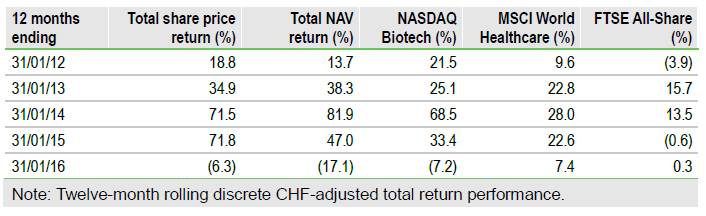

BB Biotech AG (DE:BIONn) seeks to achieve long-term capital growth by investing in fast-growing biotech companies. A discount management programme adopted in 2012 allows it to return 5% of its value each year as a capital distribution, resulting in an unusually high yield (6.4% at 3 February) for a fund investing in a low-yielding sector. Biotech has performed strongly and BION has beaten the benchmark NASDAQ Biotechnology index in three of the last five years, although it has underperformed in a sharp sell-off since the start of 2016. The fund invests globally and across the size spectrum, with a concentrated portfolio heavily weighted towards 5-8 core holdings. It is currently focused more on primary care end-markets, where the lower-cost, higher-volume model is less affected by political pressure on pricing.