From start to finish, the coming week will have a heightened focus on employment. Labor Day weekend in a presidential election year provides the obvious backdrop. Stubbornly high unemployment and sluggish economic growth underscore the issue of greatest concern.

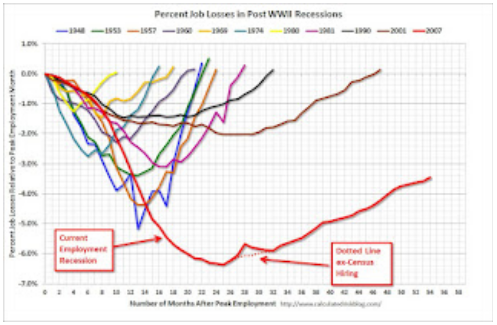

This popular chart from Calculated Risk shows the nature of this recovery, described in terms of employment. So little accomplished, and so far, so far to go....

What are the solutions? Republicans contend that Obama policies, even augmented by aggressive Fed action, have failed. Expect the Democrats to use their convention to blame Congress.

The week culminates with the monthly employment situation report for August. It is more important than ever, since most see the data as significant in determining the Fed's next move.

I'll offer some of my own expectations in the conclusion, but first let us do our regular review of last week's news.

Background on "Weighing the Week Ahead"

There are many good sources for a list of upcoming events. With foreign markets setting the tone for US trading on many days, I especially like the comprehensive calendar from Investing.com. There is also helpful descriptive and historical information on each item.

In contrast, I highlight a smaller group of events. My theme is an expert guess about what we will be watching on TV and reading in the mainstream media. It is a focus on what I think is important for my trading and client portfolios.

This is unlike my other articles, where I develop a focused, logical argument with supporting data on a single theme. Here I am simply sharing my conclusions. Sometimes these are topics that I have already written about, and others are on my agenda. I am putting the news in context.

Readers often disagree with my conclusions. Do not be bashful. Join in and comment about what we should expect in the days ahead. This weekly piece emphasizes my opinions about what is really important and how to put the news in context. I have had great success with my approach, but feel free to disagree. That is what makes a market!

Last Week's Data

Each week I break down events into good and bad. Often there is "ugly" and on rare occasion something really good. My working definition of "good" has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially -- no politics.

- It is better than expectations.

There was very little data last week, and the news was open to varying interpretations.

- Bernanke threads the needle. The Fed Chair did better than I forecast last week, since I thought that anything less than a clear policy statement would disappoint markets. He did enough hinting to satisfy, while making it clear that more data is needed. Of the many discussions of his speech, I want to emphasize those most helpful for investors. I like the discussion in The Economist and also the interpretation from Jon Hilsenrath. For those of us who are interested in what we expect to happen, we should respect the conclusion:

Mr. Bernanke acknowledged some of the hurdles he faces, noting, "It is true that nontraditional policies are relatively more difficulty to apply," he said.

But he left little doubt that he sees the benefits of trying. "Over the past five years, the Federal Reserve has acted to support economic growth and foster job creation," he said, "and it is important to achieve further progress, particularly in the labor market."

- Rail traffic is at a four-year high (via Todd Sullivan).

- Sentiment via the AAII survey, has backed off from excessively bullish levels. On a contrarian basis, this is positive.

- ECB President Draghi skipped the Jackson Hole Symposium. The market saw this as good news as participants concluded that the ECB team was hard at work on a specific proposal for next week. We shall see about that, but the stories on this front got a positive reaction.

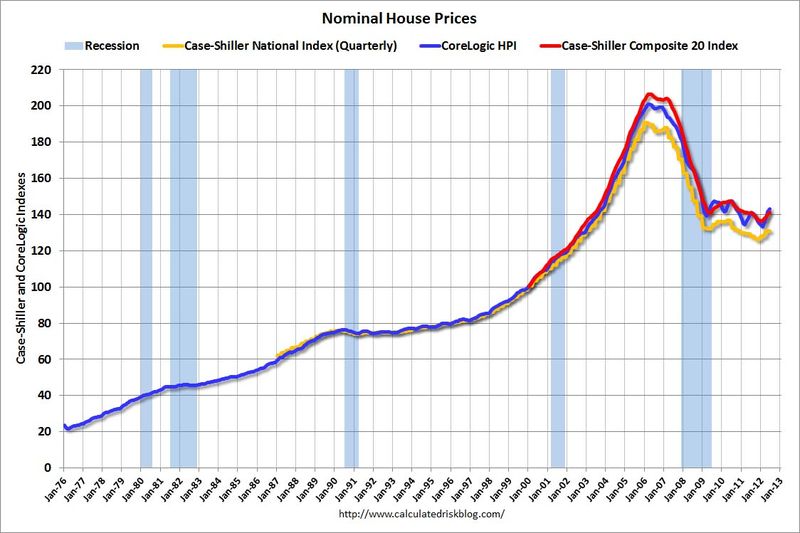

- Housing is showing strength. S&P's David Blitzer calls it a "significant turn." Still only back to the 1999 or 2000 levels in real terms, the nominal prices do show an uptick. See Calculated Risk for the expected fine analysis and several charts.

