Investing.com – The U.S. dollar was down against its major counterparts in thin trade on Friday, after a string of strong U.S. economic data encouraged investors towards higher yielding currencies on the final trading day of 2010.

On Thursday, official data showed that U.S. initial jobless claims fell to their lowest level in more than two years, while the Chicago PMI rose in December at its fastest pace since 1988. A separate report by the National Association of Realtors said that pending home sales rose more-than-expected in November, up for the second straight month.

The greenback slipped to a two-week low against the euro and closed trading near a record low against the Swiss franc, as thin year-end trade exaggerated price movements. The yen rose to its highest level against the dollar in seven weeks as Japanese exporters bought up the currency ahead of the year's end.

The Australian dollar reached a 28-year peak against the greenback, supported by strong commodity prices while the Canadian dollar rose to its highest level since May 2008.

The euro was the worst-performing major currency against the dollar in 2010, sliding 6.5%, the largest annual drop in five years. The second-worst performer was the pound, which had 3.5% loss. The best-performing major currency against the greenback was the yen, soaring 14.7% even as the Japanese government took steps to weaken it.

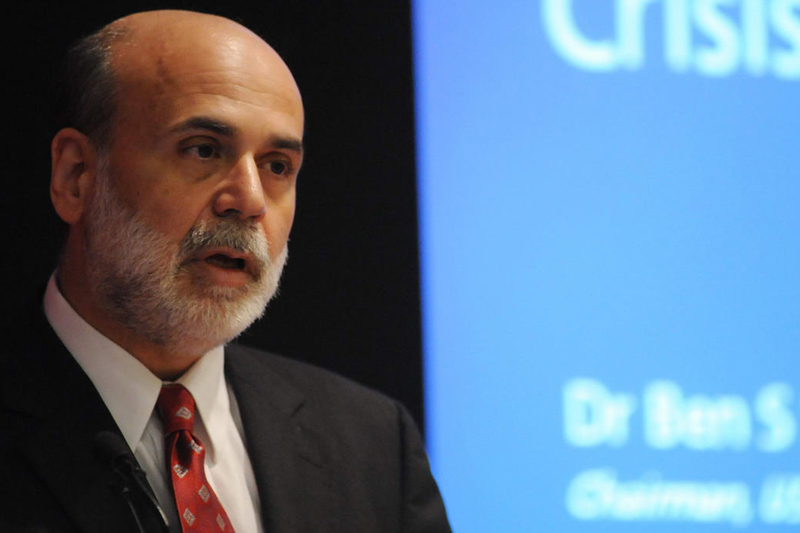

In the week ahead, the U.S. is to release employment data for December on Friday while Federal Reserve Chairman Ben Bernanke is to testify before the Senate budget panel the same day.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, January 3

Markets in the euro zone, Switzerland, the United Kingdom, Japan, Canada, Australia and New Zealand will be closed for the New Year’s Day bank holiday.

The U.S. is to publish industry data on manufacturing activity, a leading indicator of economic health. In addition, Switzerland and the euro zone are to publish reports on manufacturing growth.

Tuesday, January 4

The U.K. is to publish industry data on house prices, a leading indicator of the housing industry's health. Later in the day, the country is to release reports on manufacturing, net lending to individuals and final mortgage approvals.

The euro zone is to publish preliminary data on consumer price inflation, which accounts for the majority of overall inflation, while Germany is to publish data on the change in the number of people employed during the previous month.

In the U.S., the Federal Reserve is to publish the minutes of its most recent monetary policy committee meeting, which provide an in-depth insight into the country’s economic and financial outlook. The country is also to publish official data on factory orders, a leading indicator of industrial production.

Also Tuesday, Australia is to publish official data on commodity prices, which account for over half of the country’s export earnings.

Wednesday, January 5

The U.S. is to publish data on ADP non-farm payrolls, which leads the government-released employment data by two days. Later in the day, the country is to publish a report on service sector growth, a leading indicator of economic growth as well as a report on crude oil stockpiles.

The euro zone is to publish official data on industrial new orders, a leading indicator of production. The U.K. is to publish data on activity in the construction sector, an important indicator of economic health.

In addition, Canada is to publish official data on inflation while Australia is to publish industry data on new home sales.

Thursday, January 6

The U.S. is to publish key weekly data on initial jobless claims, a leading indicator of overall economic health.

In the euro zone, Germany is to produce official data on factory orders, a leading indicator of production, while the euro zone is to publish a report on retail sales, the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

Meanwhile, the U.K. is to publish a report on activity in the services sector, while Switzerland is to produce official data on consumer price inflation, a leading indicator of economic growth.

