Until now, the 2013 stock market rally has clearly been led by the Dow Jones Industrial Average, while the Nasdaq Composite has lagged behind considerably.

But since the recovery off the April 18 “swing lows” in the broad market, the Nasdaq has climbed 3.3%, while the Dow has gained only 0.9% during the same period.

Is this sudden display of relative strength in the Nasdaq only a short-term aberration, or is it the start of new leadership in the stock market?

It’s too early to know for sure. However, if funds have indeed begun rotating into the Nasdaq, it would be a bullish signal for the overall market.

This type of sector rotation would point to an increasing appetite for risk among banks, mutual funds, hedge funds, and other market-moving institutional players. This is because the tech-heavy Nasdaq is generally considered to be more “risky” then deploying funds in the “old school” Dow. Of course, the potential rewards for investing and trading in the Nasdaq are typically much greater than the Dow as well.

Because our momentum-based strategy for swing trading stocks focuses primarily on small to midcap stocks (many of which are traded on the Nasdaq), we would obviously welcome the next phase of the market rally being driven by the Nasdaq.

Presently, we are long two individual stocks in our model trading portfolio of The Wagner Daily stock picking newsletter. Both of these leading stocks rallied to close at fresh all-time highs yesterday, even though the Nasdaq was unchanged (and the Dow declined slightly).

Celldex Therapeutics (CLDX) is now showing an unrealized gain of 20% since our April 9 buy entry. To see a chart highlighting our initial entry point into CLDX, go here (when CLDX was only up 8.9% at that time).

Our other current stock holding is LinkedIn (LNKD), which is presently up 7.5% since our April 9 swing trade entry.

CLDX and LNKD, both of which closed at new record highs in each of the past two days, are great examples of how leadership stocks can really start generating swift and substantial returns when the Nasdaq gets in gear.

It’s not only stocks that benefit from a strengthening Nasdaq. The right industry sector ETFs can show leadership and relative strength too.

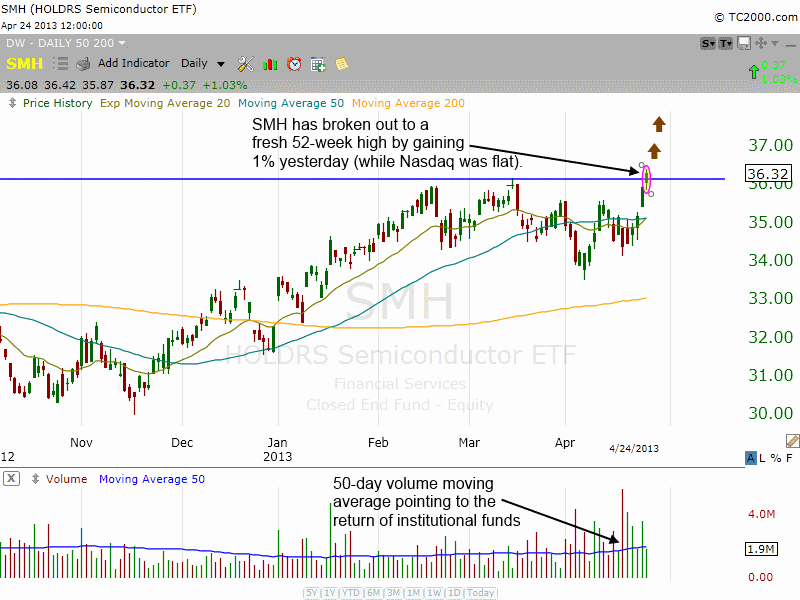

Market Vectors Semiconductor ETF (SMH), which is currently showing an unrealized gain of 3% since buy entry, nicely fits the bill.

Despite the Nasdaq Composite being completely flat yesterday, SMH still gained 1.0% on the day. More importantly, the ETF broke out above a 3-month base of consolidation and closed at a fresh 52-week high. Whenever a stock or ETF advances versus a flat day in the broad market, or jumps to a new high ahead of a broad-based index, it is a clear sign of relative strength (and something you want in your portfolio).

Yesterday’s breakout to a new 52-week high in SMH is shown on the daily chart below:

In case you missed it, we initially made a bullish call on SMH (and the semiconductor sector) nearly a month ago.

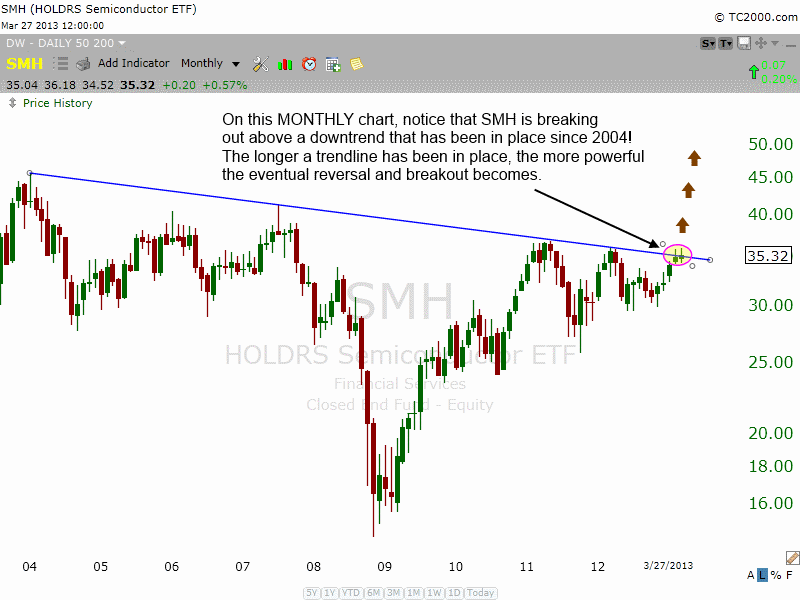

At that time, we liked that SMH was breaking out above resistance of a nine-year downtrend line, which was only apparent by looking at the long-term monthly chart interval of the ETF.

Below is the same monthly chart of SMH we pointed out on March 28, back when SMH was still in consolidation mode (trading below its 52-week high):

Now that SMH has finally broken out to a new 52-week high, the breakout above the nine-year downtrend line shown above is becoming confirmed.

Because this trend reversal is of such a long-term nature, it may provide swing traders with many stock and ETF buying opportunities in the semiconductor sector; not only in the near-term, but in the intermediate-term as well.

In case you are new to momentum swing trading, it’s important to understand that stocks and ETFs breaking out to new 52-week high usually provide us with our largest gains because these equities have a complete lack of overhead price resistance (which would otherwise be created by sellers who bought a higher price).

What is your assessment of the apparent rotation into the Nasdaq? Are you starting to see stronger moves in your stocks as well (AAPL doesn’t count)?

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why Relative Strength In The Nasdaq Can Make You More Profitable

Published 04/25/2013, 04:13 AM

Updated 07/09/2023, 06:31 AM

Why Relative Strength In The Nasdaq Can Make You More Profitable

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.