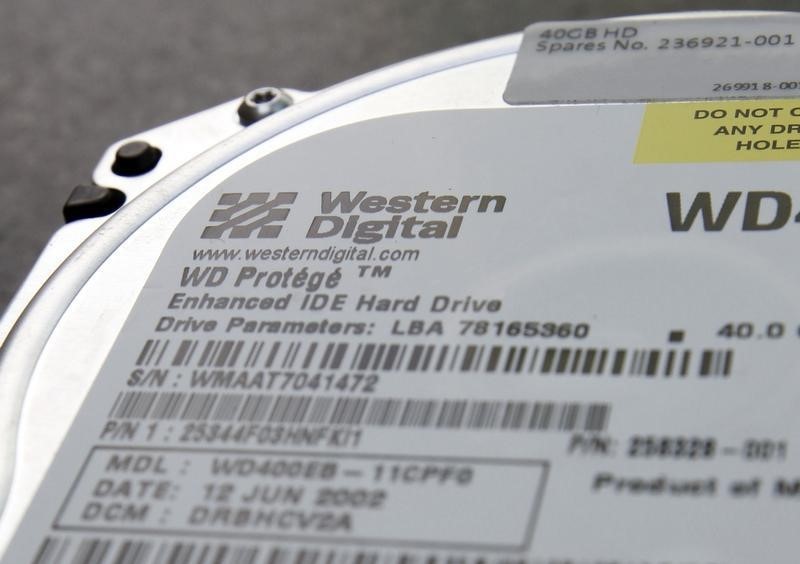

On Tuesday, Evercore ISI highlighted Seagate Technology (NASDAQ:STX) and Western Digital (NASDAQ:WDC) in a positive light following the release of preliminary estimates for hard disk drive (HDD) revenue by IDC for the March quarter. The data suggests a stronger performance than the companies had forecasted, with industry revenue up by 12-18% year-over-year, driven by growth in average selling prices (ASPs) and exabytes shipped.

The analyst from Evercore ISI noted that the HDD revenue increase was approximately 22% quarter-over-quarter, which is significantly higher than Seagate's guidance of an 8% increase and Western Digital's expectation of around 20%. The growth was primarily fueled by the hyperscale nearline segment, although other segments like consumer and video continued to see a decline.

The trends observed in the March quarter are expected to persist into the June quarter, with cloud demand projected to grow sequentially while other market segments may see further declines. IDC anticipates that the sustained growth in cloud services will lead to a period where demand exceeds supply, potentially resulting in a favorable pricing environment for HDDs.

According to Evercore ISI, these preliminary figures from IDC corroborate their expectation that both Seagate and Western Digital will surpass their initial March quarter projections and potentially raise their future guidance. The recovery in the HDD market appears to be ongoing, and the analyst's thesis suggests that the two companies are well-positioned to benefit from the current market dynamics.

InvestingPro Insights

Western Digital (NASDAQ:WDC) has been in the spotlight with its recent performance and market trends. According to real-time data from InvestingPro, Western Digital's market capitalization stands at a robust 23.57 billion USD, signaling strong investor confidence in the company. Despite a challenging environment, the company's stock has seen a significant uptick, with a one-year price total return of 107.54%, showcasing its resilience and potential for growth.

InvestingPro Tips highlight that Western Digital is a prominent player in the Technology Hardware, Storage & Peripherals industry, which is reflected in its strong return over the last three months, amounting to 47.58%. This aligns with the positive sentiment surrounding the HDD market and the potential for Western Digital to exceed its initial projections. However, it's worth noting that analysts have raised concerns about the company's profitability, with a P/E ratio (LTM as of Q2 2024) at -10.87, indicating that Western Digital has not been profitable over the last twelve months.

For investors seeking a deeper dive into Western Digital's performance and future outlook, there are additional InvestingPro Tips available at https://www.investing.com/pro/WDC. These tips provide valuable insights, such as the stock's volatility and the recent revisions by 7 analysts who have adjusted their earnings expectations upwards for the upcoming period. For those interested in taking advantage of these insights, use the coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription.

Overall, the preliminary estimates for HDD revenue and the subsequent analysis by Evercore ISI suggest a promising trajectory for Western Digital, complemented by the detailed insights available through InvestingPro, which includes a total of 13 additional tips for investors looking to make informed decisions.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.