By Alexandra Alper

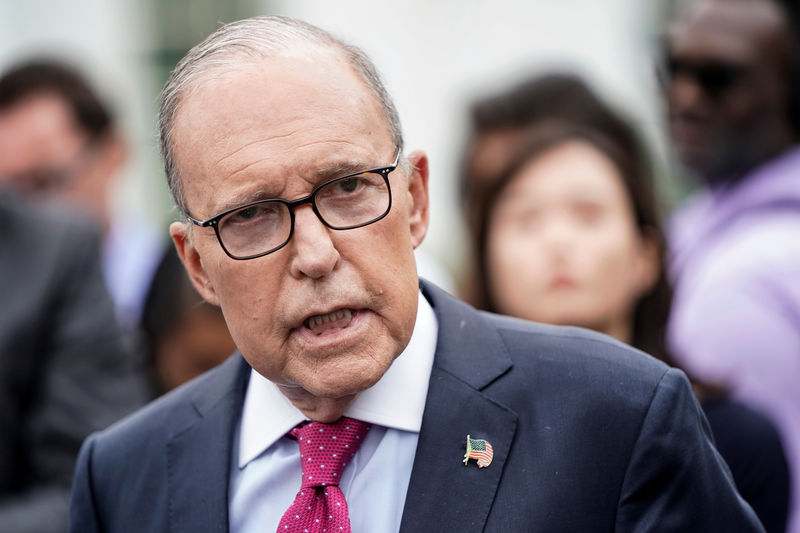

WASHINGTON (Reuters) - White House economic adviser Larry Kudlow on Thursday suggested the U.S. central bank's staff is part of a "deep state" and repeated his own and U.S. President Donald Trump's call on Federal Reserve policymakers to reduce borrowing costs further.

"They're moving in the right direction," Kudlow told CNBC, adding that a 25 basis point cut would be appropriate. "Their models are highly flawed. The deep state, board staff, of course, has not been helpful. Oops, did I say that?" Kudlow told CNBC, using a conspiracy term used by some to refer to a shadowy government.

Fed policymakers meet in two weeks to decide on interest rates, which they have cut twice this year in response to rising risks including the ongoing U.S.-China trade war and slowing global growth. Trump has urged the Fed to take rates down to zero and even below, lobbing insults like "boneheads" at policymakers for not doing so.

In comments to reporters after the TV interview, Kudlow said he wasn't making a personal attack, but asserted that the Fed's models are not working.

The Washington-based Board of Governors is part of the federal government, but its members serve 14-year terms, outlasting any one president. The central bank releases its financial statements publicly and provides regular updates to its congressional overseers. It operates independently from the White House to achieve its legal mandate of full employment and stable prices for the nation.

The Fed system employs 22,400, including 2,800 in Washington and the rest at its privately funded regional banks. Besides economic analysis, staff duties include bank supervision, cyber security, payments and a raft of other roles.

MANY MODELS

The U.S. unemployment rate has fallen to 3.5%, lower than the Fed's estimate of a sustainable level that does not create unwanted inflation, and yet inflation has remained below 2% for years, Kudlow noted, adding that this suggests a disconnect from what models say and how the economy has been behaving.

The typically inverse relationship between the unemployment rate and the inflation rate is often referred to as the "Phillips curve."

Kudlow's remarks use an outdated view of how the Fed looks at the relationship between inflation and unemployment and overlook decades of research into the importance of public expectations in creating economic outcomes and which feed into central bank policy. Indeed some have argued that in controlling inflation successfully in the 1970s and 1980s, independent central banks may themselves have killed the traditional Phillips Curve tradeoff, or, along with globalization and other forces, at least weakened it.

The Fed's hundreds of economists, along with the broader economic profession, use variations of the Phillips curve among many rules and models to assess the economic outlook.

Fed policymakers, speaking to community groups and business leaders in many of the 50 states as well as in Washington, have many times acknowledged that they have underestimated how low unemployment can go without sparking inflation.

They point out that an aging U.S. population as well as disinflationary global factors are pushing down on U.S. inflation in ways that have not been seen previously. They also regularly warn that leaving rates too low for too long could cause problems not limited to too-high inflation.

The U.S. central bank has made numerous efforts to provide transparency about its deliberations. The rate-setting committee meets eight times a year. In January, Fed Chair Jerome Powell moved to holding a press conference after each one, instead of quarterly as has been the custom in recent years. Minutes of policy discussions are published on the Fed's website three weeks later while full transcripts of the rate-setting committee's meetings are released with a five-year lag.

A Fed spokesperson declined to comment on Kudlow's remarks.