The Bad

There was negative news, but fairly modest in overall significance.

- GM idling Volt plant for four weeks, beginning September 17th. The July employment data was positively influenced because the traditional summer plant closings did not take place. This plant involves only about 1200 workers (who will receive 90% of normal pay from unemployment compensation). For those of us watching employment data, it is something to note.

- Spain continues to delay in asking for help. The market reacts negatively, since it delays the process. It is rational for Spain, since the objective is to get the best possible terms. They want to see the ECB proposal.

- The Bundesbank's Jens Weidmann is threatening to resign over expanded ECB bond buying. This is a natural response, and a good bargaining posture. Chancellor Merkel has urged him to stay on the board and make his views clear.

- More bad news on China's economic growth as the 'flash" PMI "collapses" and hits a nine-month low. We all want to get the best data on China. The flash index differs from official data. Actual consumption of key inputs may differ from either of these surveys. One key input is iron ore, so I was intrigued by the thoughtful analysis from the FT's Izabella Kaminska, Iron ore, an alternative view. There is an intriguing analysis of the data and some good charts. China watchers -- and that should be all of us -- need more reporting like this.

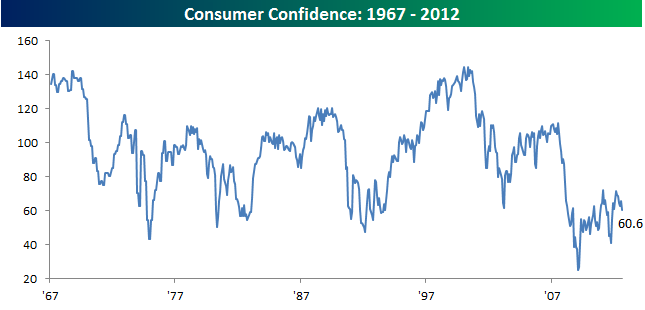

- Consumer Confidence (via the Conference Board) was weaker. Here is the long-term chart from Bespoke. The University of Michigan report was slightly better than expectations.

The Ugly

Individual investor knowledge. The SEC studied this by doing some tests with fake fund prospectuses. They discovered that investors did not even grasp the basics. Donald Marron has a good account of the study.

Meanwhile, there is an increase in day trading among individual investors.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger.

This week's award goes to Todd Sullivan, who has some great insight on employment and the economy.

His work qualifies for the Silver Bullet because so many prominent pundits have been completely wrong on this subject. He fearlessly takes on the big names like the ECRI, David Rosenberg, Nouriel Roubini, and Nassim Taleb.

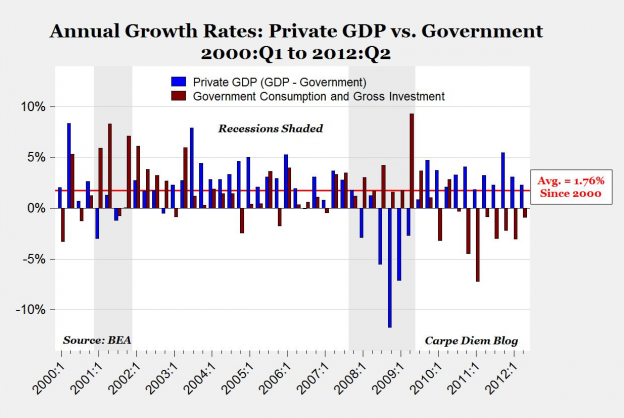

He highlights the most important aspect of the discouraging employment picture, the drag from the continuing loss of government jobs. If you view the data in terms of private employment growth, the picture is quite different.

Todd's analysis should help anyone who wants a complete picture of the sources of sluggish growth.

The Indicator Snapshot

It is important to keep the current news in perspective. My weekly snapshot includes the most important summary indicators:

- The St. Louis Financial Stress Index.

- The key measures from our "Felix" ETF model.

- An updated analysis of recession probability.

The SLFSI reports with a one-week lag. This means that the reported values do not include last week's market action. The SLFSI has moved a lot lower, and is now out of the trigger range of my pre-determined risk alarm. This is an excellent tool for managing risk objectively, and it has suggested the need for more caution. Before implementing this indicator our team did extensive research, discovering a "warning range" that deserves respect. We identified a reading of 1.1 or higher as a place to consider reducing positions.

The SLFSI is not a market-timing tool, since it does not attempt to predict how people will interpret events. It uses data, mostly from credit markets, to reach an objective risk assessment. The biggest profits come from going all-in when risk is high on this indicator, but so do the biggest losses.

The C-Score is a weekly interpretation of the best recession indicator I found, Bob Dieli's "aggregate spread.

