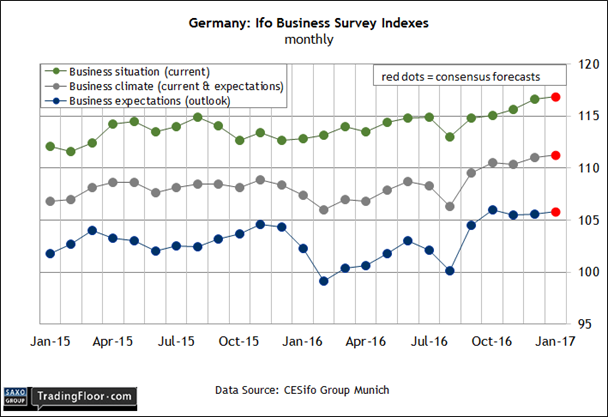

- Ifo survey data for German businesses to tick higher at the start of 2017

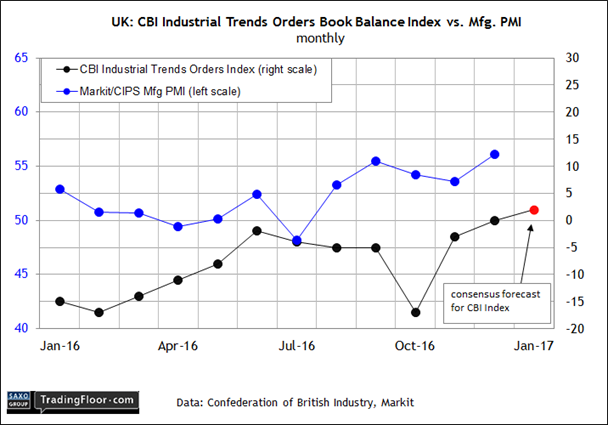

- CBI Industrial trends for the UK should return to positive territory this month

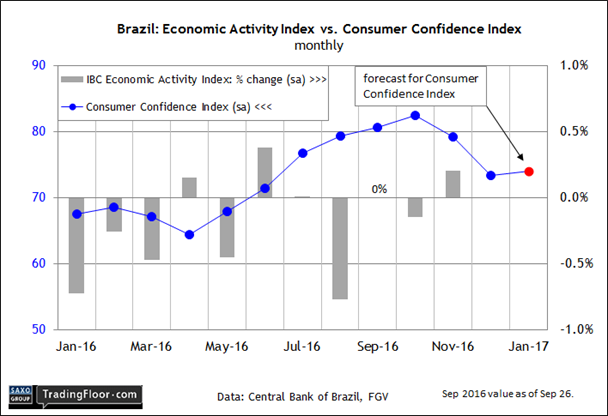

- Brazil’s Consumer Confidence Index set to rise for the first time in three months

Sentiment in Germany’s business sector is in focus today via the Ifo survey data for January. Later, we’ll see the January report for the UK’s CBI Industrial Trends Index and this month’s release of Brazil’s Consumer Confidence Index.

Germany: Ifo Business Climate Survey (0900 GMT): Private-sector economic activity eased slightly in January, according to yesterday’s flash release of the Germany Composite Output Index. But the outlook for the broad trend remains encouraging, IHS Markit advised.

“Looking ahead, German companies are increasingly optimistic,” said an economist at the firm. “Both manufacturers and service providers anticipate healthy growth in 2017.”

Today’s Ifo Business Climate Index reading for January is expected to support a healthy forecast. Economists are looking for incrementally higher numbers for the current and expectation benchmarks for 2017’s debut.

If the estimates are right, the current situation index will inch up to 111.3, the highest level in over five years.

The macro trend for Europe’s biggest economy looks encouraging at the start of the new year, but political uncertainty hangs over the Eurozone.

Elections scheduled this year in Germany, France and the Netherlands, and perhaps Italy too, could threaten the euro area via victories by populist parties.

Fitch Ratings yesterday warned that such shifts in political power could cut growth in the currency bloc overall.

“Using a composite financial shock of banking, bond and stock markets, we find that the real economic costs would be high in all large Eurozone members and that policy options to respond to the shock would be very limited,” the director of the firm’s economics team said.

For the moment, however, the near-term trend for Europe’s main economy remains healthy, and today’s Ifo data looks set to reaffirm that view.

UK: CBI Industrial Trends Survey (1100 GMT): Forecasters have abandoned their Brexit-related recession warning for Britain, but slow growth is lurking, according to a new estimate from the EY Item Club.

“It may look like the economy is taking the referendum in its stride, but we think that impression is deceptive,” the consultancy said, predicting that three years of “relatively slow growth” await.

GDP’s pace is expected to dip to 1.3% this year, sliding to 1% in 2018 and then rebounding to 1.4% in 2019.

Perhaps, but economists don’t expect to see a slowdown in today’s January update of the CBI Industrial Trends Orders Index.

The benchmark is on track to rise into positive terrain for the first time in nearly two years, according to TradingEconomics.com’s consensus estimate.

Markit’s survey numbers also point to a stronger manufacturing sector. The PMI jumped to a 30-month high last month, in part because of higher orders.

"Based on its historical relationship against official manufacturing output data, the survey is signalling a quarterly pace of growth approaching 1.5%, a surprisingly robust pace given the lacklustre start to the year and the uncertainty surrounding the EU referendum,” a senior economist at Markit noted earlier this month.

Today’s CBI data appears poised to confirm PMI’s upbeat outlook.

Brazil: Consumer Confidence Index (1100 GMT): The expected rebound for Brazil’s battered economy has had some setbacks recently, but optimism reigns supreme in the country’s stock market.

The Ibovespa Sao Paulo Index was near a five-year high in mid-day trading on Tuesday.

Will the hard economic data in the new year support the crowd’s optimism? An early hint arrives in today’s monthly update of the Consumer Confidence Index (CCI) from FGV, a thinktank in Rio de Janeiro.

Recent numbers show that the mood has stumbled – CCI fell in November and December after rising for six straight months.

“The year ends with consumers dissatisfied with the present situation and pessimistic about the coming months,” FGV said in a statement last month.

Today’s January report, however, is expected to show a mildly firmer reading -- the first gain for CCI since October, based on TradingEconomics.com’s consensus forecast.

Meantime, a bit of good news for consumers, and the economy generally, is the central bank’s decision on January 11 to cut interest rates by 75 basis points to 13.0%, which follows two declines in late-2016.

The current policy rate is still painfully high, especially for an economy that’s struggling to break free of recession. Yet some analysts think the recent cuts mark a regime shift, which implies that monetary stimulus will accelerate in the months ahead.

“With the lower interest rate, we will be able to reduce the cost of credit more and more, making it easier and cheaper for consumption and investment,” Brazilian Finance Minister Henrique Meirelles advised.

It’ll be interesting to see if the minister’s optimism finds any traction in today’s consumer survey.

Disclosure: Originally published at Saxo Bank TradingFloor.com