Sometimes looking ahead includes understanding what has just happened. This week will emphasize housing news, but it will also include a continuing debate on the dramatic changes in policy both in the US and Europe.

Economic prospects improved greatly last week. Key policymakers have geared up to fight deflation and a potential liquidity trap.

For those of us who put aside our preferences about the upcoming election, focusing instead on the economy, the answer is clear. There is an active debate in the economic community, among those who have knowledge, analytical skill, and data. The Fed decision reflects that.

The investment community sees a different and wrongly-focused picture. It is one that has been costly in the past, and will continue to be so. This is because they rely on a bogus perception of Fed policy, something I emphasized last week. Anyone who paid attention was on the right side of the market last week, and will have a better understanding in the future.

There is not much mystery about predicting Fed moves and the market results, but it does require objectivity.

Implications for Housing

Savvy market followers are already watching the improving trends in housing. Bill McBride at Calculated Risk was bearish and authoritative on housing at the right time and for the right reasons. He earned the respect of the entire economic community and expanded his coverage aggressively and extensively. Readers should set aside an hour or so to go through the archives at Calculated Risk, emphasizing the 2012 take on housing.

You can start with this article, The economic impact of a slight increase in house prices. Follow the links from there. Do the same with this piece, linking the housing bottom and unemployment. Bringing the story up to speed we have, Analysis: Bernanke Delivered.

You will find the analysis both cogent and convincing. Your hour will be well-spent and profitable.

I'll offer some of my own expectations in the conclusion, but first let us do our regular review of last week's news.

Background on "Weighing the Week Ahead"

There are many good sources for a list of upcoming events. One source I especially like is the weekly post from the WSJ's Market Beat blog.

In contrast, I highlight a smaller group of events. My theme is an expert guess about what we will be watching on TV and reading in the mainstream media. It is a focus on what I think is important for my trading and client portfolios.

This is unlike my other articles where I develop a focused, logical argument with supporting data on a single theme. Here I am simply sharing my conclusions. Sometimes these are topics that I have already written about, and others are on my agenda. I am putting the news in context.

Readers often disagree with my conclusions. Do not be bashful. Join in and comment about what we should expect in the days ahead. This weekly piece emphasizes my opinions about what is really important and how to put the news in context. I have had great success with my approach, but feel free to disagree. That is what makes a market!

Last Week's Data

Each week I break down events into good and bad. Often there is "ugly" and on rare occasion something really good. My working definition of "good" has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially -- no politics.

- It is better than expectations.

The news last week was very good, even better than the market result.

- The new Fed policy is market-friendly in many ways. The additional investment of $40B per month in MBS securities is fresh and "unsterilized" buying. The focus on housing is constructive. Most importantly, the policy is open-ended, dependent on results rather than time. It cannot be gamed by traders or pundits.

- The German Constitutional Court delivered as expected. This sets the framework for more aggressive banking rules in Europe. It was a crucial step in the incremental process for a Eurozone solution. Those who do not see this are in denial over their incorrect forecasts. Italian and Spanish bond yields have moved dramatically lower. Italy might not even need a further bailout (via Reuters).

- Michigan consumer sentiment showed surprising strength. This is good news for employment and for consumer spending, especially since gas prices have been higher. Doug Short's chart captures the long-term patter, showing that we are back to the recent highs.

- Technical indicators remain positive according to Charles Kirk. One advantage of writing after my usual Saturday time is that I can include Kirk's weekly chart show, usually published on Sunday. I always read Charles and you should, too (small subscription required, and well worth it). The short message this week is that there is nothing yet to indicate that the rally is in jeopardy.

- Economic confidence (via Gallup) has surged.

The Bad

There was a bit of negative news.

- Chinese economic indicators weaken. See Dr. Ed. for discussion and a great chart.

- Employment growth prospects are mixed at best (via the BLS JOLTS report). See Steven Hansen's analysis and charts.

- Initial jobless claims popped to 382,000. Seasonal factors are cited, once again, but this should be recognized as bad news.

- Sea container counts are lower (via Steven Hansen). This is a good concurrent indicator.

- Industrial production declined by 1.2%, the worst since the start of the recession. Since this is part of the NBER's group of recession indicators, we watch it closely. The best source is Doug Short's "Big Four" update. Here is the most recent chart:

The Ugly

The ugliest news this past week related to the death of US Ambassador to Libya, J. Christopher Stevens. The story has many dimensions and dominated weekend news programs. A real analysis is beyond what we can do in the weekly column, but it certainly represents a topic we should all be watching.

The underlying issues involve freedom of speech, security at embassies, foreign aid, and the US image abroad. The consequences affect oil prices, trade issues, and even nuclear flashpoints.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger.

