Banks constitute a major part in the broad Finance sector. Recent developments in the banking sector, including 2017 capital plan approval for all participating banks in the annual stress test depicting financial stability, Fed interest rate hikes and the approval of Financial Choice Act, are driving factors for investors to add banking stocks to their portfolio. Therefore, based on strong fundamentals and solid long-term growth opportunities, Southside Bancshares, Inc. (NASDAQ:SBSI) is one such stock.

Southside Bancshares has been witnessing upward estimate revisions for the last 30 days, reflecting analysts’ optimism about its future prospects. The Zacks Consensus Estimate for 2017 and 2018 moved up around 2.8% and 5.8%, respectively.

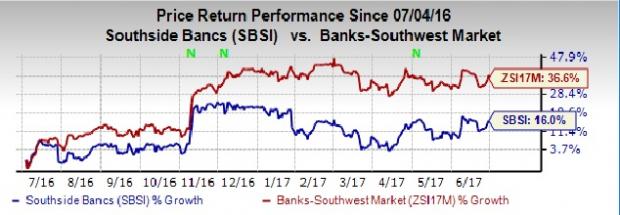

Further, shares of this Zacks Rank #2 (Buy) stock gained 16.0% over the last one year compared with 36.6% growth recorded by the Zacks categorized Southwest Banks industry.

Notably, Southside Bancshares has a number of other aspects that make it an attractive investment option.

Why Southside Bancshares is an Attractive Buy Now

Revenue Growth: Southside Bancshares continues to make steady progress toward improving its top line. Also, the company’s projected sales growth (F1/F0) of 20.35% (as against the nil industry average) indicates constant upward momentum in revenues.

Superior Return on Equity (ROE): Southside Bancshares’s ROE of 10.19%, as compared with the industry average of 9.90%, highlights the company’s commendable position over its peers.

Stock is Undervalued: Southside Bancshares has a P/E ratio and P/B ratio of 16.1x and 1.93x compared to the S&P 500 average of 18.9x and 3.17x, respectively. Based on these ratios, the stock seems undervalued.

Other Stocks to Consider

BOK Financial Corporation (NASDAQ:BOKF) has been witnessing upward estimate revisions for the last 60 days. Over the last one year, the company’s share price has been up more than 36%. It currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comerica Incorporated (NYSE:CMA) has been witnessing upward estimate revisions for the last 30 days. Additionally, the stock soared nearly 80%, over the past one year. It currently has a Zacks Rank #2.

BancFirst Corporation (NASDAQ:BANF) has been witnessing upward estimate revisions for the last 30 days. Also, the company’s shares have risen nearly 61.5%, over the last one year. It holds a Zacks Rank #2, at present.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Comerica Incorporated (CMA): Free Stock Analysis Report

BOK Financial Corporation (BOKF): Free Stock Analysis Report

BancFirst Corporation (BANF): Free Stock Analysis Report

Southside Bancshares, Inc. (SBSI): Free Stock Analysis Report

Original post