Elsewhere, Australia is to publish official data on building approvals as well as a report on activity in the construction sector, while Canada is to release key data on manufacturing activity.

Friday, January 7

The U.S. is to round up the week with key data on non-farm employment change and a report on the country's unemployment rate, both leading indicators of economic health. Later in the day, the country is to publish a report on consumer credit.

In the euro zone, Germany and France are to publish official data on their trade balances, the difference in value between imports and exports over the month. Germany is also to publish official data on retail sales and industrial production, while Italy is to release key monthly data on unemployment.

The euro zone is also to produce final data on third quarter gross domestic product as well as a report on its unemployment rate.

Elsewhere, Canada and Switzerland are to release official data on their unemployment rates while Canada is to produce a report on employment change.

On Thursday, official data showed that U.S. initial jobless claims fell to their lowest level in more than two years, while the Chicago PMI rose in December at its fastest pace since 1988. A separate report by the National Association of Realtors said that pending home sales rose more-than-expected in November, up for the second straight month.

The greenback slipped to a two-week low against the euro and closed trading near a record low against the Swiss franc, as thin year-end trade exaggerated price movements. The yen rose to its highest level against the dollar in seven weeks as Japanese exporters bought up the currency ahead of the year's end.

The Australian dollar reached a 28-year peak against the greenback, supported by strong commodity prices while the Canadian dollar rose to its highest level since May 2008.

The euro was the worst-performing major currency against the dollar in 2010, sliding 6.5%, the largest annual drop in five years. The second-worst performer was the pound, which had 3.5% loss. The best-performing major currency against the greenback was the yen, soaring 14.7% even as the Japanese government took steps to weaken it.

In the week ahead, the U.S. is to release employment data for December on Friday while Federal Reserve Chairman Ben Bernanke is to testify before the Senate budget panel the same day.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, January 3

Markets in the euro zone, Switzerland, the United Kingdom, Japan, Canada, Australia and New Zealand will be closed for the New Year’s Day bank holiday.

The U.S. is to publish industry data on manufacturing activity, a leading indicator of economic health. In addition, Switzerland and the euro zone are to publish reports on manufacturing growth.

Tuesday, January 4

The U.K. is to publish industry data on house prices, a leading indicator of the housing industry's health. Later in the day, the country is to release reports on manufacturing, net lending to individuals and final mortgage approvals.

The euro zone is to publish preliminary data on consumer price inflation, which accounts for the majority of overall inflation, while Germany is to publish data on the change in the number of people employed during the previous month.

In the U.S., the Federal Reserve is to publish the minutes of its most recent monetary policy committee meeting, which provide an in-depth insight into the country’s economic and financial outlook. The country is also to publish official data on factory orders, a leading indicator of industrial production.

Also Tuesday, Australia is to publish official data on commodity prices, which account for over half of the country’s export earnings.

Wednesday, January 5

The U.S. is to publish data on ADP non-farm payrolls, which leads the government-released employment data by two days. Later in the day, the country is to publish a report on service sector growth, a leading indicator of economic growth as well as a report on crude oil stockpiles.

The euro zone is to publish official data on industrial new orders, a leading indicator of production. The U.K. is to publish data on activity in the construction sector, an important indicator of economic health.

In addition, Canada is to publish official data on inflation while Australia is to publish industry data on new home sales.

Thursday, January 6

The U.S. is to publish key weekly data on initial jobless claims, a leading indicator of overall economic health.

In the euro zone, Germany is to produce official data on factory orders, a leading indicator of production, while the euro zone is to publish a report on retail sales, the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

Meanwhile, the U.K. is to publish a report on activity in the services sector, while Switzerland is to produce official data on consumer price inflation, a leading indicator of economic growth.

Elsewhere, Australia is to publish official data on building approvals as well as a report on activity in the construction sector, while Canada is to release key data on manufacturing activity.

Friday, January 7

The U.S. is to round up the week with key data on non-farm employment change and a report on the country's unemployment rate, both leading indicators of economic health. Later in the day, the country is to publish a report on consumer credit.

In the euro zone, Germany and France are to publish official data on their trade balances, the difference in value between imports and exports over the month. Germany is also to publish official data on retail sales and industrial production, while Italy is to release key monthly data on unemployment.

The euro zone is also to produce final data on third quarter gross domestic product as well as a report on its unemployment rate.

Elsewhere, Canada and Switzerland are to release official data on their unemployment rates while Canada is to produce a report on employment change.