This week's award goes to Bob McTeer, although his entry is modestly stated. The problem is that he is a frequent guest on Larry Kudlow's show. Kudlow has skewed to an almost unwatchable level of political commentary (so sad for me, one of his most loyal viewers). McTeer is a rock-ribbed Republican, and a genteel and gracious person.

Kudlow said something that is very foolish, but sounds good to the average viewer. McTeer calls him on it, but without naming the source. I already had the Kudlow statement on my own blog agenda, so this saves me the work of a post. Meanwhile, does McTeer deserve full honors when he will not name the source?

Here is the point. Kudlow notes that the Fed claims to have created two million jobs while increasing the balance sheet by $2 trillion. This is a frequent blunder by critics of government policy, who ignore what the expenditure has purchased. Here is McTeer's response:

"The arithmetic may be right, but the logic is wrong. The “spending” may have been motivated by the need to unfreeze credit markets and stimulate the economy and create jobs, but the spending was on Treasury securities, mortgage-backed securities, commercial paper and the like—assets that are still on the Fed’s balance sheet if they haven’t matured and been replaced. Those assets did not disappear. They can be sold or held to maturity. Meanwhile, they produce earnings which increase the amounts turned over to the Treasury by the Fed. Taxpayer funds have not been used; they have been augmented.

To repeat for emphasis, however many jobs the $2 trillion may have helped “buy,” it also bought $2 trillion of securities."

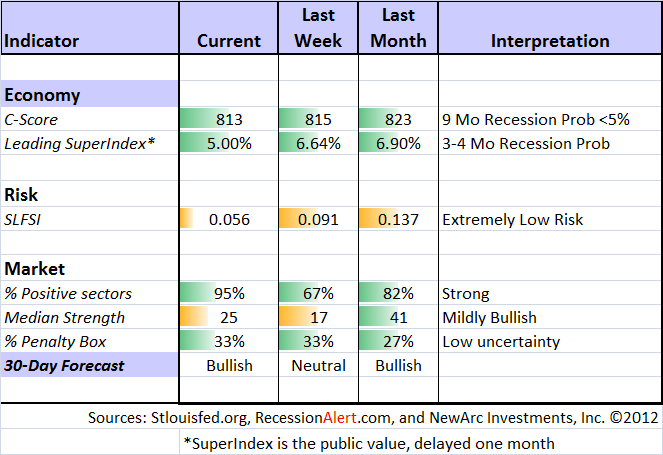

The Indicator Snapshot

It is important to keep the current news in perspective. My weekly snapshot includes the most important summary indicators:

- The St. Louis Financial Stress Index.

- The key measures from our "Felix" ETF model.

- An updated analysis of recession probability.

The SLFSI reports with a one-week lag. This means that the reported values do not include last week's market action. The SLFSI has moved a lot lower, and is now out of the trigger range of my pre-determined risk alarm. This is an excellent tool for managing risk objectively, and it has suggested the need for more caution. Before implementing this indicator our team did extensive research, discovering a "warning range" that deserves respect. We identified a reading of 1.1 or higher as a place to consider reducing positions.

The SLFSI is not a market-timing tool, since it does not attempt to predict how people will interpret events. It uses data, mostly from credit markets, to reach an objective risk assessment. The biggest profits come from going all-in when risk is high on this indicator, but so do the biggest losses.

The C-Score is a weekly interpretation of the best recession indicator I found, Bob Dieli's "aggregate spread."

Bob and I recently did some videos explaining the recession history. I am working on a post that will show how to use this method. As I have written for many months, there is no imminent recession concern. I recently showed the significance of by explaining the relationship to the business cycle.

The evidence against the ECRI recession forecast continues to mount. It is disappointing that those with the best forecasting records get so much less media attention. The idea that a recession has already started is losing credibility with most observers. I urge readers to check out the list of excellent updates from prior posts.

Readers might also want to review my new Recession Resource Page, which explains many of the concepts people get wrong.

The single best resource for the ECRI call and the ongoing debate is Doug Short. This week's article describes the complete history, the critics, and how it has played out. The post highlights the most important economic indicators used in identifying recessions, showing that none have rolled over. Doug updates the recession debate every week and includes a great chart of the "big four" indicators used by the NBER in recession dating.

Meanwhile, the ECRI story continues to change. The latest variation is that the data will eventually be revised lower to show that we are already in recession. The Bloomberg interviews, which have generally been very friendly, now state,

Tom Keene To Achuthan: 'Come Back When There's A Recession'

Watch the video, but the title tells the story!

