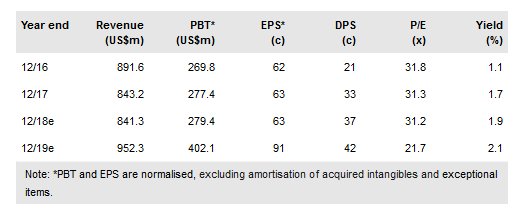

FY17 results were characterised by a record level of gold sales and of dividend payouts to shareholders. Overall, production attributable to Wheaton Precious Metals Corp (NYSE:WPM) in FY17 was 28.6Moz Ag and 355koz Au cf guidance of 28Moz Ag and 340koz Au and our prior forecast of 28.5Moz Ag and 343koz Au. Results for Q4 were notable for the close correlation of production and sales, demonstrating the traditional ‘flush through’ effect in the final quarter of the year. Financial results were similarly better than our forecasts (see Exhibit 1, overleaf), partly on account of an increase in gold production compared to Q317, but also on account of a material increase in other income. Nevertheless, excluding this item, Q4 net earnings still exceeded our forecasts by 3.6%.

Corporate development entering next phase

As at 31 December 2017, WPM had net debt of US$671.5m, which equated to financial gearing (net debt/equity) of 13.7% and leverage (net debt/[net debt+equity]) of 12.1%. All other things being equal, we estimate that WPM’s net debt position will have declined organically, to US$351.8m by the end of FY18 and that it will be net debt free in H219/H120. As a result, WPM reports that it is busy from a corporate development perspective, with at least six potential deals that could close within the next 12 months and US$2-3bn of deals that could close within 12-24 months, approximately evenly split between ‘development and expansion’ projects and corporate ‘balance sheet repair’.

To read the entire report Please click on the pdf File Below: