The majority of global equity indices continued to march higher on Tuesday and during the Asian morning Wednesday following the positive news over a potential coronavirus vaccine, but the latest gains stayed limited, perhaps as daily infections accelerated yesterday.

Overnight, the RBNZ kept its official cash rate unchanged, while remarks by Governor Orr lessened the chance for the adoption of negative interest rates by this Bank in the foreseeable future.

Risk On Prevails After Upbeat Vaccine Headlines

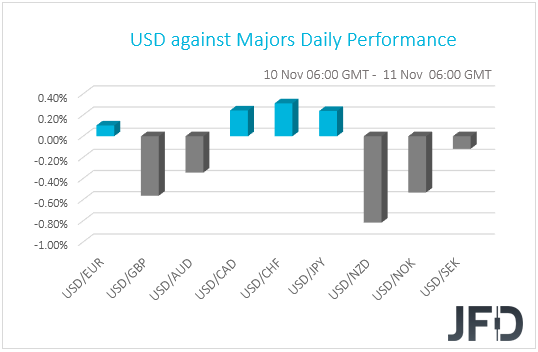

The US dollar traded mixed against the other G10 currencies on Tuesday and during the Asian morning Wednesday. It gained slightly against CHF, CAD, JPY, and EUR in that order, while it underperformed versus NZD, GBP, NOK, AUD and SEK.

The weakening of the safe-havens franc and yen, combined with the strengthening of the risk-linked Kiwi and Aussie, suggests that markets continued trading in a risk-on manner following the positive news with regards to a potential COVID-19 vaccine breakthrough.

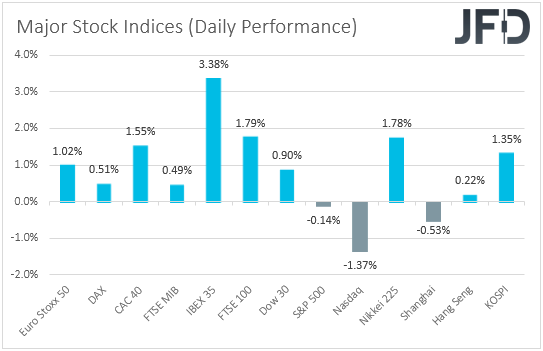

Indeed, major EU indices were a sea of green, but the upbeat investor morale softened somewhat during the US session. Although the Dow Jones gained 0.90%, the S&P 500 slid 0.14%. The tech-heavy NASDAQ fell 1.37% as most stocks that benefited during the pandemic, like Amazon (NASDAQ:AMZN), continued to slide.

Appetite recovered again during the Asian session today. Although China’s Shanghai Composite is currently 0.53% down, Japan’s Nikkei 225, Hong Kong’s Hang Seng, and South Korea’s KOSPI are up 1.78%, 0.22% and 1.35% respectively.

With the global daily infections from the coronavirus accelerating yesterday, it seems that concerns over the pandemic’s economic impact may have limited further gains in equities and other risk-linked assets.

As we noted yesterday, it is still too early to start cheering that the COVID-era is behind us. There are still many questions with regards to the vaccine to be answered, such as how effective it is by age and how long immunity could last.

And even if we get the answers, there is the hurdle of how it will be delivered, as it has to be shipped at extremely cold temperatures. In any case, our own view remains the same. We are now a step closer in finding the cure for this virus, which combined with Biden’s victory in the US elections, may allow investors to jump back into the action at some point soon and push risk-linked assets up.

