One of our favorite themes in 2016 has been reversion to the mean, and one of our favorite reversion-to-the-mean themes has been Brazil. We began to turn positive on Brazil in October of last year, when we noted that “The news [in Brazil] is so bad it beckons the seasoned speculator.” In March we noted that Brazil’s perfect storm of economic crash and political crisis bore a strong resemblance to the Watergate scandal in the U.S. in the early 1970s. The comparison suggested that a bottom could be in for the Brazilian market and the Brazilian currency, even if the final impeachment of Brazil’s President was months off and the economy had not yet turned the corner.

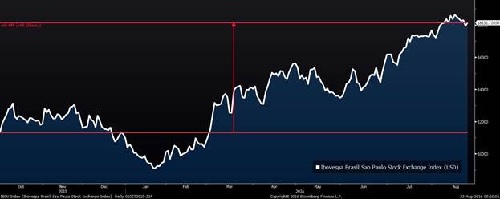

Since our October 2015 note, Brazil’s Ibovespa stock market index, the Brazilian real, and Brazilian bonds have all risen substantially in U.S. dollar terms.

Brazil’s President, Dilma Rousseff, was suspended in May pending an impeachment trial, and Vice President Michel Temer took the country’s helm as acting President. He immediately moved to reassure global markets by selecting a business-friendly cabinet and proposing reforms that would help turn around an economy hard-hit by the global commodity downturn and the spendthrift policies of his predecessors.

Now Dilma Rousseff’s fate is finally in view. Brazil’s senate has voted to move forward with the trial, which is expected to happen within the next several weeks, and which is expected to result in Rousseff’s impeachment. Temer will serve out the remainder of her term and face re-election in 2018.

There has been little doubt about the outcome of the impeachment vote. Nevertheless, as long as Temer is merely the acting president, his status has made it difficult to ensure he has the political capital to push through difficult reforms. In the meantime, Temer has moved carefully. The speaker of Brazil’s lower chamber resigned last month facing corruption charges, and was replaced by a Temer ally who will help push through planned reforms. It has been a careful balancing act for Temer to build support and work to ensure his confirmation as President after Rousseff’s impeachment.

So Temer’s reform drive is soon set to begin in earnest, and he’ll want to act quickly once Rousseff’s impeachment goes through -- so that he will have time to weather any popular reaction before the 2018 elections get underway.

What are his key reforms, and when could they be implemented?

First, and most critical, is a constitutional amendment that would freeze Brazil’s budget in real terms for up to 20 years -- only permitting budget increases at the pace of inflation. This would be one of the deepest fiscal reforms in Brazilian history, and would offer strong reassurance to investors that Brazil would reverse the trend towards unsustainable debt levels. (On current trends, Brazil’s debt would exceed 80% of GDP next year -- a developed-world debt level for a developing economy -- and further dim international investors’ view of the country’s prospects.) Temer’s administration is confident that it will be able to muster the three-fifths majority it will need to push the measure through.

However, this reform requires another one. Without a reform of pension and social security entitlements, those entitlements will eat up a larger and larger part of government spending once the new fiscal freeze is in place. These reforms will include raising the retirement age (currently just 55 for men) and gradually eliminating retirement discrepancies between men and women and among various special occupational groups. If the fiscal freeze goes through as expected in October, social security reforms would be on track to follow in the first half of 2017.

These are Mr. Temer’s two front-burner issues and will go far to stabilize Brazil’s financial foundations. He also wants to push for reforms to make the labor market more flexible; firing workers in Brazil is expensive, and wage negotiations highly regulated and cumbersome. All of this will make employment recovery from the current recession slower and more painful. He would like to revamp Brazil’s complex and bureaucratic tax system, which falls heavily on consumption and therefore has seen revenues decline drastically during the recession. And finally, he would like to see political reforms -- particularly a “barrier clause” which would help restrict the presence and influence of Brazil’s swarm of small parties. (As we’ve noted in the past, since they receive government funding, many small parties are just a form of rent-seeking, and actively hamper the functioning of Brazilian democracy rather than enhancing it.)

Temer’s ambitions are bold, and, we do not doubt, would be very beneficial for the Brazilian economy if they are enacted. For now, he is concentrating on securing his power and seeing off his predecessor; then he will move to the big fiscal reform and try to push it through before election worries begin to rise. Shortly thereafter, he’ll tackle pension reforms. Markets may respond positively to catalysts along the way: when the Rousseff impeachment vote goes through; when the fiscal freeze amendment is made to the constitution; when pension reforms occur. It will take a long time before the positive effects of these reforms make themselves strongly felt in the Brazilian economy -- but the market will anticipate those benefits months before they are actually seen.

We continue to be bullish on Brazil.

Investment implications: We continue to be bullish on Brazil. The Brazilian senate has voted to begin President Dilma Rousseff’s impeachment trial. When that is completed, probably within a month, and Michel Temer is confirmed as President, he will embark on his most ambitious reform effort: a constitutional amendment to freeze Brazil’s budget at current levels in real terms for up to 20 years. After that, he intends to tackle entitlement reform by raising and standardizing Brazil’s retirement age, and move on to labor market, tax, and political reforms -- aiming to get as much done as possible before he has to face re-election in late 2018. Any reform successes -- particularly the fiscal freeze and social security reforms -- could be catalysts for the Brazilian market, even though their positive economic effects could be a year or more away.