(Bloomberg) -- It’s increasingly becoming a question of when, not if, the European Central Bank will pump up its emergency bond buying program to help the most vulnerable euro-area economies avoid a deeper recession.

With countries relying on borrowing to finance their response to the coronavirus pandemic, the ECB will likely take on more of that bond supply, as private investors steer away from taking on risk. The crisis will spur governments to issue an extra 850 billion euros ($935 billion) this year, according to analysts at ABN Amro.

The central bank isn’t expected to buy all the additional debt, but its role needs to be big enough to keep borrowing costs low and ensure that the economic shock doesn’t turn into a debt crisis like the one that nearly tore the monetary union apart less than a decade ago.

The 750 billion-euro pandemic bond-buying program has emerged as the ECB’s preferred tool in fighting Europe’s worst post-war economic crisis. Most economists surveyed by Bloomberg before this week’s policy meeting expected central bankers to add 500 billion euros later this year.

“They’re falling a bit short at the moment in terms of mopping up additional supply,” said James Athey, investment director at Aberdeen Standard.

The Governing Council on Thursday kept the size of the program unchanged, opting instead to use other tools to boost bank lending. But President Christine Lagarde said it can increase and be extended beyond 2020.

The question of when revolves around the possible trigger.

While private investors are likely to line up for the safest debt, such as Germany’s, they may demand increasingly higher interest rates from weaker nations such as Italy and Spain -- which are also the hardest hit by the virus.

That so-called risk premium would flow through to other interest rates for business and consumer loans, deepening the recession. In the worst case, it could make government repayments unaffordable.

While the ECB’s primary role is to ensure price stability, it considers safeguarding monetary stability -- unwarranted market volatility and investors fleeing to haven assets -- complementary to that.

Enter the Pandemic Emergency Purchase Program. It’s been tailored to achieve this goal because it doesn’t have of most of the restrictions that restrain the older programs.

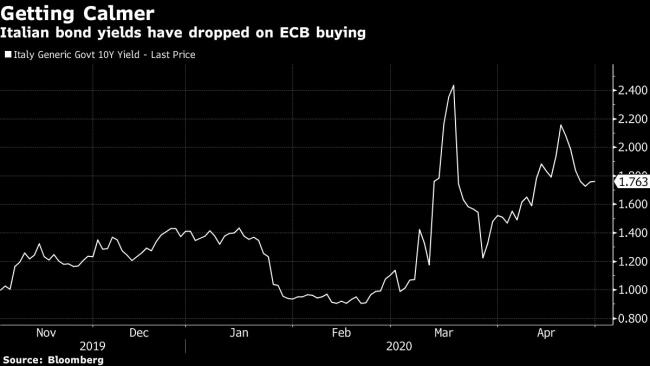

It allows the central bank to skew bond purchases toward heavily indebted Italy. Bond yields there have subsided since the program started in March in a sign that the ECB is doing just that, and a bond sale passed successfully last month. Still, the nation’s credit rating was unexpectedly downgraded by Fitch.

Lagarde on Thursday called the PEPP the “best tool that we have in our toolbox.” Chief Economist Philip Lane, who writes the policy proposals for the Governing Council, echoed that sentiment the next day.

He said in a blog that the ECB aims to lower the the cost of safest debt across all maturities, and said the successful implementation of the emergency program is “critical.”

“The overall size of the Pandemic Emergency Purchase Program is a key factor in determining the risk-free yield curve, while the flexibility embedded in the design of the PEPP enables the ECB to play its market stabilization role and implement its monetary policy in an efficient manner.”

-Philip Lane, ECB blog, May 1

“To me it’s only a matter of time because the support will be needed for longer,” said Frederik Ducrozet, strategist at Pictet Asset Management. “They’ll need to double the pace ultimately. By June they’ll make the decision to extend the PEPP into next year.”

Lane also followed Lagarde in urging governments to come up with a joint euro-area approach which spreads the cost across the bloc. That’s looking like a stretch so far -- the European Commission has been asked to come up with a proposal by May 6 but leaders are still divided on whether aid should take the form of grants or loans.

What Bloomberg’s Economists Say...

“The sharp deterioration in economic and fiscal prospects means we still forecast the program will have to be expanded, a move likely to happen in June.”

-Maeva Cousin. Read her ECB REACT

Proposals for a jointly issued bond, which the ECB views as a cheaper option than national debt because it would be a safe asset, are opposed by countries such as Germany, the Netherlands and Austria who fear they’ll end up footing much of the bill.

The ECB’s worst-case scenario sees the economy shrinking as much as 12% this year and not returning to its pre-virus size until the end of 2022. That suggests a long and expensive recovery.

“The economic shock and related funding needs are likely going to be much larger than what the ECB anticipated,” economists at Bank of America (NYSE:BAC), who predict the bond plan will be expanded to 1.5 trillion euros and extended into 2021, wrote in a note. “The European government response remains lacking and inappropriate.”

©2020 Bloomberg L.P.