The July ODAC meeting voted 16:0 (plus a statistical abstention) that an imaging test for clear cell renal carcinoma would be clinically useful. Wilex meets the FDA in September to discuss a Phase III imaging trial design for Redactane. In August, Wilex AG (WL6.DE) undertook a €23.9m equity issue.

This enables repayment of the €7.5m dievini loan plus €0.27m interest as equity and generates €16.1m cash. Following the $17.5m cash in July for Rencarex US rights plus undisclosed milestones, Wilex seems funded well into 2014 on a yearly cash use of €20-24m. Phase III Rencarex data is due Q4.

Discussing the principle, not the product

The Oncology Drugs Advisory Committee (ODAC) met on 25 July to decide if a hypothetical imaging agent to identify clear-cell renal cell carcinoma (ccRCC, about 85% of cases) would “speak for itself” and be clinically relevant given that all tumours >3cm are removed anyway. Redectane was not discussed but its images were used to illustrate the hypothetical agent.

On the basis that the putative agent discriminated between ccRCC and other renal masses, the vote was 16:0 (the statistician abstained) in favour. Renal biospy was seen as unreliable, not a gold standard and less used clinically so imaging could be a good alternative. A confirmatory Phase III for Redactane is needed but its design needs discussion with the FDA. A meeting is scheduled for September but agreement may be some months off.

Cash boost

Wilex’s annual cash need after sales income and costs is estimated at €20-24m. Before July 2012, Wilex raised about €23.2m via an equity issue of €9.8m and $17.5m (€13.4m) from Prometheus as part-payment for the Rencarex US rights. The rights issue and private placement completed on 24 August adds 6,460,544 new shares issued at €3.70 (€23.9m). This is at a 4.1% discount to the average end of July price.

As part of the issue, the dievini Hopp BioTech loan of €7.5m plus interest of €0.27m will be settled in equity. This leaves net €16.1m in new cash. Our estimate pre-rights was of year-end cash of €6.7m. This leaves the UCB loan of €2.5m and about €23m cash at the year end. With ongoing revenues and possible Rencarex milestones ($2.5m plus undisclosed amounts), Wilex is funded well into 2014.

Valuation: Priced in data

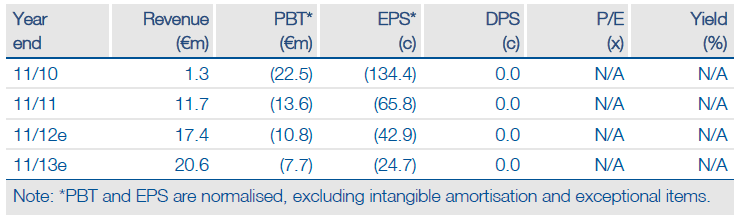

Our indicative valuation for Wilex is €207m, or €6.55/share. The value of some technologies (like ADC) is not included but could be significant. A Mesupron deal, with a significant fee, is expected in 2013 after good trend data was seen in both the pancreatic and breast cancer studies.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Wilex ODAC: Rights Issue And Private Placement

Published 08/30/2012, 03:37 AM

Updated 07/09/2023, 06:31 AM

Wilex ODAC: Rights Issue And Private Placement

Right on ODAC

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.