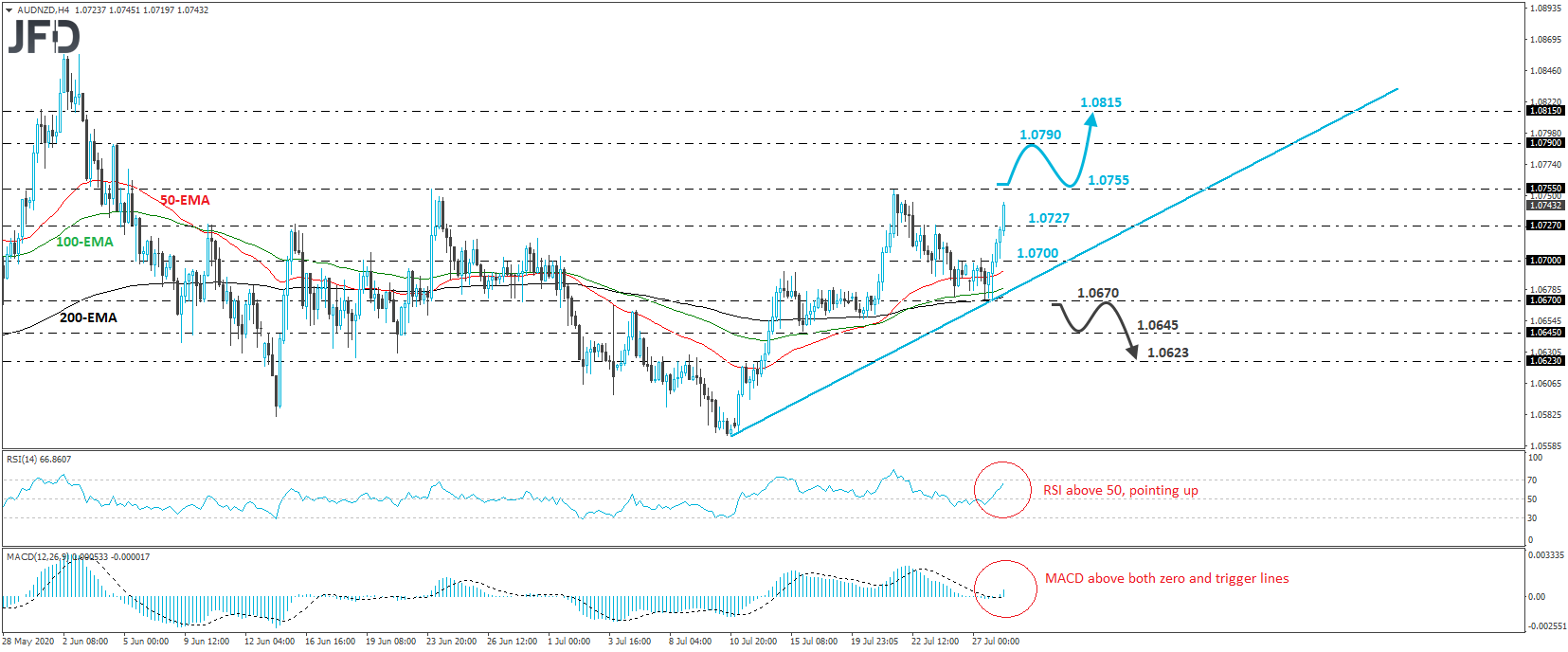

AUD/NZD has been in a rally mode since yesterday, when it hit support near the 1.0670 barrier, thereby allowing us to draw a tentative upside support line from the low of July 10th. With that in mind, and also considering that the rate is also trading above all three of our moving averages on the 4-hour chart, we would consider the near-term outlook to be positive for now.

However, in order to get confident on larger bullish extensions, we would like to see the rate emerging above the 1.0755 barrier, which is defined as a resistance by the highs of June 24th and July 21st. Such a move would confirm a forthcoming higher high and may initially pave the way towards the 1.0790 area, marked by the high of June 4th. Another break, above 1.0790, may encourage the bulls to push the action towards the 1.0815 obstacle, which is near the high of June 1st.

Shifting attention to our short-term oscillators, we see that the RSI stands above 50, points up, and looks to be heading towards the 70 line. The MACD lies above both its zero and trigger lines, pointing north as well. Both indicators detect upside speed and support the notion for some further near-term advances in this exchange rate.

In order to abandon the bullish case and start examining whether the bears have gained the upper hand, we would like to see a decisive dip below 1.0670. The pair would already be below the aforementioned upside support line and thus, the bears may dive towards the 1.0645 zone, near the low of July 15th, the break of which may allow more declines, perhaps towards the 1.0623 area, marked by the inside swing high of July 13th.