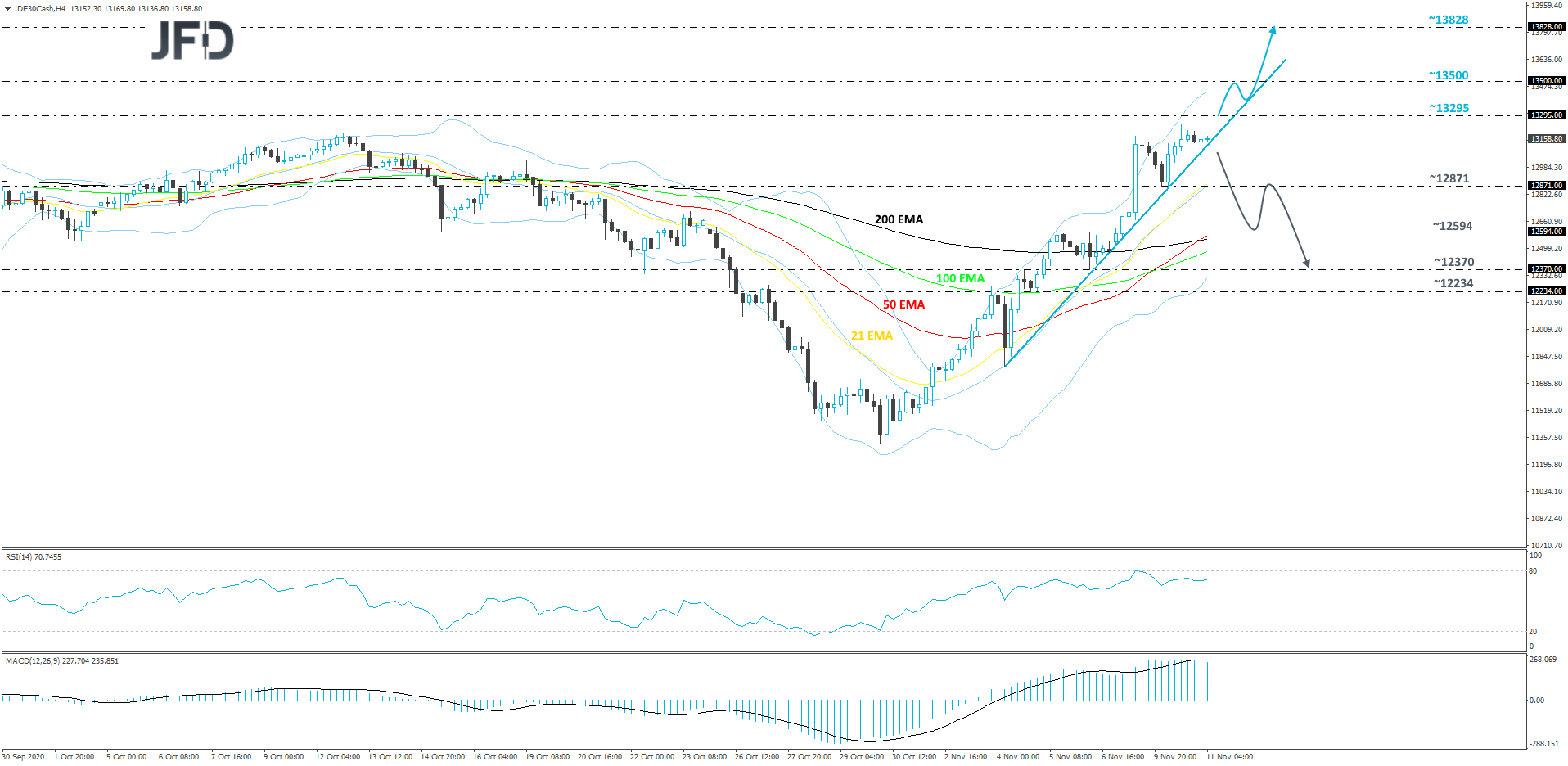

DAX Technical Outlook

The German DAX continues to climb higher, while balancing above a short-term upside support line drawn from the low of Nov. 4. As long as the price stays above that line, the near-term outlook could remain positive. However, to get a bit more comfortable with that idea, we would first like to see a strong break above the current high of this week, at 13295.

If the price moves above that 13295 barrier, this will confirm a forthcoming higher high and may clear the way to some higher areas. DAX might then travel to the 13500 zone, marked by the low of February 21st, a break of which could set the stage for a move to the 13828 level. That level marks the highest point of February.

Alternatively, if the price breaks below the aforementioned upside line, this could result in a change of the short-term uptrend, potentially clearing the path to the downside. More sellers may join in if DAX drops below the 12871 hurdle, marked by the low of Nov. 10. This is when we will aim for the 12594 obstacle, a break of which could send the German index to the 12370 level. That level marks the low of Nov. 6.

RBNZ Sounds Less Dovish Than Anticipated

Back to the currencies, overnight, the Kiwi spiked higher and took the first place among the G10 winners, in response to the RBNZ monetary policy decision. The Bank decided to keep its official cash rate and Large-Scale Asset Purchase program unchanged, and although it noted that it will launch a funding for lending program in December, Governor Adrian Orr said that domestic activity since August has been more resilient than previously assumed, which means that the chance for adopting negative interest rates may have eased.

As a risk-linked currency, the Kiwi may continue to gain against the US dollar if the financial community stays in a risk-on mode, and due to the lowering of the negative-rate chance, it may even outperform the other commodity-linked currencies, namely the Aussie and the Loonie. In other words, we see the case for AUD/NZD to drift south, and for NZD/CAD to strengthen.

