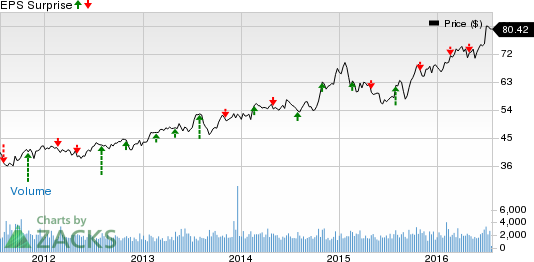

IDACORP Inc. (NYSE:IDA) will release second-quarter 2016 financial results before the market opens on Jul 28. Last quarter, this electric utility came out with a negative earnings surprise of 7.27%. Let’s see how things are shaping up at the company prior to this announcement.

Factors to Consider

In the second quarter of 2016, IDACORP is expected to see an increase in its customer base on the back of improving service territory economies. Manufacturing activities have picked up in its regions of operations leading to higher utility demand.

Also, an early redemption of bonds will generate a net tax benefit of $5.5 million for the company in the second quarter.

Weather too will play an important role during the second quarter. Historically, the second and the third are its biggest quarters because of the coming together of cooling load and irrigation load.

Earnings Whispers

Our proven model does not conclusively show that IDACORP is likely to beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) for this to happen. But, that is not the case here as you will see below.

Zacks ESP: The Most Accurate estimate is pegged at $1.02 while the Zacks Consensus Estimate is $1.09, resulting in an Earnings ESP of -6.42%.

Zacks Rank: Though IDACORP’s Zacks Rank #3 increases the predictive power of the ESP, its -6.42% ESP makes a beat unlikely this quarter.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are a few stocks in the utility space worth considering as our model shows that thy have the right combination of elements to beat estimates this quarter:

DTE Energy (NYSE:DTE) has an Earnings ESP of +2.2% and a Zacks Rank #2. It is expected to report earnings on Jul 26.

Avista Corp. (NYSE:AVA) has an Earnings ESP of +2.33% and a Zacks Rank #2. It is scheduled to report earnings on Aug 3.

Pattern Energy Group Inc. (NASDAQ:PEGI) has an Earnings ESP of +100.0% and a Zacks Rank #2. It is scheduled to report earnings on Aug 8.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

DTE ENERGY CO (DTE): Free Stock Analysis Report

IDACORP INC (IDA): Free Stock Analysis Report

AVISTA CORP (AVA): Free Stock Analysis Report

PATTERN ENERGY (PEGI): Free Stock Analysis Report

Original post

Zacks Investment Research