On Jan 5, we issued an updated research report on Astec Industries, Inc. (ASTE). The company is poised to benefit from investment in infrastructure, introduction of new products, acquisitions as well as organic growth. However, its fourth-quarter results are likely to be hurt by product mix and holiday schedules.

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Astec Industries, Inc. (ASTE): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

Original post

Zacks Investment Research

In early October, Astec announced that it has initiated significant design upgrades to customers' plants in Georgia and Arkansas to meet wood production for wood pellets. The company identified significant design issues at the plant sites and is making necessary upgrades to achieve full production at both the sites. This affected third-quarter earnings by 59 cents in the third quarter. Adjusting for the wood pellet investment, Astec projects earnings in fourth-quarter 2017 to be slightly below third-quarter earnings.

The company remains cautious for the fourth quarter due to product mix and contract to delivery dates. Further, considering the Thanksgiving and Christmas holiday schedules, the company expects fourth quarter-2017 earnings per share to be sequentially lower. The company also stated it will not take an order for another pellet plant until it has passed the production test at the plants in Georgia and Arkansas.

The Zacks Consensus Estimate for the fourth quarter is at 45 cents, reflecting a year-over-year decline of 15.09%. Astec’s earnings in the third quarter were pegged at 47 cents per shares, after adjusting for the wood pellet plant investment. Including this, the company had suffered a loss of 12 cents per share.

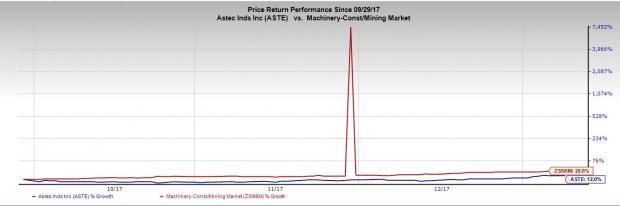

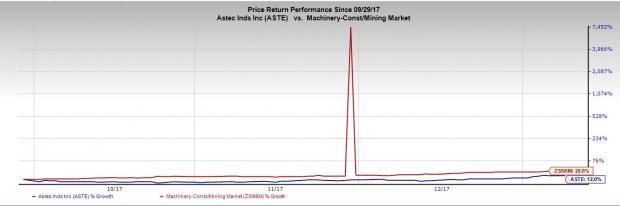

Consequently, Astec has underperformed its industry’s performance with respect to share price since October. The stock gained around 12%, while the industry recorded growth of 29.6%. However, we believe there is scope for further upside as despite the current setback on the Georgia and Arkansas plants, the long-term outlook for pellet plants remains robust. Success at these sites will put the company in a strong leadership position for orders going forward. Including the recent investment, the company has invested approximately $31 million over seven years to develop this annual $100 million business.

Further, orders have been good in the Infrastructure group and Aggregate Mining group. The Infrastructure Group’s revenues will benefit from infrastructure rebuild benefiting from the passage of the highway bill. In the Aggregate & Mining segment, there is pent-up demand for new quarries and the company will benefit as these translates into orders. Energy group continues to experience good order intake for products targeted at the construction industry along with increased order activity for water, oil and gas drilling products.

Growing part sales volume in the long term, along with competitive part sales and service sales will boost revenues in the future. Majority of customers in the United States have been experiencing a stable product market and the company remains focused on selling existing and new products. It remains optimistic regarding the infrastructure group's outlook on infrastructure-related equipment. Moreover, acquisitions remain a key piece of Astec’s growth strategy along with organic growth and targeted sales growth efforts, both in the United States and international markets.

Astec carries a Zacks Rank #3 (Hold).

Stocks That Warrant a Look

Some better-ranked stocks in the same sector include Deere & Company, Sun Hydraulics Corporation (SNHY) and Caterpillar Inc. (CAT).

Deere has delivered an average positive earnings surprise of 19.52% in the trailing four quarters. Its shares have gained 52% in the past year. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Sun Hydraulics, a Zacks Rank #1 stock, has an average positive earnings surprise of 9.58% in the trailing four quarters. Its shares have rallied 71% in the past year.

Caterpillar, has a Zacks Rank #2 (Buy) and an average positive earnings surprise of 53.06% in the trailing four quarters. Its shares have gained 75% in the past year.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

On Jan 5, we issued an updated research report on Astec Industries, Inc. (NASDAQ:ASTE) . The company is poised to benefit from investment in infrastructure, introduction of new products, acquisitions as well as organic growth. However, its fourth-quarter results are likely to be hurt by product mix and holiday schedules.

In early October, Astec announced that it has initiated significant design upgrades to customers' plants in Georgia and Arkansas to meet wood production for wood pellets. The company identified significant design issues at the plant sites and is making necessary upgrades to achieve full production at both the sites. This affected third-quarter earnings by 59 cents in the third quarter. Adjusting for the wood pellet investment, Astec projects earnings in fourth-quarter 2017 to be slightly below third-quarter earnings.

The company remains cautious for the fourth quarter due to product mix and contract to delivery dates. Further, considering the Thanksgiving and Christmas holiday schedules, the company expects fourth quarter-2017 earnings per share to be sequentially lower. The company also stated it will not take an order for another pellet plant until it has passed the production test at the plants in Georgia and Arkansas.

The Zacks Consensus Estimate for the fourth quarter is at 45 cents, reflecting a year-over-year decline of 15.09%. Astec’s earnings in the third quarter were pegged at 47 cents per shares, after adjusting for the wood pellet plant investment. Including this, the company had suffered a loss of 12 cents per share.

Consequently, Astec has underperformed its industry’s performance with respect to share price since October. The stock gained around 12%, while the industry recorded growth of 29.6%. However, we believe there is scope for further upside as despite the current setback on the Georgia and Arkansas plants, the long-term outlook for pellet plants remains robust. Success at these sites will put the company in a strong leadership position for orders going forward. Including the recent investment, the company has invested approximately $31 million over seven years to develop this annual $100 million business.

Further, orders have been good in the Infrastructure group and Aggregate Mining group. The Infrastructure Group’s revenues will benefit from infrastructure rebuild benefiting from the passage of the highway bill. In the Aggregate & Mining segment, there is pent-up demand for new quarries and the company will benefit as these translates into orders. Energy group continues to experience good order intake for products targeted at the construction industry along with increased order activity for water, oil and gas drilling products.

Growing part sales volume in the long term, along with competitive part sales and service sales will boost revenues in the future. Majority of customers in the United States have been experiencing a stable product market and the company remains focused on selling existing and new products. It remains optimistic regarding the infrastructure group's outlook on infrastructure-related equipment. Moreover, acquisitions remain a key piece of Astec’s growth strategy along with organic growth and targeted sales growth efforts, both in the United States and international markets.

Astec carries a Zacks Rank #3 (Hold).

Stocks That Warrant a Look

Some better-ranked stocks in the same sector include Deere & Company (NYSE:DE) , Sun Hydraulics Corporation (NASDAQ:SNHY) and Caterpillar Inc. (NYSE:CAT) .

Deere has delivered an average positive earnings surprise of 19.52% in the trailing four quarters. Its shares have gained 52% in the past year. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Sun Hydraulics, a Zacks Rank #1 stock, has an average positive earnings surprise of 9.58% in the trailing four quarters. Its shares have rallied 71% in the past year.

Caterpillar, has a Zacks Rank #2 (Buy) and an average positive earnings surprise of 53.06% in the trailing four quarters. Its shares have gained 75% in the past year.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Astec Industries, Inc. (ASTE): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

Original post

Zacks Investment Research