The Western Union Company (NYSE:WU) has recently renewed its agreement with Rite Aid Corporation (NYSE:RAD) .

Earlier, Western Union and Rite Aid had signed a multi-year agreement to expand the availability of Western Union Money Transfer services to 930 Rite Aid stores. The collaboration with Right Aid has enabled Western Union to significantly grow its agent network as the former has stores across the United States. Concurrently, Right Aid has been able to increase store traffic by attracting customers with Western Union services.

Repeated renewal of agreements between the two companies reflects the successful relationship of more than two decades that has supported both to jointly cater to the transactional needs of the Right Aid customers. The collaboration has also delighted the customers with premium after sales service.

Consumers will now be able to avail Western Union Money Transfer services at Rite Aid locations to send and receive money within minutes across the United States as well as worldwide to over 200 countries and territories. Also, customers will now have the provision of buying money orders and paying their bills at Rite Aid locations throughout the country.

Western Union is optimistic about the agreement renewal and expects further advancement of its cross-border platform. The deal will also allow the insurer to enhance the speed, ease and reliability of its money transfer services.

Right Aid remains focused on its customers’ daily requirements along with their health and wellness needs. Hence, this extended collaboration with Western Union will enable the company to create substantial value for its customers.

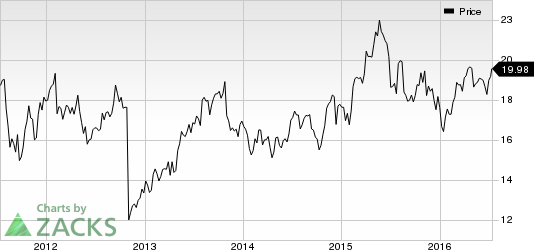

Western Union is set to release its second quarter earning on August 3. The Zacks Consensus Estimate that is currently pegged at 40 cents for the second quarter, which reflects a year-over-year decline of 2.3%. However, our proven model does not conclusively show that the company will beat earnings this quarter. This is because the insurer carries a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%.

Stocks to Consider

Some better-ranked stocks from the financial transaction services industry are WEX Inc. (NYSE:WEX) and Qiwi Plc (NASDAQ:QIWI) Both these stocks sport Zacks Rank #1 (Strong Buy).

WEX INC (WEX): Free Stock Analysis Report

RITE AID CORP (RAD): Free Stock Analysis Report

WESTERN UNION (WU): Free Stock Analysis Report

QIWI PLC-ADR (QIWI): Free Stock Analysis Report

Original post

Zacks Investment Research