By Howard Schneider and Abhirup Roy

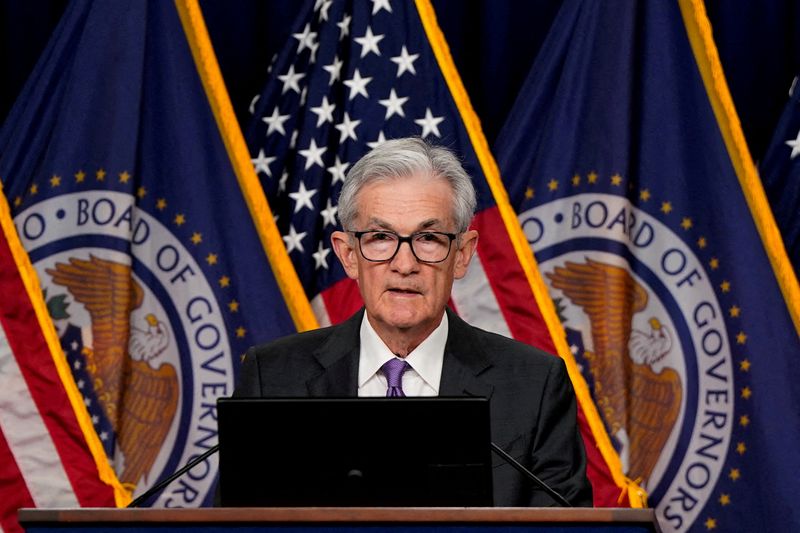

STANFORD, California (Reuters) -Federal Reserve officials including U.S. central bank chief Jerome Powell on Wednesday continued focusing on the need for more debate and data before interest rates are cut, a move financial markets expect to occur in June.

"Recent readings on both job gains and inflation have come in higher than expected," Powell said in a speech to the Stanford Graduate School of Business. While policymakers generally agree that rates can fall later this year, he said this will happen only when they "have greater confidence that inflation is moving sustainably down" to the Fed's 2% target.

His remarks repeated language the Fed has adopted as it tries to balance the risks of cutting interest rates before inflation is truly controlled with the risks of suppressing economic activity more than is needed.

As new data arrives, however, as many questions have been raised as answered.

In separate comments to CNBC on Wednesday, Atlanta Fed President Raphael Bostic said rates should likely not be reduced until the fourth quarter of this year. Bostic anticipates only one quarter-percentage-point cut will be appropriate in 2024, well below the three or more cuts most of his colleagues anticipate.

"We've seen inflation kind of become much more bumpy," Bostic said. "If the economy evolves as I expect, and that's going to be seeing continued robustness in GDP and employment, and a slow decline in inflation over the course of the year, I think it will be appropriate for us to start moving down at the end of this year, the fourth quarter."

Few other Fed officials have been as specific in their public remarks about the interest rate outlook as Bostic, however.

Fed Governor Adriana Kugler, for one, agreed with the assessment from Bostic, Powell and other officials that recent progress on inflation has been "bumpy." Still, Kugler said in comments at Washington University in St. Louis, "I expect the disinflationary trend to continue" and help pave the way for rate cuts over the course of the year.

"If disinflation and labor market conditions proceed as I am currently expecting, then some lowering of the policy rate this year would be appropriate," she said, without commenting on the timing or extent of policy easing she expects.

The Fed last month held its benchmark overnight interest rate steady in the 5.25%-5.50% range, where it has been since July.

'LATER THIS YEAR'

Powell's prepared remarks and answers to questions at the event in Stanford, California, broke no new policy ground.

As he did at his press conference at the end of the Fed's last policy meeting on March 20, Powell maintained the baseline outlook that rates will fall "later this year," and said that recent data did not "materially change the overall picture which continues to be one of solid growth, a strong but rebalancing labor market, and inflation moving down toward 2% on a sometimes bumpy path."

But neither has he hinted at when the Fed might loosen its grip on credit, with upcoming jobs data, including the March nonfarm payrolls report on Friday, and incoming inflation readings next week important in shaping the outlook for the central bank's April 30-May 1 and June 11-12 policy meetings.

"Given the strength of the economy and progress on inflation so far, we have time to let the incoming data guide our decisions on policy," Powell said, with decisions made "meeting by meeting.

Inflation, based on the Fed's preferred measure, remains half a percentage point or more above the central bank's 2% target, and recent progress has been minimal.

"January and February showed a bit of firming in the inflation data," Kugler said.

But she also said recent inflation numbers "featured some atypical or seasonal factors that suggest a need to withhold judgment" before deciding that last year's rapid progress back to the Fed's 2% target had indeed slowed.

Rather, Kugler said, she felt there was "still a bit of room" for supply improvements to slow the pace of price increases, "especially in the services sector, where solid labor supply growth will continue to ease wage and inflation pressures."