By Karin Strohecker

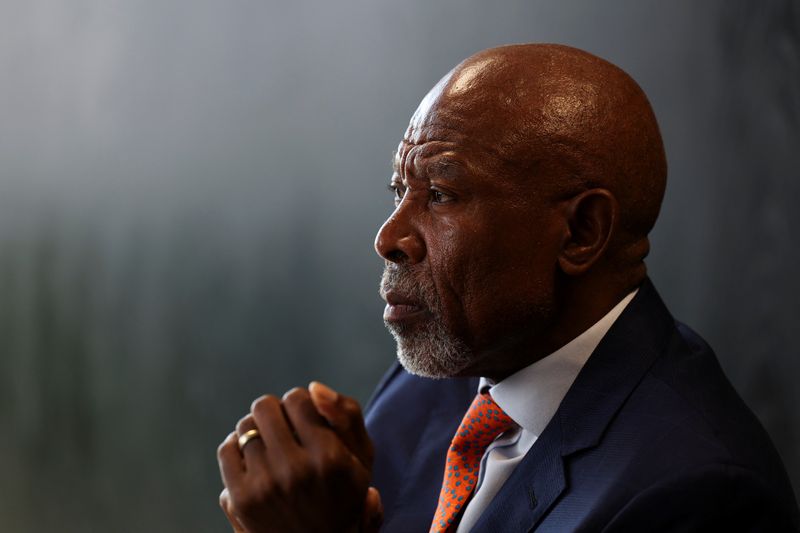

WASHINGTON (Reuters) - South Africa faces upside risks to its inflation outlook, Central Bank Governor Lesetja Kganyago said, but the latest data has not shown evidence of price pressures from food despite adverse El Nino weather wreaking havoc across Africa.

Data out on Wednesday had shown headline inflation fell to 5.3% year-on-year, down from 5.6% in February and coming in a touch below analyst expectations.

In its March decision, the South African Reserve Bank (SARB) said headline inflation was expected to reach 4.5% - the midpoint of its target range - only at the end of 2025, later than previously forecast.

"There are upside risks to the inflation outlook," Kganyago told Reuters on the sidelines of the International Monetary Fund and World Bank spring meetings in Washington.

Those risks stemmed from higher oil prices on the back of heightened tensions in the Middle East, but also the prospect of tight global financial conditions amid the prospect of interest rates at the U.S. Federal Reserve staying higher for longer.

This would likely suck capital out of emerging markets and into advanced economies, which could lead to a realignment of exchange rates, he said.

"And we are in that category," said Kganyago.

South Africa's rand has weakened more than 4% against the dollar since the start of the year.

Price pressures from food stuffs has been in focus across the continent, with droughts and adverse weather in much of the region wreaking havoc. However, Kganyago said the latest inflation data had not shown signs of those pressures in South Africa.

"There are El Nino conditions... but the El Nino effect has not been felt yet."

Africa's most industrialised nation is grappling with an ailing economy and high debt ahead of a general election on May 29 that could see the governing African National Congress party lose its parliamentary majority for the first time since the end of apartheid 30 years ago.

Asked about the election uncertainty, Kganyago said this was a global phenomenon with a record number of countries around the globe holding elections.

"That is what you face - that uncertainty manifests itself in the foreign exchange market, it manifests itself in the bond market, in the equities market."