By David Lawder

WASHINGTON (Reuters) - The World Bank on Thursday adopted a plan to aid China with $1 billion to $1.5 billion in low-interest loans annually through June 2025, despite the objections of U.S. Treasury Secretary Steven Mnuchin.

Mnuchin told a House Financial Services Committee hearing that the Treasury's representative on the bank's board had objected on to the plan on Wednesday, adding he wanted the World Bank to "graduate" China from its concessional loan programs for low- and middle-income countries.

The new five-year plan calls for lending to "gradually decline" from the previous five-year average of $1.8 billion.

It was published http://documents.worldbank.org/curated/en/902781575573489712/pdf/China-Country-Partnership-Framework-for-the-Period-FY2020-2025.pdf on Thursday afternoon after the World Bank's board "expressed broad support" for the multilateral development lender's engagement in China's structural and environmental reforms.

The World Bank loaned China $1.3 billion in the fiscal 2019 year ended June 30, down from about $2.4 billion during fiscal 2017.

"Lending levels may fluctuate up and down from year to year due to normal pipeline management based on project readiness," the World Bank said in the new plan.

It said Beijing had requested continued financing from the World Bank's International Bank for Reconstruction and Development division "as platforms for reform, institution building and knowledge transfer."

U.S. RIGHTS, TRADE CONCERNS

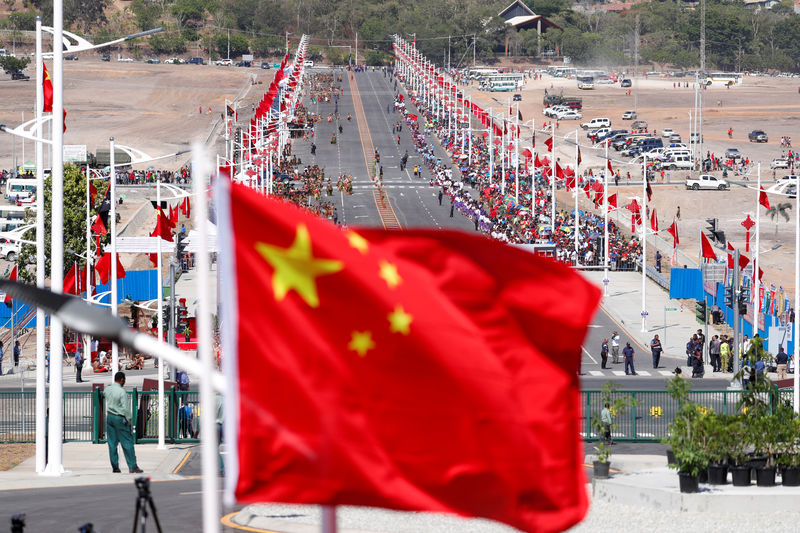

But the decline in lending is not fast enough for Mnuchin, who has argued China is too wealthy for such international aid when it is lending hundreds of billions of dollars of its own to poor countries through its Belt and Road infrastructure drive.

U.S. lawmakers are also increasingly expressing concerns that U.S. taxpayer funds loaned through the World Bank to China will enable human rights abuses and unfair economic competition with the United States.

In Senate floor remarks on Thursday, Senate Finance Committee Chairman Charles Grassley cited alleged human rights abuses in Xinjiang associated with detention camps for Muslim Uighurs in criticizing the World Bank lending plan.

"The World Bank, using American tax dollars, should not be lending to wealthy countries that violate the human rights of their citizens and attempt to dominate weaker countries either militarily or economically," Grassley said.

China defended its partnership with the World Bank.

"We are willing to make an effort and work together (with the bank) to summarize and share China's success and experience in poverty alleviation with other developing countries, to realize a long-term sustainable development for these countries," foreign ministry spokeswoman Hua Chunying told a news briefing Friday.

Although the United States hold an effective veto power over major board decisions such as capital increases and leadership appointments, the latest China lending plan did not require a formal vote.

Mnuchin told lawmakers he expected the World Bank's lending to China to fall below $1 billion during the current fiscal year, with more repayment funds flowing back to the lender from China than loan funds going out.

The World Bank said the loans in the five-year plan would be aimed at advancing market and fiscal reforms, promoting greener growth and increasing citizens' access to health and social services.