ForecastSTOCKS:

The European debt contagion remains front and center. Spanish and Italian short-and-long term bond yields have moderated moderated recently given the ECB looks to step in to buy’em. This shall support stocks in the short-term, but won’t solve the overriding debt and fiscal problems...kicking the can down the road. So enjoy it while it lasts; a day of reckoning will come after the initial euphoria surrounding ECB debt purchases.

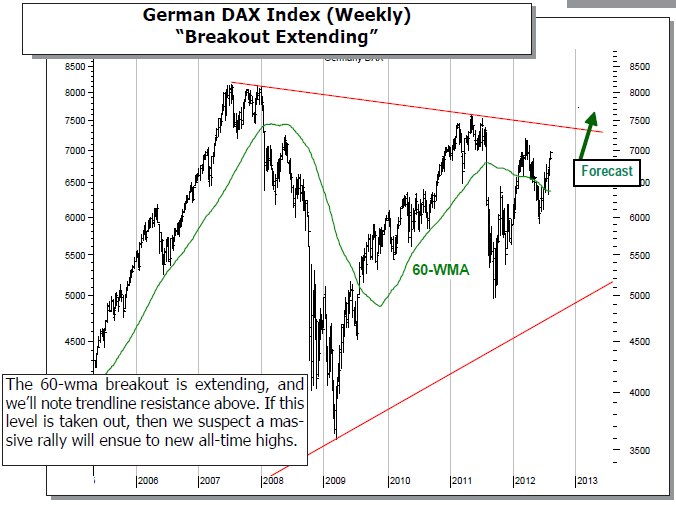

STRATEGY: The S&P 500 remains above long-term support at the 160- wma at 1209; which delineates bull/bear markets. However, the 200-dma support zone at 1266-to-1278 remains the bulls “Maginot Line,” while overhead resistance at 1340-to-1360 was extended above on Friday. This, coupled with the S&P 500 bullish weekly key reversal higher all suggest higher prices are ahead towards 1450-to-1500. Obviously this is tradable; but at that point we’d expect a larger decline to develoip.

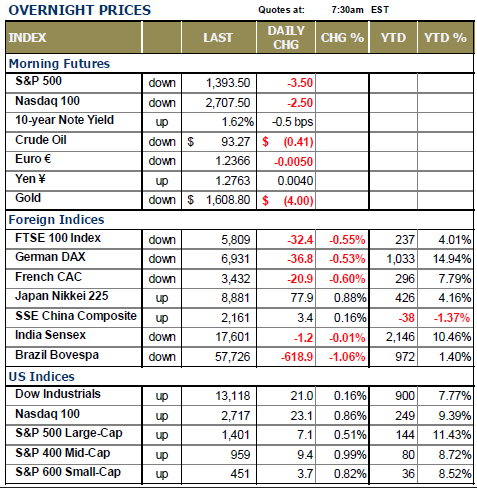

WORLD MARKETS ARE ON “PAUSE” FOR THE TIME BEING as the rally of the past three trading sessions is taking a respite. Asian bourses were for the most part higher, while European bourses opened lower and remain lower on average by -0.5%. Spanish and Italian bond yields are very modestly “mixed,” as they await any and all fresh news out of the ECB and other central banks. This is normal August trading we see nearly every year; get used to it.

Moving back to the current rally, it is progressing under the most difficult of circumstances – i.e. there is very little volume, there seems to be very little that drives stock prices sharply higher, and it is confounding the bears day-after-day. Again, they will point to the fact the rally should fail immediately; however, that doesn’t have to be the case, for it can persist for far longer than we or they can believe under the current circumstances. Our upside S&P target remains the 1450-to-1500 zone.

TRADING STRATEGY: Although we have a target projection, we are focusing upon individual issues, and the technicals behind them. Yesterday, we added to our long position by adding another 5% long position in US Steel (X) given the “double bottom” breakout and the distance below the long-term moving averages.

Today, we’ll add a 10% long position in Newmont Mining (NEM), which is far below its long-term moving average, and is setting up on bullish fashion. Moreover, NEM provides a 3.0% dividend, which is tied to the price of gold. If physical gold prices move higher, then NEM’s dividend will rise commensurately with it.

To Read the Entire Report Please Click on the pdf File Below.