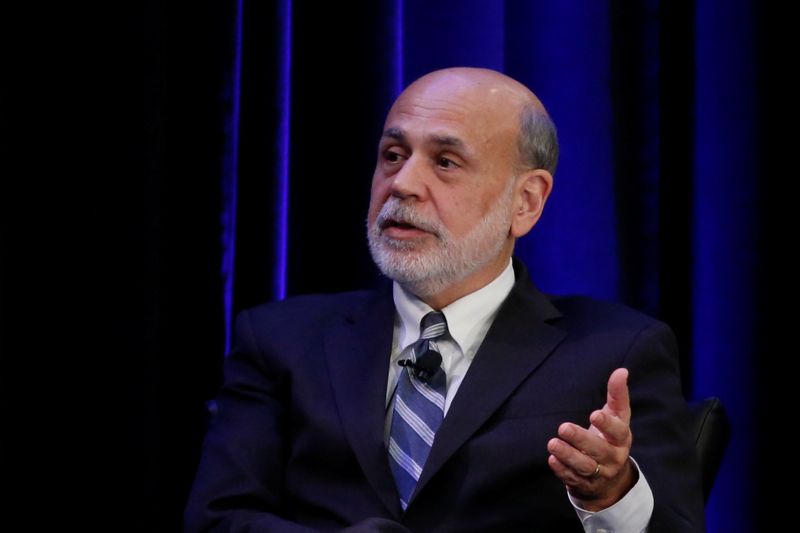

SAN DIEGO (Reuters) - The U.S. Federal Reserve still has enough clout to fight a future downturn, but policymakers should state in advance the mix of policies and policy promises they plan to use to get the most bang for their buck, former Fed chief Ben Bernanke said on Saturday.

In an address to the American Economics Association, Bernanke pushed back on the notion that central banks have lost influence over the economy, and laid out his thoughts about how the Fed in particular could change its monetary policy "framework" to be sure that is not the case.

Citing new research of his own and others at the Fed and elsewhere, Bernanke said the bondbuying programs known as "quantitative easing" were effective in lowering long-term interest rates even after the Fed's target policy rate had been cut to zero. Several rounds of QE were rolled out in response to the deep 2007-2009 financial crisis and recession, and Bernanke said bondbuying should be made a permanent part of the U.S. central bank's toolkit.

Similarly, "forward guidance," or promises about future policy, proved effective particularly as those pledges became more specific and tied to particular goals like reaching a certain level of unemployment.

"Forward guidance in the next downturn will be more effective - better understood, better anticipated, and more credible - if it is part of a policy framework clearly articulated in advance," Bernanke said. "Both QE and forward guidance should be part of the standard toolkit going forward."

"The room available for conventional rate cuts is much smaller than in the past," Bernanke said, but "the new policy tools are effective."

STRONGEST STATEMENT

The current low level of interest rates has led many to conclude that central banks will be hobbled when a downturn occurs. The Fed's current policy rate, for example, is in a range of between 1.50% and 1.75%, compared to more typical levels of around 3.50% in the past.

The rate cuts used to battle downturns have typically started with rates at even higher levels, allowing the central bank to slash them by perhaps 5 percentage points or more.

Bernanke said he feels a combination of bondbuying and forward guidance could produce the equivalent of about 3 percentage points of cuts to the Fed's target interest rate. Even at the current low levels of U.S. interest rates, that would give the Fed enough ammo to stimulate the economy by about as much as it has in past downturns.

Bernanke's conclusions about the effectiveness of QE are not new - nor are they universally accepted, with some arguing the purchases of Treasury bonds and mortgage-backed securities did little to boost the real economy, particularly beyond the initial round of buying in the immediate aftermath of the crisis.

But it amounts to his strongest statement yet about how the Fed should prepare for the next recession - including a recommendation that the Fed maintain "constructive ambiguity" about the possibility of using negative interest rates, and not rule out a tool it might find useful under some conditions.

Fed officials have largely ruled out the use of negative rates in the United States, despite their wide application in Japan and Europe.

The central bank is in the final stages of a discussion of just that issue, and some of the ideas Bernanke mentioned are similar to those already put in play by sitting Fed officials.

In a speech last year, Fed Board of Governor Lael Brainard, for example, suggested the Fed might promise in its new framework that once rates reached zero it would not raise them until inflation returned to the central bank's 2% target - the sort of explicit pledge Bernanke said would be easy to implement and make the Fed more effective in fighting a downturn.