(Reuters) - Danaher (NYSE:DHR) on Tuesday beat Wall Street estimates for third-quarter profit as strong demand for its diagnostic tests for respiratory diseases helped soften the blow from weaker sales at the healthcare conglomerate's life-sciences unit.

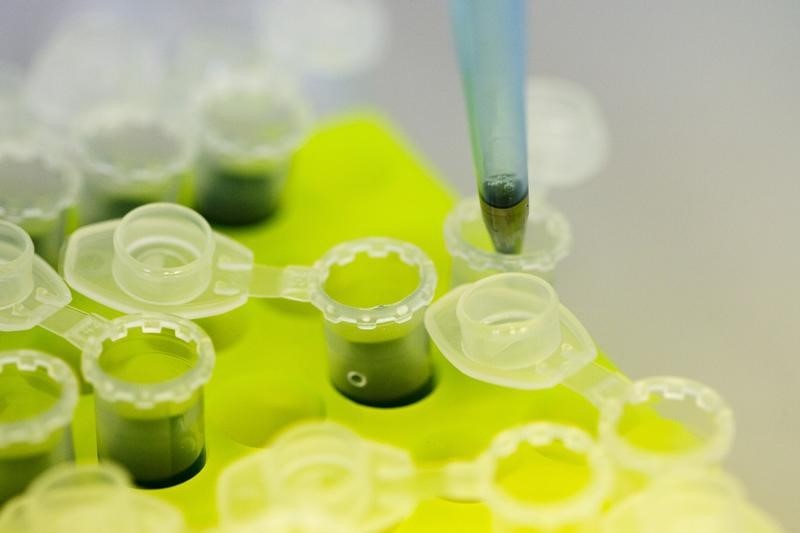

The diagnostics unit, which makes kits, also used for COVID-19 testing, as well as reagents and other tools, reported sales of $2.25 billion, beating the average analyst estimate of $2.12 billion, according to LSEG data.

However, the life sciences unit, which provides reagents and lab equipment used in the discovery of new drugs and vaccines, posted sales of $1.71 billion, missing estimates of $1.78 billion.

"Revenue in the third quarter came in ahead of our expectations, with Biotechnology performing as anticipated, and higher respiratory testing revenue more than offsetting slightly softer-than-anticipated demand in Life Sciences," Danaher CEO Rainer Blair said in a statement.

Shares of the Washington D.C.-based company rose 1.2% to $206.50 before the bell.

Danaher now expects a slight decline in adjusted core sales for the year, compared with its previous expectation of a low single-digit rise.

Life sciences companies such as Danaher, Agilent (NYSE:A) and Thermo Fisher (NYSE:TMO) cut their annual profit forecasts earlier this year as some clients slashed their budgets for biopharma services due to a funding crunch.

Rising interest rates squeezed funding needed for drug development programs, weighing on demand for contract research services offered by Danaher and rival Thermo Fisher.

Danaher's forecast excludes the impact of the spinoff of its Environmental & Applied Solutions unit, Veralto, which began trading on Oct. 2.

On an adjusted basis, Danaher reported a profit per share of $2.02, beating analysts' expectations of $1.87.

Third-quarter sales of $6.87 billion also topped estimates of $6.63 billion.