By Byron Kaye and Harish Sridharan

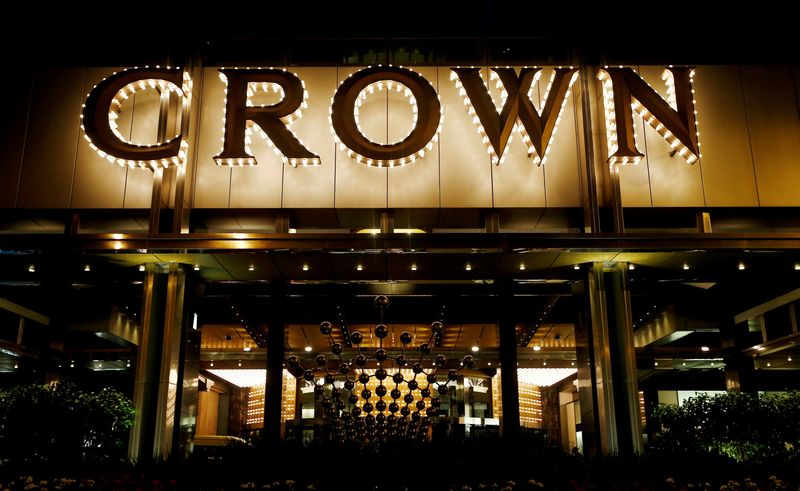

(Reuters) -Crown Resorts, the Australian casino operator bought by Blackstone (NYSE:BX) Inc after three damaging inquiries, agreed to pay a A$450 million ($294 million) fine for breaking anti-money laundering laws, a step toward ending its darkest chapter.

The company, dominated by billionaire founder James Packer before he agreed to sell last year, said it agreed to the payment after allegations over wide-ranging governance problems sparked inquiries in all the states in which it operated, plus an investigation by the financial crime watchdog.

The fine, which the federal court must approve, is the third-largest for an Australian company, and takes Crown's total penalties to A$680 million since it was rocked by accusations of ignoring organised crime and employee safety in hearings since 2020.

"Crown's contraventions... meant that a range of obviously high-risk practices, behaviours and customer relationships were allowed to continue unchecked for many years," Australian Transaction Reports and Analysis Centre (AUSTRAC) CEO Nicole Rose said in a statement.

Crown has stopped doing business with foreign travel agents, or "junkets", who brought in Chinese gamblers, and since 2021 replaced most of its leadership in a bid to show the authorities it has rebuilt its governance systems. Blackstone took Crown private for A$8.9 billion in 2022.

"We are pleased to have reached this agreement with AUSTRAC," said Crown Resorts CEO Ciarán Carruthers, who started in the role in September. "The company that committed these unacceptable, historic breaches is far removed from the company that exists today."

Blackstone declined to comment.

If the federal court agrees to the fine at hearings scheduled for July 10 and 11, the amount would put Crown behind only Westpac Banking (NYSE:WBK) Corp and Commonwealth Bank of Australia (AX:CBA), which were also penalised in the past.

Australian regulators over the recent years have penalised a slew of companies over breaches and non-compliances, with the country's "Big Four" banks fined the most.

($1 = 1.4743 Australian dollars)