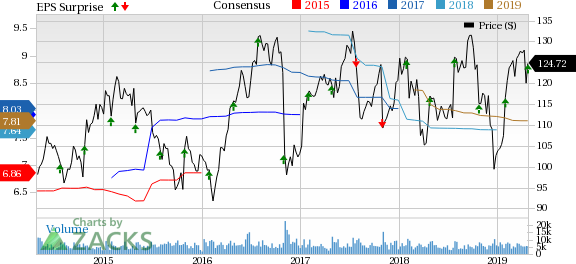

Zimmer Biomet Holdings, Inc. (NYSE:ZBH) posted first-quarter 2019 adjusted earnings per share (EPS) of $1.87, ahead of the Zacks Consensus Estimate by a penny. However, the figure dipped 2.1% year over year.

On a reported basis, EPS came in at $1.20, a 41.2% improvement from the year-ago period.

Revenue Details

First-quarter net sales came in at $1.98 billion, a 2.1% decline (a 0.7% rise at constant exchange rate or CER) year over year. The figure beat the Zacks Consensus Estimate of $1.97 billion by a close margin.

During the quarter under review, sales generated in the Americas totaled $1.19 billion (down 0.9% year over year at CER), while the same in EMEA (Europe, the Middle East and Africa) grossed $464 million (up 1.5% year over year at CER). Asia-Pacific registered 5.6% growth at CER to $318 million.

Segments

Sales in the Knees unit inched up 0.5% year over year at CER to $694 million. Hips recorded a 1.7% increase at CER from the prior-year quarter’s tally to $484 million. Revenues in the S.E.T. (Surgical, Sports Medicine, Foot and Ankle, Extremities and Trauma) unit rose 1.7% year over year to $440 million.

Among the other segments, Spine & CMF were up 1.7% at CER to $183 million, while Dental declined 0.2% to $105 million. Other revenues were down 9.4% to $70 million.

Margins

Gross margin after excluding intangible asset amortization came in at 71.9%, reflecting an expansion of 53 bps in the first quarter. Selling, general and administrative expenses were 0.7% down to $796.4 million. Research and development expenses rose 6.3% to $101.7 million. Adjusted operating margin contracted 46 bps to 26.5% during the quarter.

Cash Position

Zimmer Biomet exited first quarter 2019 with cash and cash equivalents of $586.8 million compared with $542.8 million in 2018. Long-term debt at the end of the first quarter totaled $8.81 billion compared with $8.94 billion at the end of 2018.

At the end of the first quarter, net cash provided by operating activities was $283.6 million compared with $490.5 million a year ago.

2019 Guidance

The company stated that, it has reaffirmed its 2019 revenues and adjusted EPS guidance which is as follows:

Sales in 2019 are projected to be down 0.5% to up 0.5% compared with the previous year. Per management, projected sales growth figures include 100-150 basis points of impact from an adverse currency movement. Adjusted EPS for 2019 is expected in the range of $7.70-$7.90.

Our Take

Zimmer Biomet ended the quarter on a mixed note. While the quarter’s numbers exceeded the respective Zacks Consensus Estimate, the year-over-year performance remained sluggish.

While sales in Americas remained dull, the company witnessed strength in the Asia Pacific and EMEA regions as well as in the Spine & CMF business. However, the company’s declining dental sales at CER disappoint. We believe that escalating costs and expenses are putting pressure on the adjusted operating margin.

Zacks Rank & Key Picks

Zimmer Biomet has a Zacks Rank #3 (Hold).

Some better-ranked stocks which posted solid results this earning season are Stryker Corporation (NYSE:SYK) , Abbott Laboratories (NYSE:ABT) and CONMED Corporation (NASDAQ:CNMD) , each carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Stryker delivered first-quarter 2019 adjusted EPS of $1.88, beating the Zacks Consensus Estimate by 2.2%. Revenues of $3.52 billion were in line with the Zacks Consensus Estimate.

Abbott reported first-quarter 2019 adjusted EPS of 63 cents, surpassing the Zacks Consensus Estimate by 3.3%. Worldwide sales totaled $7.54 billion, beating the Zacks Consensus Estimate of $7.47 billion.

CONMED’s first-quarter 2019 adjusted EPS of 57 cents beat the Zacks Consensus Estimate of 54 cents. Revenues of $218.4 million also surpassed the Zacks Consensus Estimate of $213 million.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Abbott Laboratories (ABT): Free Stock Analysis Report

Stryker Corporation (SYK): Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH): Free Stock Analysis Report

CONMED Corporation (CNMD): Free Stock Analysis Report

Original post

Zacks Investment Research