Forex News and Events

Brazilian real’s rally running out of steam

Since mid-January, Brazilian assets found favour in the eyes of investors on the prospect of potential improvements on the political side as well as a commodity rally. Since mid-January, the Brazilian real rose as much as 14% against the US dollar, while the Ibovespa surged the most among the EM-complex, up 33%. The fading risk-off sentiment and hopes for stronger Chinese demand supported iron ore prices, one of Brazil's key export sectors, and pushed prices by roughly 40%. However, it seems that both the equity and commodity rallies are coming to an end as the market realises that nothing has changed on the fundamentals side. Fortunately, things continue to move along on the political side as the impeachment process gears up, thanks to mounting pressure from the street. In fact, this is the only thing that could prevent the real to debase once again against the US dollar as the market sees it as the only solution to put an end to the political gridlock. The Brazilian real will likely feel the heat on Tuesday as commodities are massively sold-off, with 3.70 (USD/BRL) as the next target.

Japan keeps monetary policy unchanged

Last night, the Bank of Japan voted 7-2 in favour of keeping current negative rates unchanged at -0.1%. Obviously the central bank is now thoroughly weighing up the full effects of negative interest rates on the economy. At the press conference, policymakers maintained that recent economic weakness comes down to the slowdown of emerging economies. Governor Kuroda added that more easing is in fact possible in terms of quantity, quality or rate. In other words, the BoJ is now more than ever all-in and this policy shows that there is not much room left for the central bank to act other than increasing the money waterfall. A new sales tax increase, following the one from 2014, has now been postponed to next year. The BoJ simply cannot implement such measures for the time being and so to us, this latest announcement represents nothing more than a simple verbal intervention. However, 2017 also seems way too soon to raise sales tax, especially as the negative impact the first one had two years ago is still fresh in our minds.

The next BoJ meeting will be held on April 28 and we feel there is a strong likelihood that further easing will be announced. At this stage of the game Japan has no choice but to keep going down this path. There is no way back. Inflation is still the key issue for the Japanese central bank and in our view there is no chance that the 2% target will be achieved before the end of Kuroda’s term.

Ironically, since entering negative territory on January 29, the USD/JPY has lost almost 5% on global concerns and low oil prices. Japan remains a safe haven despite its massive debt. Confidence in the central bank seems way more important for financial markets than owning massive debt.

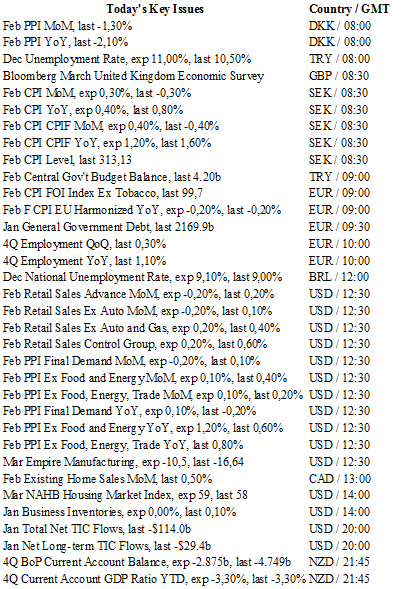

Watching US Retail Sales

In the near term risk appetite will be guided by the Fed. The Fed seems to be trying to stall expectations for rate hikes until global overcapacity eases. At this point down the road, stronger US growth outlook and higher interest rates is less likely to spark a mass capital migration into the USD. However, given the deceleration in global trade, it’s more likely that US growth also falls, shifting the rate path lower. The strength of the US domestic economy has been central to the USD bull's view that a hike should remain a possibility at this week’s FOMC meeting. This makes today's retail sales read an important barometer for the health of the consumer and the state of economic conditions. We expect US retail sales data to continue to support Fed tightening, as retail sales ex-auto and gas should rise 0.2% on a monthly basis, a slight decrease from 0.4% prior read. Retail sales headline read will be distorted due to a sharp fall in gasoline prices in February. In addition, manufacturers are reporting that car and light truck sales are also softer. An upside surprise should allow the US curve to flatten nearer to the March FOMC meeting. USD should have a limited but positive rally, however, we anticipate no rate change tomorrow and a less optimistic Fed (negative for the USD as Fed/ECB monetary policy convergence trade entrenches).

The Risk Today

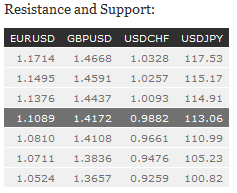

EUR/USD is now weakening. Hourly resistance lies at 1.1218 (10/03/2016 high). Hourly support can be located a 1.1078 (14/03/2016 low). Expected to show further consolidation. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD is clearly following a medium-term bearish trend-line. Hourly resistance can be found at 1.4437 (11/03/2016 high) while hourly support can be found at 1.4108 (04/03/2016 low). The technical structure suggests further decline. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY remains in a range between strong resistance at 114.91 (16/02/2016 high) and support at 110.99 (11/02/2016 low). Hourly support lies at 112.61 (10/03/2016 low). The technical structure suggests a growing short-term momentum. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF is not very volatile these past few days. An hourly support lies at 0.9796 (11/03/2016 low). Hourly resistance is located at 0.9891 (11/03/2016 high & intraday high). Expected to show further consolidation. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/low). The technical structure favours a long term bullish bias.