Crude prices, which reached $110 per barrel in mid-2014, fell to a 12-year low of $26.21 in February as investors panicked over the oversupplied market. The commodity’s collapse threatened the industry’s creditworthiness by hurting cash flows, drying up liquidity and contracting producers’ profit margins.

However, indications of easing supply helped oil prices to rebound some 90% since then and took the commodity past $50.

The surge in the benchmark crude was driven by supply outages in Nigeria, Libya, Venezuela and Canada – countries that hold some of the world’s major sources of crude.

The upward pressure in oil prices also reflect the U.S. Energy Department's recent inventory releases that show crude stockpile builds turning into draws.

Q2: Best Quarter for Oil in 7 Years

Unlike the previous few quarters, second-quarter 2016 turned out to be a rather good one with crude advancing more than 26% sequentially -- the best quarterly percentage gain in seven years. West Texas Intermediate (WTI) crude futures during the Apr–Jun 2016 period hovered mostly between $40 and $50 per barrel.

All's Not Well for Oil

Despite oil’s massive recovery since February, its price is still under $50 – about half the level of two years ago – and far below the breakeven price for many energy companies. Therefore, the commodity is not yet out of the woods.

Even the industry, which is cutting deeper, seems to think so. Companies around the world continue to slash jobs, defer/cancel projects worth billions of dollars and renegotiate contracts with suppliers to help protect their balance sheets.

Consequently, things are looking bleak for the upcoming Q2 earnings season. Per our Earnings Trends report, the Oil/Energy sector’s earnings are expected to crash 77.1% from second-quarter 2015 levels, while the top line is likely to show a drop of 25.7%.

Oilfield Services Set to Kick Off Earnings Season

The oil services companies – providers of technical products and services to drillers of oil and gas wells – kicks off what is expected to be another tough earnings season for U.S. energy firms.

With U.S. rig count falling to record levels, oilfield services players have braced themselves for a prolonged period of contraction in drilling activity. Moreover, as the 2016 budget cycle represents a further fall in upstream players’ capital spending, product and service pricing will suffer. This, coupled with project delays and job cancellations, is likely to translate into margin contraction. Needless to say, profitability levels will suffer.

Therefore, notwithstanding the nice bump in oil prices, it will take some time for service providers to translate it into earnings gain.

Get Ready for 5 Big Releases Tomorrow

There are five such companies expected to come up with second-quarter numbers on Thursday. Let’s take a look at how things are shaping up at their end.

The largest U.S. oil services company by market value, Schlumberger Ltd. (NYSE:SLB) is expected to report second-quarter 2016 results before the opening bell. Following Halliburton’s earnings release today, Schlumberger will become the second member of the ‘big 4 oil service companies’ to come out with quarterly numbers.

In the first quarter of 2016, this Paris-based technology and project management supplier to the worldwide energy industry reported weaker-than-expected earnings on challenging market conditions –– both in terms of pricing and activity.

An earnings beat might be tough for Schlumberger this time around too.

For the quarter to be reported, Schlumberger has an Earnings ESP of -4.55%, while it carries a Zacks Rank #3 (Hold). (Read more: Will Schlumberger Stock Disappoint on Q2 Earnings?)

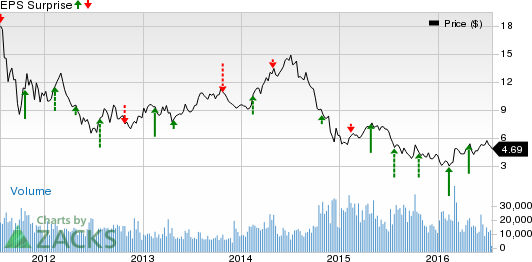

Headquartered in Houston, TX, Oceaneering International Inc. (NYSE:OII) is set to report second-quarter 2016 results after the closing bell. The company manufactures and provides deepwater equipment and services to the global oil and gas industry.

Estimates have been falling lately prior to Oceaneering’s second-quarter earnings release. The Zacks Consensus Estimate of 28 cents declined nearly 7% over the past 30 days. Oceaneering carries a Zacks Rank #3 and has an Earnings ESP of -14.29%, again making it difficult to conclusively predict an earnings beat.

Coming to earnings surprises, the company has a good track. It surpassed/met estimates in three of the last four quarters at an average rate of 0.36%.

Precision Drilling Corp. (NYSE:PDS) is another oilfield services provider to report second-quarter results tomorrow – this time before the market opens.

Headquartered in Calgary, Alberta, Precision supplies its customers in the oil and gas industry with drilling, completion and production services.

We do not expect Precision to beat earnings expectations as our proven model shows that it does not have the right combination the two key components. While a Zacks Rank #2 (Buy) increases the predictive power of ESP, the company’s ESP of -5.00% makes surprise prediction difficult. Also, the Zacks Consensus Estimate of a loss of 20 cents was revised downward by 5% over the last seven days.

The company, however, has an excellent track of earnings surprises. It beat estimates in each of the last four quarters at an average rate of 48.42%.

Basic Energy Services Inc. (NYSE:BAS) – a top provider of well servicing rigs – will come up with second-quarter results post market close.

Over the last 30 days, the Zacks Consensus Estimate for the company deteriorated 6%to a loss of $1.44 per share for the upcoming release. The Fort Worth, TX-based Basic Energy has an Earnings ESP of -1.39% and carries a Zacks Rank #3. Though a Zacks Rank #3 increases the predictive power of ESP, a negative ESP makes surprise prediction difficult.

Basic Energy delivered positive surprises in two of the last four quarters, with an average positive surprise of 0.22%.

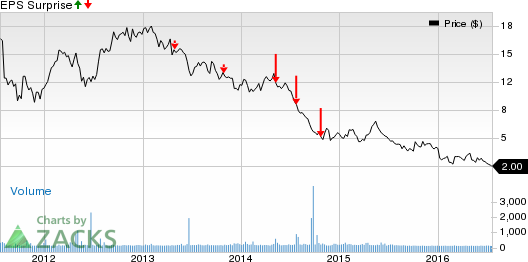

Petroleum Geo-Services ASA (OTC:PGSVY) , a Norway-based marine geophysical service provider to the oil and gas industry, will release second-quarter results before the opening bell.

Our model does not indicate that the company is likely to beat on earnings this time around. This is because Petroleum Geo-Services is a Zacks Rank #3 stock but has an Earnings ESP of 0.00%.

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

OCEANEERING INT (OII): Free Stock Analysis Report

BASIC EGY SVCS (BAS): Free Stock Analysis Report

PRECISION DRILL (PDS): Free Stock Analysis Report

PETROLEUM GEO (PGSVY): Free Stock Analysis Report

Original post

Zacks Investment Research