of around 10%. While it is true that Russian GDP has declined 0.6% y/y, this data is still accounting for last year’s downturn. We also take the same view concerning retail sales, which although negative on a yearly basis, are slightly improved month over month.

There are two main reasons why Russia is experiencing this upturn. Firstly, its interest rates are increasingly attracting investors. Secondly, the rebound in oil prices has helped the country to enter a new positive cycle, however, this may be short-lived as we may soon see prices lower again due to oversupply from OPEC members. On top of this, a new dynamic seems to be emerging: the emancipation of oil, as is currently being discussed in Norway as part of their strategy to ban fossil fuel cars by 2025. This is just the start of a long-term trend but is symbolic of where we see oil prices in the medium-term: very low.

Swiss data prints mixed but remains soft

Swiss economic data has come in mixed but nevertheless remains on the soft side. Retail sales real y/y contracted to -2.2% following a revised -3.5% fall. Today's read was a minor recovery after a steady string of weak reads since mid-2015. There was also a positive recovery in food sales of 0.6% in nominal and a 0.8% in real terms rise. However, this rebound should be discounted as a result of the favourable summer weather. Sales data has been consistently low since the SNB abandoned the EUR/CHF minimum exchanged rate. The strong CHF has shifted Swiss consumer behaviour, undermining domestic sales as consumers search for bargains on durable goods and big ticket items in neighbouring nations. This long term shift in consumer habits will add further negative pressure to inflation expectations as retailers reduce prices to compete with the exchange rate disadvantage. Elsewhere, Swiss August PMI manufacturing improved to 51.0 from 50.1 against expectations of 50.6.

There was a minor improvement across the board with the order backlog rising to 50.8 from 49.3 and finished goods stock decreasing to 45.5 against 55.4. Surprisingly, given the rise in the unemployment rate, the employment segment increased to 48.2 against 46.7, yet the indicator remains weak. The upwards swing temporarily halts the data's downward slide, potentially into contraction territory. The overvalued CHF continues to damage the Swiss domestic outlook; however, with limited tools the SNB appears paralyzed (SNBs steady expansion of its balance sheet seems to have provided a provisional backstop for CHF strength). Forced to watch, powerless as events unfold, the central bank will now be praying for a Fed rate hike and limited ECB easing. USD/CHF traders will focus on the 0.9950 resistance after clearing the 78.6% Fibo retracement at 0.9870. EUR/CHF is preparing to challenge the 1.100 key resistance. A break would trigger an extension of bullish momentum to 1.1100.

Gold – Testing 1300 Dollars.

The Risk Today

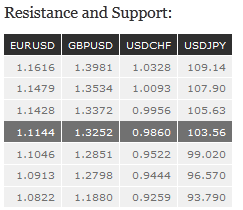

EUR/USD keeps on pushing lower after the break of the uptrend channel. Key resistance is given at 1.1352 (23/08/2016 high) then 1.1428 (23/06/2016 high). Hourly support lies at 1.1046 (05/08/2016 low). The road is wide-open for further decline. In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD is trading in range between hourly resistance at 1.3279 (26/08/2016 high) and hourly support at 1.3024 (19/08/2016 low). This low volatility may indicate that selling pressures are fading. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY keeps on increasing after breaking hourly resistance given at 102.83 (02/08/2016 high). Strong support is given at 99.02 (24/06/2016 low). Expected to show further strengthening. We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF keeps on pushing higher. The road is definitely wide-open for further strengthening. Hourly resistance lies at 0.9844 (09/08/2016 high) and at 0.9956 (30/05/2016 high). Key support can be found at 0.9522 (23/06/2016 low). Expected to show further bullish move. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.