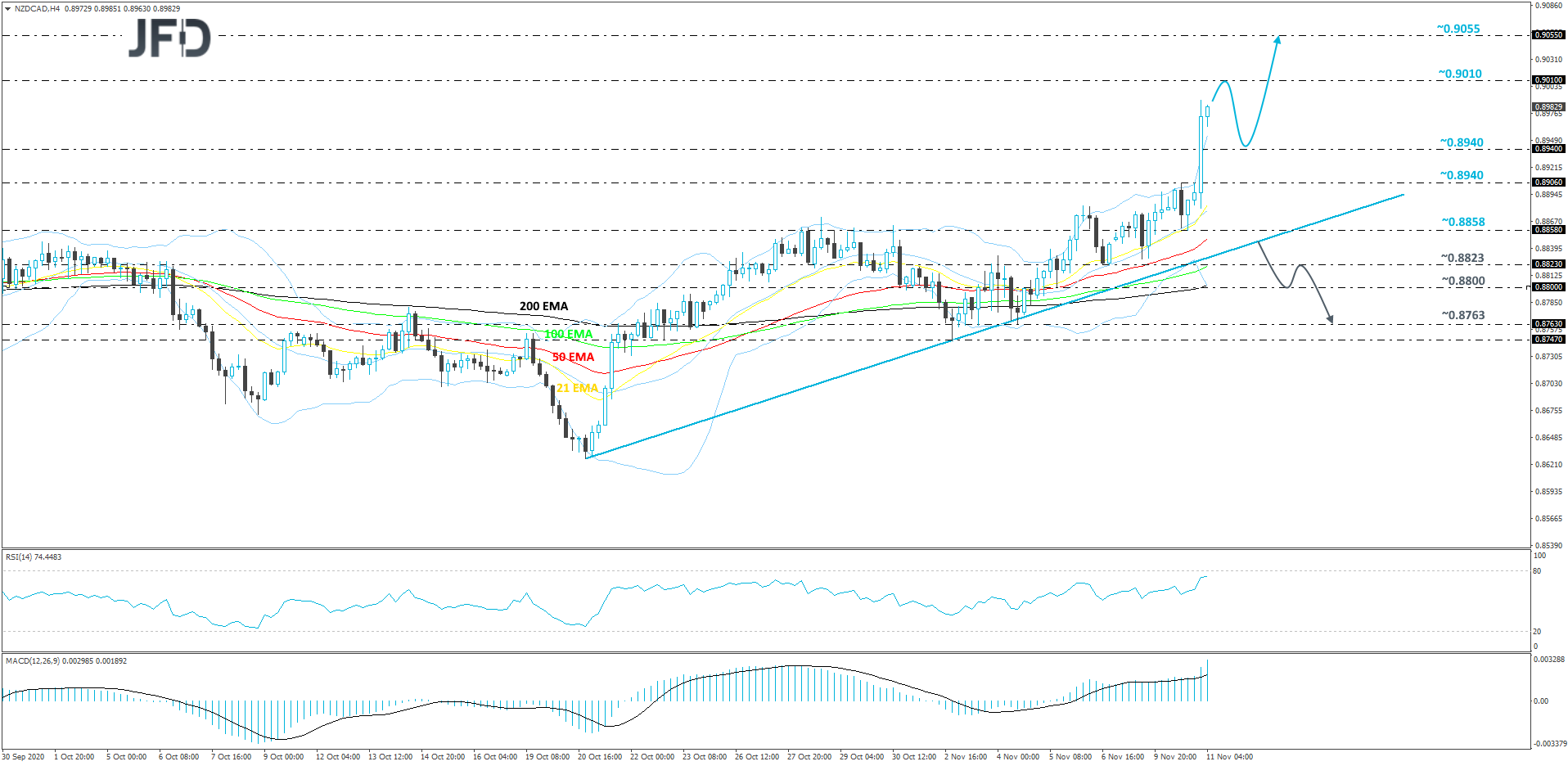

NZD/CAD Technical Outlook

During the early hours of the Asian morning, we saw NZD/CAD exploding to the upside, breaking some key resistance areas on the way up. The RSI and the MACD are indicating that the price momentum is still positive. This suggests that we could see more upside in the near term, especially if the rate continues to trade above a short-term upside line taken from the low of Oct. 20. But given the recent steep uprise, there might be a possibility to see a small correction lower at some point. That said, we will remain positive, at least for now.

A further push north could bring the rate closer to the 0.9010 barrier, marked by the highest point of July, which may provide a temporary hold-up for the pair. If so, NZD/CAD might retrace back down a bit, but if it stays somewhere above the 0.8940 hurdle, which is the highest point of September, that might interest the bulls again, who could take advantage of the lower rate. The pair may rise again and if this time it is able to overcome the 0.9010 hurdle, the next potential target may be at 0.9055. That level marks the high of Apr. 16, 2019.

On the other hand, if the pair suddenly breaks the aforementioned upside line and then slides below the 0.8823 hurdle, marked by the low of Nov. 6, that may raise the selling interest, potentially opening the door for further declines. NZD/CAD may then drift to the 0.8800 obstacle, marked by an intraday swing low of Nov. 5. If the selling doesn’t end there, the next possible target might be at 0.8763, which is the low of Nov. 4.

As For The Rest Of Today's Events

The calendar is very light today, with no major economic indicators due to be released. However, we have three ECB speakers on the agenda, from whom we may get more details with regards to the likelihood of further stimulus by the ECB in December. Those are President Christine Lagarde, Vice President Luis De Guindos, and Executive Board member Philip Lane.