Wal-Mart Stores (NYSE:WMT)

Consumer Discretionary - Food & Staples Retailing | Reports February 21, Before Market Opens

Key Takeaways

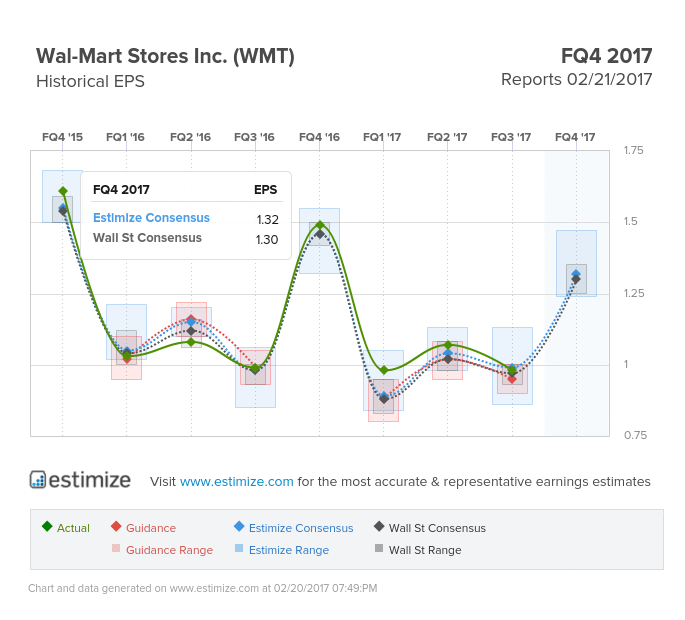

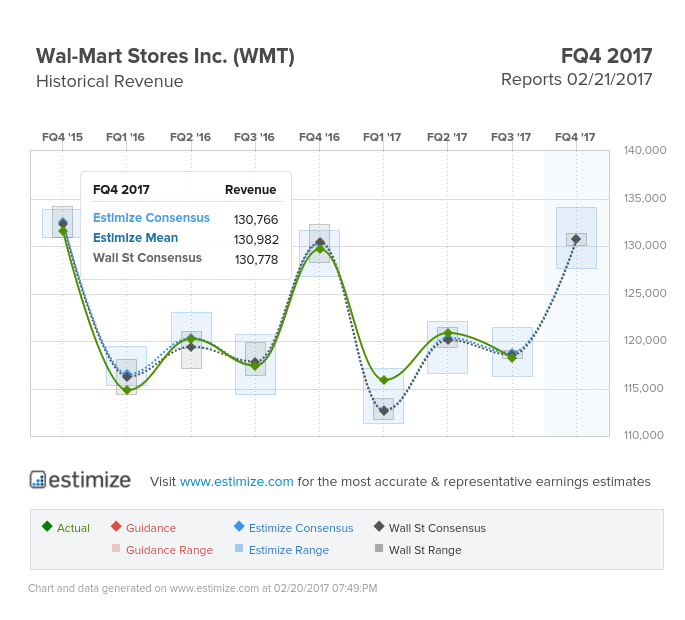

- The Estimize consensus is calling for earnings per share of $1.32 per share on $130.77 billion in revenue, 2 cents higher than Wall Street on the bottom line but $10 million lower on the top

- Walmart looks to combat ongoing threats from Amazon (NASDAQ:AMZN) by modernizing customer’s in-store experience and expanding the ecommerce platform

- Trump’s rhetoric surrounding immigration and a border tax would severely impact Walmart’s earnings power in the future.

Walmart prepares to announce its fiscal fourth quarter earnings tomorrow before the market opens. Analysts at Estimize expect the retail giant to turn a profit of $1.32 per share, reflecting an 11% drop from the same period a year ago. That estimate declined by 2% in the past 3 months despite a streak of beating analysts estimates for 3 consecutive quarters. Revenue is forecasted to increase by 1% to $130.77 billion, marking a four continuous quarters of positive comparisons. As with many very large companies, the stock doesn’t react during earnings season as the level of surprise in a report usually falls in very narrow range.

In the past 6 months shares of Walmart tumbled about 5.5% owing to Trump’s rhetoric surrounding immigrant workers and a border tax, both of which would severely hamper financial performance. Walmart currently employs 2.3 million associates worldwide, many of which hold an immigrant status, while also offering everyday low prices, largely due to overseas production and manufacturing. Any comments or insights on the new administration’s impact on future quarterly results will break investors historically indifference to an earnings report.

Otherwise, Walmart continues to work tirelessly to modernize its brick and mortar stores and expand the online platform. The acquistion of Jet.com in the past 6 months should theoretically close the gap on Amazon’s dominance in online retail. But most analysts don’t believe the combination of Walmart and now Jet Airways Ltd (NS:JET) will make any meaningful progress at catching Amazon.

On a constant currency basis, ecommerce sales grew 20.6% with gross merchandise value up 16.8% in the third quarter, both reflecting a continued acceleration from previous quarters. This contributed to a 2.5% increase in domestic Walmart sales while international volume decreased by nearly 5%. The combination of macroeconomic volatility, weaker brand recognition overseas and currency headwinds play a considerable role in lackluster overseas sales, As for Sam’s Club, Walmart’s wholesale arm, net sales grew 1.1% to $14.27 billion from $14.08 billion with comp sales up 100 basis points.

Walmart’s biggest advantage over Amazon and other online retailer is its expansive grocery and fresh food offerings. Walmart’s are often considered one stop shops for families to do their weekly grocery shopping and to pick up anything else they might need. The adoption of these services amongst online retailers have yet to gain traction. Amazon of course opened up its first grocery store in Seattle that will eventually pose a problem for Walmart down the road. In the meantime stores like, Walmart, Target Corporation (NYSE:TGT) and Costco (NASDAQ:COST) hold the upper hand in this segment.

Original post