Bob and I recently did some videos explaining the recession history. I am working on a post that will show how to use this method. As I have written for many months, there is no imminent recession concern. I recently showed the significance of this by explaining the relationship to the business cycle.

The evidence against the ECRI recession forecast continues to mount. It is disappointing that those with the best forecasting records get so much less media attention. The idea that a recession has already started is losing credibility with most observers. I urge readers to check out the list of excellent updates from prior posts.

Readers might also want to review my new Recession Resource Page, which explains many of the concepts people get wrong.

The single best resource for the ECRI call and the ongoing debate is Doug Short. This week's article, ECRI's Embarrassing Recession Call, describes the complete history, the critics, and how it has played out. The article highlights the most important economic indicators used in identifying recessions, showing that none have rolled over.

The Bonddad Blog also has a good post on this theme.

With the release of personal income, we now know the values of all four series thought to guide the NBER's recession dating decisions. While all of these series are subject to revisions, of course, as of now the simple fact is that all four rose in July, and three of the four are at post-recession records. So unless they are revised significantly downward, the simple fact is that no new recession started in July.

Our "Felix" model is the basis for our "official" vote in the weekly Ticker Sense Blogger Sentiment Poll. We have a long public record for these positions. This week we switched to neutral. We have been bullish since June 23rd, with a one-week move to neutral a month ago. These are one-month forecasts for the poll, but Felix has a three-week horizon. The ratings have moved lower, and the confidence has deteriorated from last week.

[For more on the penalty box see this article. For more on the system ratings, you can write to etf at newarc dot com for our free report package or to be added to the (free) weekly ETF email list. You can also write personally to me with questions or comments, and I'll do my best to answer.]

The Week Ahead

While there will be fewer reports this week, the news will be especially significant.

The "A List" is all about jobs:

- The monthly employment situation report (F) will be important for markets, the Fed, and the political campaign.

- Initial claims (Th) which continue to provide the most up-to-date read on jobs and the economy.

- ADP (Th) releases private employment data.

- The ECB provides more information on its bond-buying plans (Th).

- The ISM reports on manufacturing (T).

The "B List" includes three reports:

- ISM services (Th).

- Construction spending (W).

- Auto sales (W).

The Democratic convention will also provide plenty of additional discussion about jobs.

Trading Time Frame

Our trading positions continued in fully invested mode last week. Felix became more aggressive in a timely fashion, near the start of the summer rally. Since we only require three buyable sectors, the trading accounts look for the "bull market somewhere" even when the overall picture is neutral. As the tape has improved, the ratings from Felix have gotten stronger.

Felix does not try to call tops and bottoms, but keeps us on the right side of major moves. We had one "neutral" forecast about a month ago, but things never got weak enough to reduce positions. The ratings are weaker, but there are still several attractive sectors to own.

Investor Time Frame

Sources continue to highlight the overbought nature of pure dividend stocks. This week Bespoke described August returns for stocks with different yields.

Dividend investing is fine, but you must look past the dividend yield and study the earnings, earnings growth rate, cash flow, balance sheet, and payout ratio.

If you have been following our regular advice, you have done the following:

- Replaced your bond mutual funds with individual bonds;

- Sold some calls against your modest dividend stocks to enhance yield to the 10% range; and

- Added some octane with a reasonable input of good stocks.

There is nothing more satisfying than collecting good returns in a sideways market.

If you have not done so, it is certainly not too late. We have collected some of our recent recommendations in a new investor resource page -- a starting point for the long-term investor. (Comments welcome!)

Final Thoughts on Employment

I am not expecting a strong employment report. (I'll do my regular monthly preview at mid-week). Because of the expectation of Fed action, the impact of the report may be dampened. Real weakness will be seen as confirming Fed action.

It has been a confusing year, even for professionals.

Traders, according to CNBC's Bob Pisani have been under-invested and wrong throughout the year. He writes as follows:

Oh, and did I mention that 90 percent of the traders I know are underperforming the S&P 500, which is up 12 percent this year?

"There is something lurking out there ... we cannot continue to have central bank stimulation forever, with more debt layered on more debt," one trader said to me. He, too, is underperforming. "I'm long 20 percent of what I would normally be long in a market like this. I gotta own it because my neighbor owns it, that's a silly investment concept, but it's worked this year," he said.

He also notes that 90% of traders expect an imminent correction of 10%, something that he sees as a contrarian indicator.

Top strategists are also pretty bearish. Bespoke reports on the year-end price targets. Check out the full article to see how little these have changed throughout the year.

Part of the explanation is that traders and strategists both seem to have focused too much on the obvious problems and under-estimated the resolve and power of governments and central banks. Nearly every commentary on the Fed emphasizes the author's opinion of what policy should be.

Those of us who focus instead on understanding and predicting policy decisions, regardless of our personal views, have a real advantage.

This will get increasingly difficult in the weeks before the election.