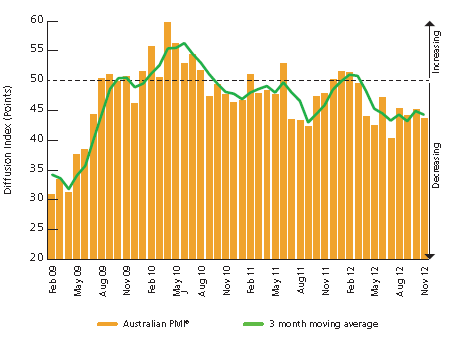

In spite of signs of stabilization in China's output, the Australian economy continues to weaken. The Australian Industry Group (AIG) Performance of Manufacturing Index (discussed here) is showing an ongoing contraction.

AIG/PwC: Manufacturing activity contracted for the ninth consecutive month in November, with the seasonally adjusted Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI®) recording a level of 43.6 (readings below 50 indicate a contraction in activity with the distance from 50 indicative of the strength of the decrease). This was a drop of 1.6 points compared to the previous month.

The slump in manufacturing new orders also extended into a ninth month, reflecting weak global demand and a softening Australian economy. The new orders sub-index dropped a further 0.4 points to 43.5 in November.

The only one of the 12 industries showing expansion is Food and Beverages - cheers! The weakest sectors are fabricated metals, chemicals and petroleum, and construction materials.

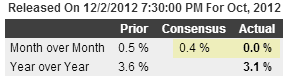

And bad economic news continued to pour in today with the October retail sales - also weaker than expected.

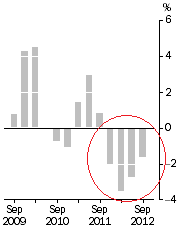

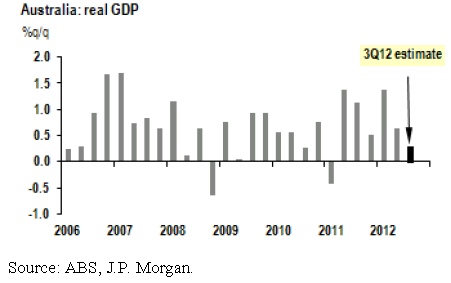

The Q3 company gross operating profits released today by Australian Bureau of Statistics (ABS) have been in the red for the past 4 quarters.

As a result, third quarter GDP is expected to be quite soft.

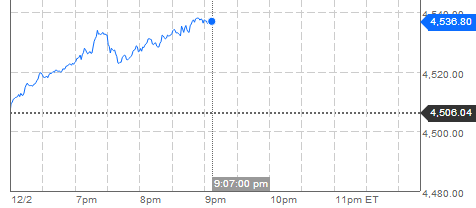

Ironically Australia's stock market is rallying in response. Why? The expectations are rising that the RBA will now have the ammunition to decrease rates to record lows (see discussion). Another central bank comes to the rescue.

Reuters: Australian shares gained 0.5 percent on Monday to a five-week high, as investors bet on the Reserve Bank of Australia cutting its policy interest rate this week to boost the economy.

Weaker than expected retail sales data released on Monday supported expectations for a rate cut by the central bank at its policy meeting on Tuesday. Following the data, interbank futures pointed to a 75 percent chance that the bank would ease rates.

A Reuters poll released on Sunday showed 16 of 23 economists expect the RBA to cut ts cash rate by 25 basis points to 3.0 percent, matching record lows seen during the global financial crisis.

A rate cut would help support equities and would fend off economic weakness in the first quarter, CMC Markets chief market strategist Michael McCarthy said.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Australia's Economic Data Stays Weak; 75% Chance Of Rate Cut

Published 12/03/2012, 01:03 AM

Updated 07/09/2023, 06:31 AM

Australia's Economic Data Stays Weak; 75% Chance Of Rate Cut

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.