By Lisa Richwine

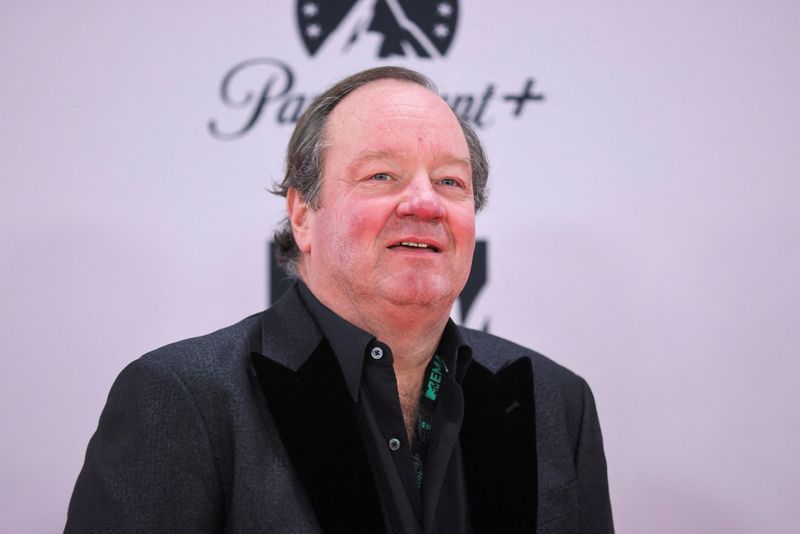

LOS ANGELES (Reuters) -Paramount Global replaced CEO Bob Bakish with atrio of executives, the company announced on Monday in the middle of talks with David Ellison's Skydance Media about a possible merger.

The owner of the Paramount+ streaming service, the Paramount Pictures movie studio and cable networks including MTV, BET and Showtime announced the change just ahead of reporting better-than-expected earnings for the quarter ended in March.

Paramount's shares were up nearly 1% at $12.36 in after-hours trading.

A new Office of the CEO will be led by CBS President and CEO George Cheeks, Paramount Pictures studio chief Brian Robbins, and Chris McCarthy, head of Showtime, MTV and other networks, the company said.

Paramount is in exclusive talks with Skydance and is working to build its streaming business as it faces tough competition from Netflix (NASDAQ:NFLX) and Walt Disney (NYSE:DIS) as viewership of cable TV declines.

"We're finalizing a long-term strategic plan to best position this storied company to reach new and greater heights in a rapidly changing world," McCarthy said on the company's quarterly earnings call.

Analysts said the executive shakeup appeared ill-timed.

The new arrangement "looks like a car crash with clear divisions among key stakeholders," PP Foresight analyst Paolo Pescatore said in a written note.

"Why replace the CEO with three executives at a time when leadership is paramount (no pun intended) to the future success of the company?" Pescatore said.

Bakish had led the company since the 2019 merger with CBS to form ViacomCBS (NASDAQ:PARA), later branded as Paramount Global. He took the helm of Viacom in 2016.

McCarthy said the three new leaders had "worked together collaboratively for years and have known each other for decades."

"It's a true partnership," he said.

For the quarter ended in March, Paramount reported adjusted earnings per share of 62 cents, well ahead of the 36 cents consensus of analysts.

Revenue came in shy of expectations at $7.69 billion. Wall Street had forecast $7.73 billion, according to LSEG data.

Advertising revenue rose 14%, boosted by the CBS broadcast of the Super Bowl in February.

The company's streaming unit reported gains. Paramount+ added 3.7 million subscribers for a total of 71 million, beating analyst expectations.

As Paramount navigates the industrywide shift to streaming, it has been in discussions with Skydance about a deal. The possible combination has upset some shareholders who say it would benefit controlling shareholder Shari Redstone at their expense. They have urged Paramount to consider other suitors including Apollo Global Management (NYSE:APO).

The Redstone family and Skydance, which has backed Paramount films such as "Top Gun: Maverick," recently offered concessions to try to make the Skydance bid more attractive, Bloomberg reported on Sunday.

On the conference call after the release of Monday's earnings, Paramount Global executives did not take questions from analysts as is the custom. The call, which lasted only 8 minutes and 34 seconds, ended with the theme song from the Paramount movie franchise "Mission: Impossible."