Our "Felix" model is the basis for our "official" vote in the weekly Ticker Sense Blogger Sentiment Poll. We have a long public record for these positions. This week we switched back to bullish after a brief stint at "neutral." These are one-month forecasts for the poll, but Felix has a three-week horizon. The ratings have moved a little higher, and the confidence has improved from last week. It has been a close call over the last few weeks.

[For more on the penalty box see this article. For more on the system ratings, you can write to etf at newarc dot com for our free report package or to be added to the (free) weekly ETF email list. You can also write personally to me with questions or comments, and I'll do my best to answer.]

The Week Ahead

There is a relatively moderate calendar for data this week.

The "A List" includes the following:

- Building permits (W) which provide the best leading indicator on housing.

- Initial claims (Th) which continue to provide the most up-to-date read on jobs and the economy.

The "B List" includes several reports:

- Housing starts (W).

- Leading economic indicators (Th) which while frequently tweaked to improve the fit, are interesting to many.

There are also the regional Fed indexes from NY and Philly. I do not regard these as very important, especially in the wake of last week's Fed decision. The market reacts when there is a big move. We also will have the Markit flash PMI reports, which are starting to earn a following.

Trading Time Frame

Despite Felix's overall "neutral" posture, our trading positions continued in fully invested mode last week. Felix became more aggressive in a timely fashion, near the start of the summer rally. Since we only require three buyable sectors, the trading accounts look for the "bull market somewhere" even when the overall picture is neutral. The ratings have been getting a little stronger, so we maintain the profitable trades.

Felix does not try to call tops and bottoms, but instead keeps us on the right side of major moves, either up or down.

Investor Time Frame

Long-term investors face a challenge this week. They will be bombarded with comments from Fed critics, gold buffs, recessionistas, and hyper-inflation zealots. These people have all been completely wrong for years, but they are still featured as experts.

Long-term investing is an objective for many of my clients, so I give it a lot of thought. Each week I use this space to share (right or wrong) my best long-term thoughts. Sometimes this means emphasizing themes that I have written about more comprehensively.

Here are two such thoughts.

How much risk should you take? The right answer is different for everyone, but too many people choose "zero." These investors do not follow the Buffett advice of buying when others are fearful. Then, when the market rallies, they are afraid that they are "too late." I wrote a new article, Stock Prices and the Fundamentals: Don't be Fooled, showing how to avoid this trap. The answer is not going "all in" since most of us have to pay more attention to short-term risk than does Mr. Buffett!

Should you worry about the "fiscal cliff?" The basic answer is "not yet." I explain why in two articles. The first reveals my one-word solution. The second offers my current expectations, and how I am investing for the long-term program.

If you have been following our regular advice, you have done the following:

- Replaced your bond mutual funds with individual bonds (bond funds are very risky!);

- Sold some calls against your modest dividend stocks to enhance yield to the 10% range; and

- Added some octane with a reasonable allocation of good stocks.

There is nothing more satisfying than getting yield and call premiums, even if stocks move sideways.

If you have not done so, it is certainly not too late. We have collected some of our recent recommendations in a new investor resource page -- a starting point for the long-term investor. (Comments and suggestions welcome!)

Final Thoughts on Housing

Most market followers are missing the inflection point in housing. The Fed has acted aggressively. To understand the significance of the new Fed policy would require a lot of reading. I cannot review it all in the weekly summary post, so let me suggest another key source, James Hamilton.

"I think the correct interpretation of QE3 is that the Fed has unambiguously signaled that it's not going to re-run the Japanese experiment to see what happens when the central bank stands by and watches wages and prices fall even while unemployment remains very high. The Fed can and will keep U.S. inflation from falling much below 2%, and that may help a little. Investors should expect that, and not a whole lot more."

The mistake that most are making is the typical one for non-economists: black and white, all or nothing.

Suppose that QE3 reduces mortgage rates by 0.125%. This translates into a purchasing power increase of about 1.5%. You cannot just tack that onto home prices, since the benefit is split. What happens is that the demand curve is shifted a little.

So ignore the clueless bozos who say things like the following:

- No new buyers will qualify.

- When did you last hear about someone who didn't buy because interest rates were too high?

These pontificating pundits do not understand economics, and they are probably on a mission related to their own pocketbook.

We need to think about marginal effects. A few more buyers will qualify. Those that do qualify can afford a little more house.

The subjects are so complicated, that I cannot treat them properly in the weekly summary article. I can only share my own conclusions, as always, and point you to the best sources.

(Note to readers: I took a little time off this weekend, but the topics are so important that I want to maintain continuity in the series. This is one of the most difficult articles in the entire series).