The Australian economy continues to show signs of weakness. To be sure, conditions are far better than in most other developed economies, but the nation is not immune to the global manufacturing slowdown - particularly in China.

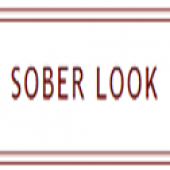

The latest manufacturing surveys show a marked contraction over the past few months.

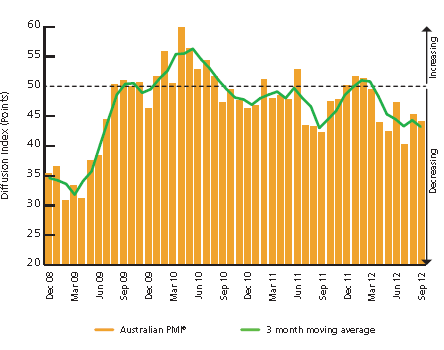

A very similar picture is developing in the Australian services sector.

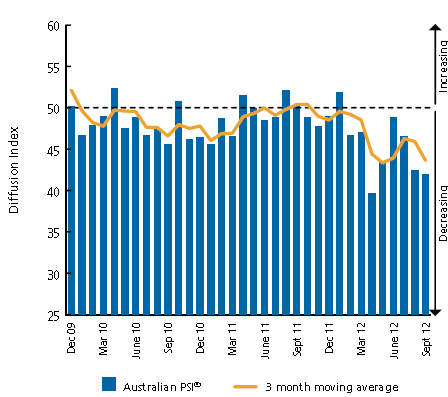

The RBA (the central bank) has been trying to stay "ahead of the curve" by lowering interest rates. The overnight rates are approaching historical lows of 3% reached in 2009.

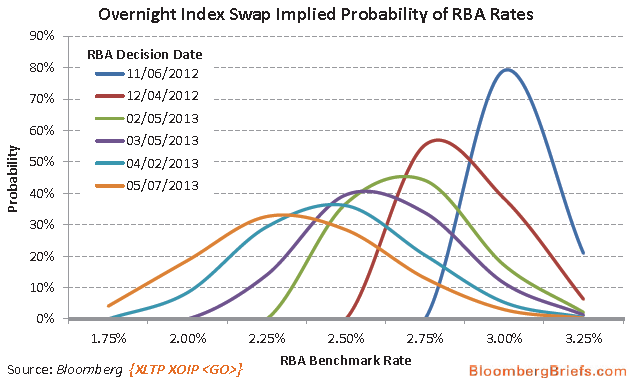

The market expects Australian short-term rates to continue moving lower. The OIS curve (overnight index swap) which predicts where the overnight rates will be in the future is highly inverted. The curve implies an 87% probability of a 25bp rate cut in November.

Bloomberg/BW: Interest-rate swaps data compiled by Bloomberg show traders see an 87 percent chance the RBA will lower its overnight cash rate target by 25 basis points to 3 percent on November 6, following a quarter-percentage point reduction on October 2. That compares with an 82 percent probability on October 5. If policy makers deliver a rate cut next month, that would be the first back-to-back reduction since June. Below are the market-implied probability curves for the overnight rate over time, as we move into record low territory (the RBA rates have never been below 3%).

Bloomberg: Swaps data compiled by Bloomberg show traders see an 81 percent chance the RBA will reduce its key rate from 3.25 percent to 2.75 percent by February, the least in the central bank’s 53-year history.

In spite of the lowest rates in its history, Australian short-term rates are still expected to stay higher than those in the US, the UK, the eurozone, and Japan.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI