USD/JPY has edged higher in the Monday session. In North American trade, the pair is trading at 109.83, up 0.33% on the day. The week started on a positive note, as Japan’s Preliminary GDP was solid in the second quarter, posting a gain of 1.0%. This easily beat the estimate of 0.6%. On Monday, there are no Japanese or US releases. On Tuesday, the US releases Retail Sales.

The Japanese economy has shown signs of improvement, and this was underscored as Preliminary GDP in Q2. Japan has now posted a sixth consecutive of growth, marking the longest expansion in over a decade. Although exports have declined, domestic demand has rebounded. With a tight labor market and the business sector confident about economic conditions, better times could continue in 2017. The fly in the ointment remains inflation, as BoJ’s ultra-easy monetary policy has failed to eliminate the threat of deflation. The BoJ has insisted that it will not tighten policy before inflation climbs closer to the bank’s inflation target of 2%, but clearly this goal is unrealistic in the short term, and the BoJ may have to lower its inflation target.

The Japanese yen was one of the winners of last week’s crisis over North Korea, as investors shunned the stock markets and sought safe-haven assets such as the yen and gold. USD/JPY dropped 1.3% last week, and the low of 108.74 marked the lowest weekly low since April. Tensions between North Korea and the US remain high, but the prevalent sentiment in the markets is that a diplomatic solution will be found to end the crisis. Still, Donald Trump and Kim Jon-un are unpredictable leaders, and any move by either side could easily ratchet up tensions and unnerve investors. Donald Trump continues to deal with domestic problems as well, and the White House faced stinging criticism from both Republicans and Democrats, as Trump failed to single out white supremacists for the violence in Charlottseville, Virginia, where one person was killed at a demonstration against far-right marchers.

USD/JPY Fundamentals

Sunday (August 13)

- 19:50 Japanese Preliminary GDP. Estimate 1.0%

- 19:50 Japanese Preliminary GDP Price Index. Estimate -0.4%

Monday (August 14)

- There are no Japanese or US events

Upcoming Key Events

Tuesday (August 15)

- 8:30 US Core Retail Sales. Estimate 0.3%

- 8:30 US Retail Sales. Estimate 0.4%

*All release times are GMT

*Key events are in bold

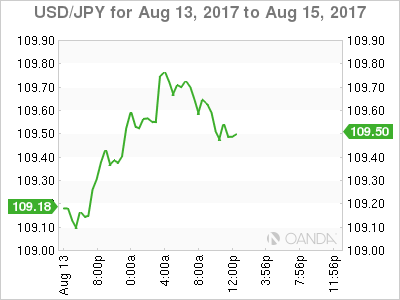

USD/JPY for Monday, August 14, 2017

USD/JPY August 14 at 11:05 EDT

Open: 109.18 High: 109.80 Low: 109.05 Close: 109.60

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 106.28 | 107.49 | 108.69 | 110.10 | 110.94 | 112.57 |

USD/JPY posted gains in the Asian session. The pair ticked higher in European trade but has retracted in the North American session

- 108.69 is providing support

- 110.10 is the next resistance line

Current range: 108.69 to 110.10

Further levels in both directions:

- Below: 108.63, 107.49 and 106.28

- Above: 110.10, 110.94, 112.57 and 113.55

OANDA’s Open Positions Ratios

USD/JPY ratio is showing movement towards long positions. Currently, long positions have a majority (67%), indicative of trader bias towards USD/JPY continuing to move upwards.