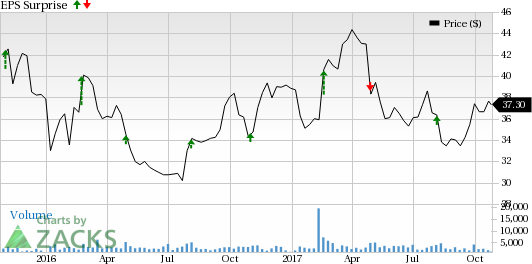

Cooper Tire & Rubber Co. (NYSE:CTB) is set to report third-quarter 2017 results, after market close on Oct 30. Last quarter, the tire manufacturer delivered an earnings beat of 14.9%

In fact, the company beat estimates thrice and missed once in the trailing four quarters, with an average positive earnings surprise of 8.1%.

Let us see, how things are shaping up for this announcement.

Factors Influencing This Quarter

Cooper Tire continues to develop great products with superior design and functionality in order to satisfy market demand in all regions. In second-quarter 2017, Americas Tire Operations registered net sales of $615 million, reflecting a decrease of 6%. In the third quarter, the Zacks Consensus Estimate for net sales from Americas Tire Operations is $683 million. Notably, in 2016, Americas Tire Operations accounted for about 85% of revenues, whereas the International Tire Operations segment accounted for 15% of revenues.

In second-quarter 2017, International Tire Operations registered a 22.4% rise in revenues to $151 million. In the third-quarter, the Zacks Consensus Estimate for net sales from International Tire Operations is $153 million.

For 2017, Cooper Tire expects unit volume growth in the International segment and in Latin America to improve. Unit volume in the United States is projected to be in line with the industry in the second half of 2017.

Earnings Whispers

Our proven model does not conclusively show that Cooper Tire is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here, as you will see below.

Zacks ESP: Cooper Tire has an Earnings ESP of +3.25% as the Most Accurate estimate and the Zacks Consensus Estimate are currently pegged at 89 cents and 86 cents, respectively. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Currently, Cooper Tire has a Zacks Rank #4 (Sell).

We caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks to Consider

Here are a few other stocks in the auto industry you may consider, as our model shows that they have the right combination of elements to post an earnings beat this quarter.

Dorman Products, Inc. (NASDAQ:DORM) has an earnings ESP of +3.05% and a Zacks Rank #3. The company is expected to report third-quarter 2017 financial results on Oct 27. You can see the complete list of today’s Zacks #1 Rank stocks here.

Horizon Global Corporation (NYSE:HZN) has an earnings ESP of +5.82% and a Zacks Rank #3. The company’s third-quarter 2017 financial results are expected to release on Oct 31.

Meritor, Inc. (NYSE:MTOR) has an earnings ESP of +2.13% and a Zacks Rank #1. The company’s third-quarter 2017 financial results are expected to release on Nov 15.

Zacks’ Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Meritor, Inc. (MTOR): Free Stock Analysis Report

Horizon Global Corporation (HZN): Free Stock Analysis Report

Dorman Products, Inc. (DORM): Free Stock Analysis Report

Cooper Tire & Rubber Company (CTB): Free Stock Analysis Report

Original post