NextEra Energy, Inc. (NYSE:NEE) is scheduled to release fourth-quarter 2017 results before the opening bell on Jan 26. Last quarter, this utility reported a positive earnings surprise of 5.7%. Let’s see how things are shaping up prior to this announcement.

Factors at Play

Despite the ill-effects of Hurricane Irma, that hampered the financial performance of many utilities, the economy of Florida remains sturdy, supporting ongoing customer growth in the last two quarters. This can be attributed to new construction and additional building permits. Overall, Florida's economy continues to flourish and could result in more customer additions.

NextEra Energy anticipates lower growth in the fourth quarter due to refinancing initiatives. Further it anticipates the favorable economic conditions to drive NPV savings up to $150 million on a cash basis but with simultaneous reduction in net income.

Despite an expected drop in net income, management believes that it is well positioned to achieve 6-8% annual adjusted earnings per share growth off 2016 base.

Earnings Whispers

Our proven model does not conclusively show that NextEra Energy is likely to beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: The Most Accurate estimate is at $1.29 per share while the Zacks Consensus Estimate is pegged higher at $1.30 per share resulting in Earnings ESP of -1.15%.

Zacks Rank: NextEra Energy carries a Zacks Rank #3. Though the Zacks Rank #3 increases the possibility of a beat, an ESP of -1.15% makes it unlikely this season.

We caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

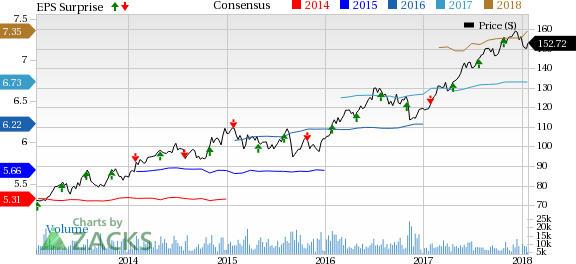

NextEra Energy, Inc. Price, Consensus and EPS Surprise

Stocks to Consider

Instead, here are a few players from the sector that have the right combination of elements to post an earnings beat this quarter.

CenterPoint Energy, Inc. (NYSE:CNP) has an Earnings ESP of +3.75% and a Zacks Rank #2. It is anticipated to report fourth-quarter 2017 earnings on Feb 22. You can see the complete list of today’s Zacks #1 Rank stocks here.

BCE, Inc. (TO:BCE) has an Earnings ESP of +2.13% and a Zacks Rank #2. The company is expected to report fourth-quarter 2017 earnings on Feb 8.

UGI Corporation (NYSE:UGI) has an Earnings ESP of +3.83% and a Zacks Rank #2. It is expected to report first-quarter fiscal 2018 earnings on Jan 31.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

UGI Corporation (UGI): Free Stock Analysis Report

BCE, Inc. (BCE): Free Stock Analysis Report

Original post

Zacks Investment Research